‘All Bets Off’ If Bitcoin Reclaims This Level, But Analysts Warn Of Potential Rejection

This week’s market recovery has seen Bitcoin (BTC) surge over 10% to retest a key barrier for the first time in weeks. Amid this performance, some analysts suggest that the flagship crypto is about to restart its bullish rally,...

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This week’s market recovery has seen Bitcoin (BTC) surge over 10% to retest a key barrier for the first time in weeks. Amid this performance, some analysts suggest that the flagship crypto is about to restart its bullish rally, while others consider that holding key levels will determine BTC’s next step.

Bitcoin Reclaims Its ‘Ultimate’ Level To Break

Bitcoin has recovered from its early April sub-$80,000 correction after surging 11% in the past week. On Friday, the largest crypto by market capitalization reclaimed the $85,000 barrier, which has served as a key barrier since late March.

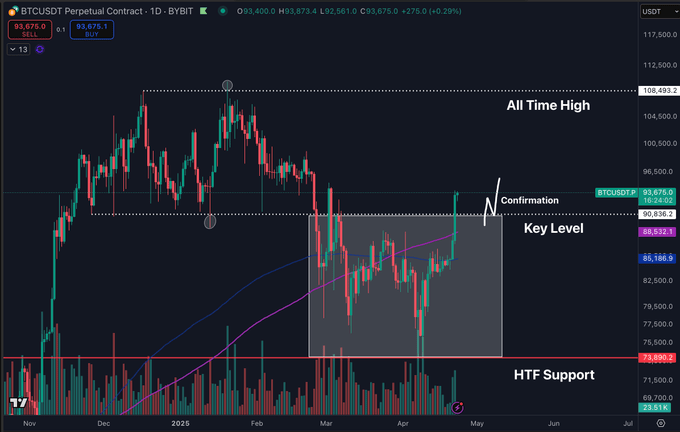

Since Friday, BTC has climbed several key levels, breaking above the $90,000 resistance on Tuesday and holding it for the past 24 hours. Analyst Daan Crypto Trades pointed out that Bitcoin has a “solid breakout back into the previous range and above the Daily 200MA/EMA.”

Bitcoin breaks above the Daily 200MA/EMA. Source: Daan Crypto Trades on X

Bitcoin breaks above the Daily 200MA/EMA. Source: Daan Crypto Trades on XNotably, the cryptocurrency has been trading within a significant area over the past weeks, as it has been retesting its multi-month downtrend line and the Daily 200 Exponential Moving Average (EMA) and Moving Average (MA).

After the Thursday pump that kickstarted the ongoing recovery, Bitcoin broke out of its four-month downtrend. The cryptocurrency bounced from the Daily 200EMA to shortly consolidate below the Daily 200MA before breaking above this level yesterday.

This sent the cryptocurrency toward the bull’s “ultimate level to break,” the $90,000-$91,000 range. However, the analyst suggested that Bitcoin must keep holding that region to confirm the breakout isn’t “just a liquidity grab to fall back down below.”

Moreover, he also stated that BTC’s daily closes should stay above these levels “ideally,” and that “some consolidation up here to regain fuel and attempt higher would be perfect” for a rally continuation.

Ali Martinez also highlighted BTC’s price performance, which is trading near its yearly opening of $93,500. The analyst asserted that this level was a strong support throughout the post-election breakout but noted that it “could now flip into key resistance” if it isn’t reclaimed.

Analysts Eye BTC’s Weekly Close

Crypto Jelle called the $93,500 resistance the bear’s “last line of defense,” stating that once BTC recovers that level, “all bets are off.”

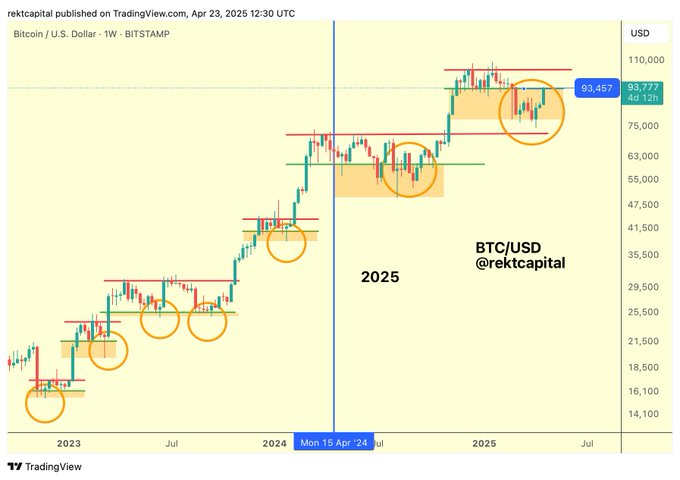

Meanwhile, Rekt Capital noted that Bitcoin has been “rallying in an effort to resynchronize with its former ReAccumulation Range and confirm the end of its first Price Discovery Correction.”

BTC nears its reaccumulation range. Source: Rekt Capital on X

BTC nears its reaccumulation range. Source: Rekt Capital on XHe highlighted that after yesterday’s performance, BTC is near the end of its downside deviation, affirming that the cryptocurrency needs to stabilize above the $93,500 level.

To achieve this, Bitcoin needs a weekly close above this crucial level and reclaim it as a new support. He also highlighted that it is repeating its mid-2021 price performance “fantastically well.”

The analyst previously explained that in 2021, Bitcoin consolidated between the two biggest bull market Exponential Moving Averages (EMAs), the 21-week and 50-week EMAs, before breaking out from the triangular structure and resuming its rally.

Now, BTC is breaking out from the range formed by the two Bull Market EMAs, which “wasn’t just anticipated back in mid-2021 as it was happening but also in this cycle as well.” Rekt Capital concluded that a Weekly Close above $87,000 “will position BTC for a confirmed breakout.”

As of this writing, Bitcoin trades at $93,459, an 8.2% surge in the monthly timeframe.

Bitcoin’s performance in the one-week chart. Source: BTCUSDT on TradingView

Bitcoin’s performance in the one-week chart. Source: BTCUSDT on TradingViewFeatured Image from Unsplash.com, Chart from TradingView.com

ValVades

ValVades

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832866/STK048_XBOX_2_C.jpg)