Bank of America CEO Brian Moynihan says he sees a relatively mild recession

Moynihan said Bank of America's research team has been consistent in calling for a mild downturn in light of the Fed's rate hikes.

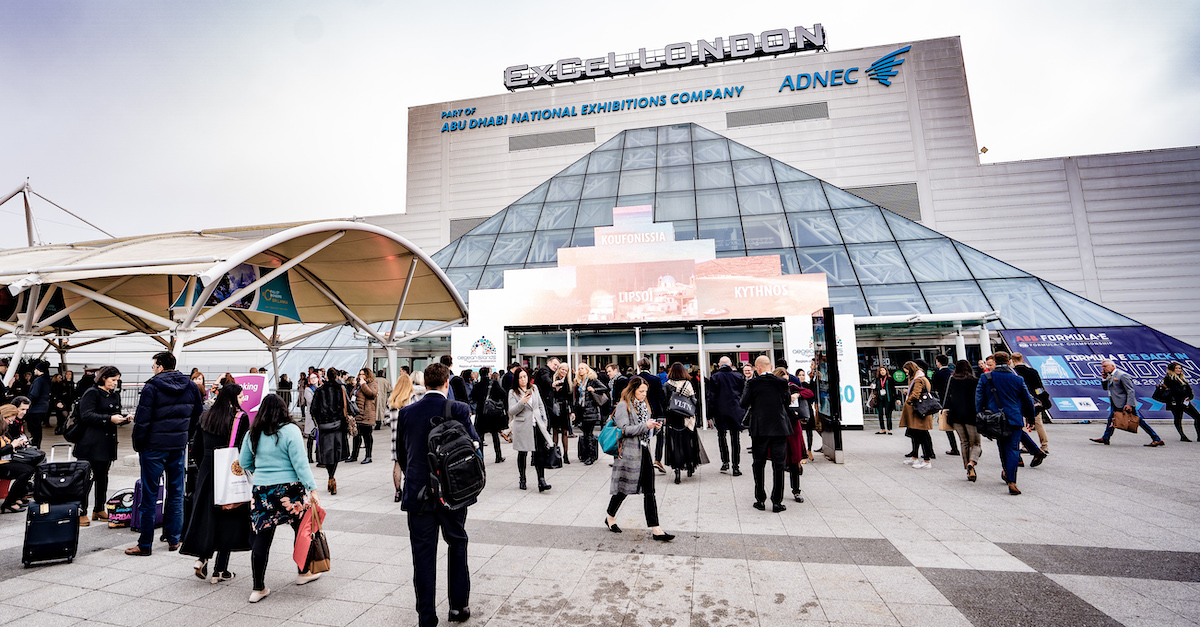

Brian Moynihan, chief executive officer of Bank of America Corp., during a panel session on corporate ESG standards at the World Economic Forum in Davos, Switzerland, on Wednesday, Jan. 18, 2023.

Bloomberg | Bloomberg | Getty Images

Bank of America CEO Brian Moynihan said Tuesday he sees only a slight recession hitting the U.S. as consumers remain in solid shape.

"Everything points to a relatively mild recession given the amount of stimulus that was paid to people and the money they have left over," Moynihan said in the bank's quarterly earnings call. "At the end of the day, we don't see the activity on the consumer side slowing at a pace that would indicate that, but we would see commercial customers are being more careful."

Moynihan said that Bank of America's research team has been consistent in calling for a mild downturn in light of the Federal Reserve's aggressive rate hikes. The central bank has raised its benchmark interest rate nine times for a total of 4.75 percentage points, the fastest pace of tightening since the early 1980s.

The bank is predicting annualized GDP contraction in the range of half to 1 percentage point in the next three quarters before going back to positive growth, he said.

Moynihan took solace in a low unemployment rate and easing wage inflation, which should prevent the economy from tipping into a deep recession.

"The fact that unemployment is still 3.5% [indicates] full employment-plus. And then the wage growth is slowing and tipping over," he said. "So the signs of inflation are tipping down and it's still there but that translates into relatively good activity so we see a slight recession and we'll see what happens."

Bank of America on Tuesday reported first-quarter earnings and revenue that topped expectations on the back of higher interest rates. The ban said its net interest income — what it makes lending minus what it pays out to customers — jumped 25% to $14.4 billion during the quarter from a year earlier.

"Our stress scenarios are always less than anybody else's because of how we built the company to go through problems including the pandemic," Moynihan said.

AbJimroe

AbJimroe