$4B Increase In Bitcoin Open Interest Fueled By Whale Transfers To Exchanges – Details

Bitcoin faced renewed volatility after a minor pullback interrupted two weeks of tight consolidation just below its all-time high of $123,000. The price briefly dipped near the $115,000 support level but has already begun to recover, signaling that bullish...

Bitcoin faced renewed volatility after a minor pullback interrupted two weeks of tight consolidation just below its all-time high of $123,000. The price briefly dipped near the $115,000 support level but has already begun to recover, signaling that bullish momentum remains intact despite recent selling pressure. Market participants appear to be reacting calmly, with strong demand quickly absorbing the dip.

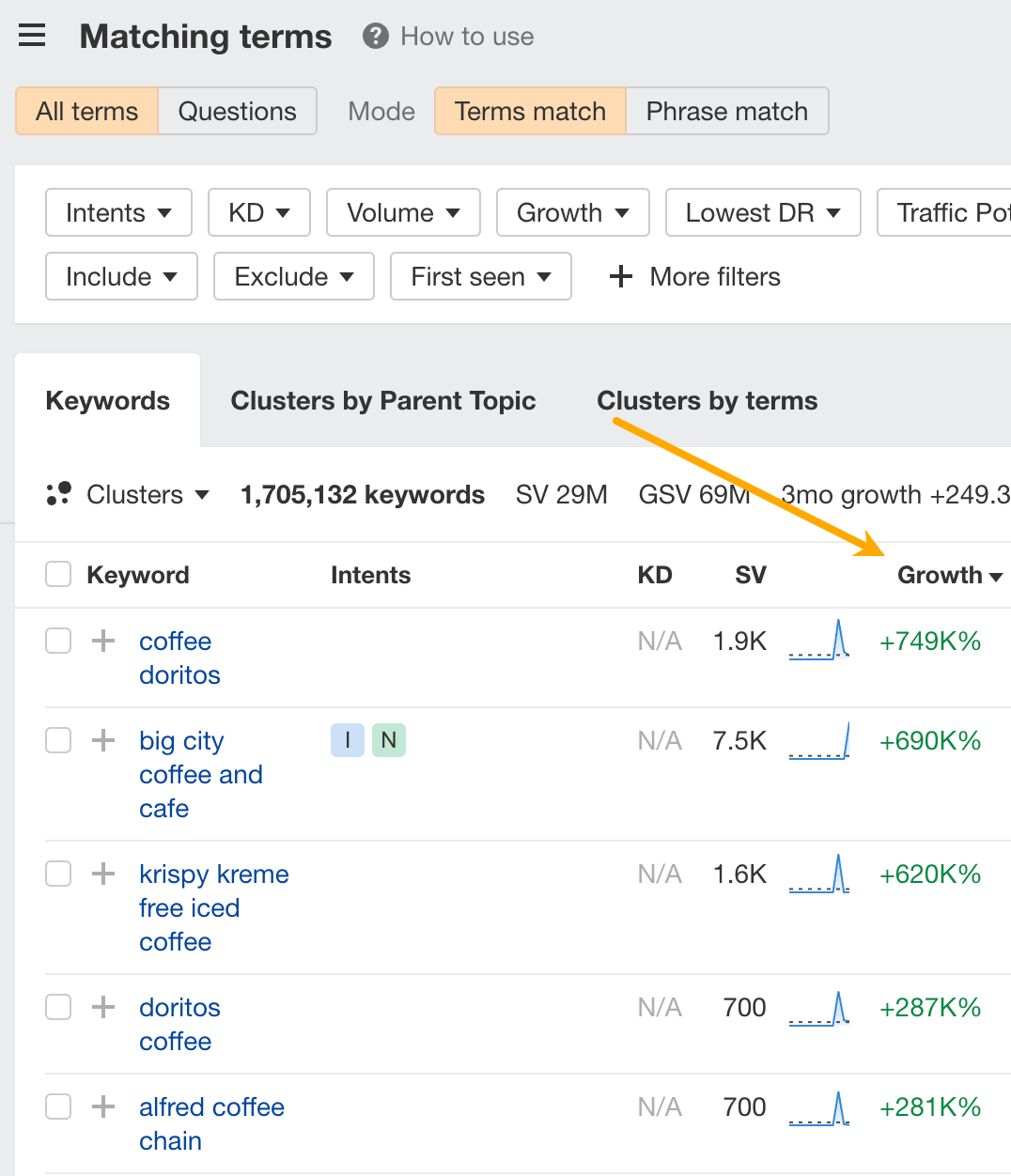

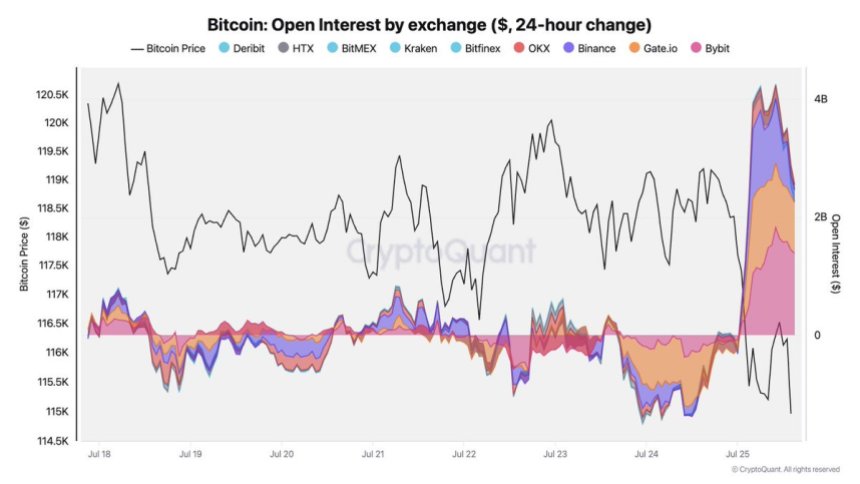

According to fresh data from CryptoQuant, today’s price movement coincides with a significant increase in open interest across major exchanges. Binance, Bybit, and Gate all recorded sharp spikes in open interest within the last 24 hours, suggesting that traders are positioning aggressively. Notably, these exchanges were among the recipients of large Bitcoin transfers earlier in the day, likely tied to institutional or whale activity.

This alignment of price recovery and rising open interest hints at a shift in sentiment. Short-term traders are re-entering the market, while bulls appear ready to defend key levels. As volatility picks up, Bitcoin’s ability to hold and reclaim recent support will determine whether it resumes its upward march or remains range-bound. The coming days could be critical for setting the tone of the next leg in Bitcoin’s price action.

Rising Open Interest Signals Growing Volatility

According to Julio Moreno, CryptoQuant’s head of research, over the last 24 hours, open interest surged by approximately $4 billion, indicating that leveraged positions—particularly shorts—have entered the market in large numbers. This spike coincided with significant Bitcoin transfers to major exchanges like Binance and Bybit, which received a substantial portion of today’s large-volume transactions.

Bitcoin Open Interest by Exchange | Source: Julio Moreno on X

Bitcoin Open Interest by Exchange | Source: Julio Moreno on XThese developments suggest increased speculative activity as traders anticipate further price movement. The inflow of coins to exchanges, combined with rising open interest, typically signals upcoming volatility. Short sellers appear to be betting on continued downside, but with Bitcoin already recovering from its recent $115,000 dip, this could lead to a short squeeze if momentum shifts back in favor of the bulls.

This market shift comes as Ethereum and altcoins show notable strength. Since May, Ethereum has consistently outperformed Bitcoin, aided by institutional accumulation and clearer regulatory signals in the US. As ETH leads the altcoin rally, investors are watching closely to see whether capital rotation from BTC into altcoins continues.

Bitcoin Holds Key Support After Minor Pullback

The daily Bitcoin chart shows that BTC remains in a bullish structure despite recent volatility. After briefly consolidating near the $122,000 resistance zone and reaching an all-time high just above that level, the price retraced toward the $115,700–$117,000 support band. This zone, marked by the horizontal yellow range, also aligns closely with the 50-day simple moving average (SMA), currently at $117,593.23, reinforcing its role as a strong technical support.

BTC consolidates within a range | Source: BTCUSDT chart on TradingView

BTC consolidates within a range | Source: BTCUSDT chart on TradingViewThe overall uptrend that started in early May remains intact, with higher highs and higher lows clearly visible on the chart. Notably, BTC continues to trade well above the 100-day (green) and 200-day (red) SMAs, which sit at $112,547.95 and $109,436.38, respectively. These levels serve as deeper support zones if selling pressure intensifies.

Volume has increased slightly on red candles, indicating some sell pressure, but there is no sign of panic. As long as BTC holds above the $115,700 level, bulls maintain the advantage. A breakout above $122,000 would signal trend continuation and could open the path to new highs.

Featured image from Dall-E, chart from TradingView

JaneWalter

JaneWalter

/cdn.vox-cdn.com/uploads/chorus_asset/file/23932741/acastro_STK070__03.jpg)