Mobile Phone Insurance Market: Safeguarding the World’s Most Valuable Personal Asset

Smartphones have quietly become the most valuable personal devices people own today. Beyond communication, they now function as wallets, offices, entertainment hubs, health trackers, and identity vaults. As their role in daily life has expanded, so too has the...

According to BIS Research, the global mobile phone insurance market was valued at $41.15 billion in 2024 and is projected to reach $126.24 billion by 2035, reflecting the growing need to protect increasingly expensive and indispensable devices. The foundation of this market’s growth lies in the explosive adoption of smartphones worldwide. While early insurance adoption was driven by premium phone users, the landscape has evolved. Today, even mid-range smartphones carry advanced processors, multi-camera systems, and fragile displays, making repairs costly and replacements disruptive. At the same time, the average selling price (ASP) of smartphones continues to rise, especially in developed markets where flagship models frequently exceed $1,000. Repair costs, particularly for screens and internal components, have followed a similar upward trend. For consumers, insurance has emerged as a rational hedge against both financial loss and operational downtime. This convergence of higher device value, repair inflation, and dependency on smartphones forms the economic backbone of the mobile phone insurance market. As consumer expectations have matured, mobile phone insurance has evolved beyond simple accidental damage coverage. Modern policies now offer multi-layered protection, reflecting how smartphones are used and abused in real-world environments. Key coverage categories include: This expansion of coverage types has transformed insurance from a reactive product into a holistic device-lifecycle protection solution, aligning well with today’s digital lifestyles. While coverage innovation matters, distribution strategy has become the true growth lever for the market. Traditional standalone insurance purchases are giving way to embedded and bundled models, where insurance is offered seamlessly at the point of sale. Original equipment manufacturers (OEMs), telecom operators, retailers, and e-commerce platforms are increasingly partnering with insurers to integrate protection plans directly into device purchases. This not only improves adoption rates but also allows insurers to price policies more accurately using device-specific and usage-based data. Digital-first distribution channels, especially app-based and online platforms, are further reducing friction, enabling instant enrollment, transparent pricing, and faster claims processing. Behind the scenes, technology is redefining how mobile phone insurance operates. Insurers are leveraging artificial intelligence (AI), automated diagnostics, and image-based damage assessment to streamline claims management. For example, AI-driven photo analysis allows users to upload images of damaged devices, enabling near-instant damage validation and claim approval. This not only reduces processing time but also helps combat fraud—one of the market’s persistent challenges. In parallel, data analytics and device telemetry are being used to refine underwriting models, personalize premiums, and improve loss ratios, making the business more sustainable at scale. Geographically, the market shows distinct patterns of maturity and opportunity. These regional contrasts underline why insurers are increasingly tailoring products and pricing strategies to local market conditions. BIS Research projects the mobile phone insurance market to grow from $41.15 billion in 2024 to $126.24 billion by 2035, driven by sustained smartphone dependency, expanding digital ecosystems, and continuous innovation in insurance delivery models. This growth trajectory reflects not a temporary trend, but a structural shift where device protection becomes an expected component of smartphone ownership rather than an afterthought. Despite strong fundamentals, the market faces notable challenges. Low awareness and affordability concerns still limit adoption in price-sensitive regions. Fraudulent claims and misuse continue to pressure insurers’ margins, while complex policy terms can deter first-time buyers. However, these challenges are also catalysts for innovation, encouraging clearer policy structures, usage-based pricing, and smarter fraud detection mechanisms. The future of mobile phone insurance lies in its ability to integrate seamlessly into the broader digital ecosystem. As smartphones become gateways to financial services, healthcare, and digital identity, insurance will increasingly position itself as a digital companion quietly protecting the device that protects everything else. For insurers, OEMs, and platform providers, the opportunity is no longer just about covering risk—it’s about enhancing trust, convenience, and long-term customer relationships in a smartphone-centric world. Smartphones have quietly become the most valuable personal devices people own today. Beyond communication, they now function as wallets, offices, entertainment hubs, health trackers, and identity vaults. As their role in daily life has expanded, so too has the financial risk associated with damage, loss, or theft. This shift has propelled the mobile phone insurance market from a niche add-on into a rapidly scaling global industry.

Smartphones have quietly become the most valuable personal devices people own today. Beyond communication, they now function as wallets, offices, entertainment hubs, health trackers, and identity vaults. As their role in daily life has expanded, so too has the financial risk associated with damage, loss, or theft. This shift has propelled the mobile phone insurance market from a niche add-on into a rapidly scaling global industry.Why Mobile Phone Insurance Is No Longer Optional

From Basic Protection to Comprehensive Coverage

Distribution Is the Real Growth Engine

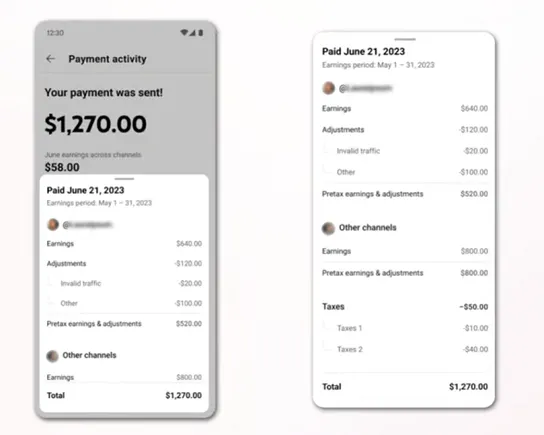

Technology Is Reshaping the Insurance Experience

Regional Dynamics: Growth Is Not Uniform

BIS Research Forecast: A Market Built for the Long Term

Challenges That Will Shape the Next Phase

The Road Ahead: Insurance as a Digital Companion

KickT

KickT