We find out what’s behind TNG Digital’s unicorn status, and why it matters for Malaysia

[Written in partnership with Malaysia Digital Economy Corporation (MDEC), but the editorial team had full control over the content.] A few months ago in August 2025, TNG Digital Sdn Bhd (the company behind TNG eWallet) was officially recognised as...

[Written in partnership with Malaysia Digital Economy Corporation (MDEC), but the editorial team had full control over the content.]

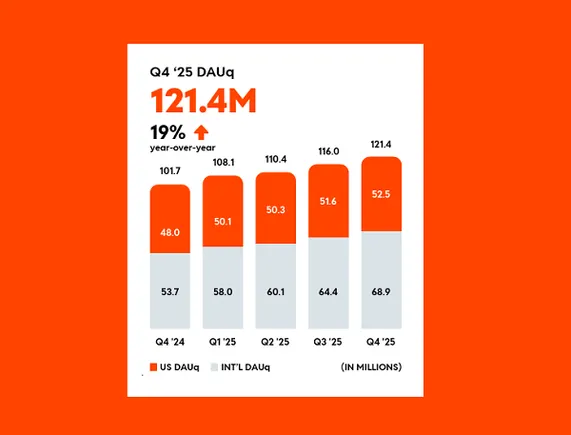

A few months ago in August 2025, TNG Digital Sdn Bhd (the company behind TNG eWallet) was officially recognised as a unicorn, valued at more than US$1 billion.

The exact valuation remains undisclosed, but CIMB Bank Bhd’s CEO stated that TNG Digital has already qualified as a unicorn, supporting the government’s aim of identifying five Malaysian unicorns by 2030.

CIMB Group Holdings Sdn Bhd, TNG Digital’s largest shareholder via 100%-owned unit Touch ‘n Go Sdn Bhd., also confirmed that the fintech firm has turned profitable earlier this year, with steady growth in transaction volumes and service adoption.

The news has been met with much enthusiasm from both public and private sectors. But it’s sparked debate as well, with people wondering how exactly the unicorn valuation was derived.

To address this, TNG Digital’s CEO Alan Ni had an interview with us to explain what’s behind the numbers.

Image Credit: TNG Digital

Image Credit: TNG Digital

How the unicorn valuation was derived

Despite what skeptics have commented, Alan shared that the valuation wasn’t self-declared.

“An independent and accredited third-party valuation firm provided a valuation recently that places TNG Digital at the level typically associated with unicorn companies,” the CEO stated.

The assessment applied standard methodologies used for fintech businesses, taking into account both its current performance and long-term earning potential.

The CEO also debunked claims that the unicorn achievement was largely due to its mobility and toll services. He shared that traditional toll and parking-related business now contributes to less than 3% of TNG Digital’s total payment value and revenue.

In 2023, TNG Digital partnered with Amanah Saham Nasional Berhad to provide Malaysians with fast, easy, and accessible investment through its eWallet. / Image Credit: TNG Digital

In 2023, TNG Digital partnered with Amanah Saham Nasional Berhad to provide Malaysians with fast, easy, and accessible investment through its eWallet. / Image Credit: TNG Digital

It’s a clear indication that the fintech company has grown beyond its roots, from a toll payment app into a comprehensive lifestyle ecosystem that serves over 24 million verified eKYC users.

For context, that covers 85% of Malaysia’s adult population, connecting them with more than 2 million merchant touchpoints nationwide and processing over RM16 billion in payments each month.

Alan explained that this growth is anchored by TNG eWallet’s diversified base which ensures long-term resilience. “Financial services, including cross-border payments and remittances, are driving strong growth, complemented by the continued strength of our payments segment.”

Other services that have grown in user popularity include TNG eWallet’s GO+ for micro-investments, CashLoan to help access credit facilities, and insurance products for a variety of needs like vehicle and health.

Image Credit: TNG Digital

Image Credit: TNG Digital

Partnerships with established firms such as Principal Asset Management, Amanah Saham Nasional Berhad (ASNB), and Affin Hwang broadens its financial offerings, while collaborations with consumer brands like foodpanda and Huawei embed TNG eWallet into daily life.

IPO readiness and the road ahead

Speaking openly, Alan shared that TNG Digital has achieved sustainable profitability since September 2024. “[We] expect to close 2025 with our first full financial year of profitability.”

He credited this milestone as the result of operational discipline, strategic diversification, and deep customer engagement.

As with any growth-oriented business, TNG Digital will continually assess a range of opportunities and initiatives to support its long-term ambitions.

While an initial public offering (IPO) would be a natural progression for TNG Digital, at this point, there is no specific timeline for it. For now, its team is focused on strengthening its fundamentals, deepening partnerships, and delivering sustained value to customers, partners, as well as stakeholders.

In June 2025, TNG Digital launched its mobile-first, zero-fee Business Account for MSMEs and gig workers. / Image Credit: TNG Digital

In June 2025, TNG Digital launched its mobile-first, zero-fee Business Account for MSMEs and gig workers. / Image Credit: TNG Digital

On a broader scale, TNG Digital’s journey of becoming a unicorn is a sign that Malaysia’s digital economy has reached a new level of maturity.

MDEC shared with us several key factors that evidenced TNG Digital’s rapidly growing success.

Firstly, TNG Digital’s vast user base demonstrates a high level of digital literacy and a readiness among consumers to embrace digital financial services. The firm’s ability to handle a large volume of daily transactions seamlessly points to the presence of a reliable and scalable digital infrastructure in Malaysia.

Such growth by fintech giants like TNG Digital would not have been possible without a supportive and forward-thinking regulatory framework, which allows for innovation while ensuring the stability and security of the financial system.

Image Credit: TNG Digital

Image Credit: TNG Digital

With these foundations in place, MDEC believes the local market is primed for more homegrown unicorns in the coming years.

Some fintech firms that are showing strong potential in following TNG Digital’s footsteps are companies like Boost (digital financial services arm of Axiata), Soft Space (who raised the largest Series C fundraising round in Malaysia thus far), and Neurogine (a rapidly expanding player in the payments space).

A catalyst for Malaysia’s digital economy

TNG Digital’s CEO, Alan Ni, and Director of Innovation,Swofilen Y / Image Credit: TNG Digital

TNG Digital’s CEO, Alan Ni, and Director of Innovation,Swofilen Y / Image Credit: TNG Digital

Although the path remains challenging, fintech leaders like TNG Digital play a catalytic role in accelerating Malaysia’s digital economy.

Through initiatives with MDEC, from earning Malaysia Digital (MD) Status to participating in the FOX programme and Business Digitisation Initiative, TNG Digital is not only scaling its own services but also helping digitalise SMEs and strengthen the local tech ecosystem.

For context, as an active participant in MDEC’s FOX programme, TNG Digital is provided with support in six key pillars—policy, business expansion, funding facilitation, amplification, talent enhancement, and mentoring. In other words, it’s equipped with the tools and knowledge needed to scale globally and continue innovating.

Image Credit: TNG Digital

Image Credit: TNG Digital

Its joint effort with MDEC on projects like MyCyberShield further underscores a shared commitment to building public trust in the digital economy through stronger cybersecurity.

Together, these initiatives amplify TNG Digital’s impact across areas such as talent development, innovation, ecosystem building, and SME digitalisation.

As Malaysia works towards its vision of establishing three more unicorns by 2030, TNG Digital stands as proof that the next generation of fintech champions is already within reach.

Learn more about TNG Digital here. Read other articles we’ve written about Malaysian businesses here.MDEC CEO Anuar Fariz Fadzil (left) with TNG Digital CEO Alan Ni (right). MDEC’s support has enabled TNG Digital to achieve unicorn status as Malaysia’s homegrown fintech champion, with the company grateful for MDEC’s role in driving fintech innovation and SME digitalisation with purpose for the nation’s benefit. / Featured Image Credit: TNG Digital

Fransebas

Fransebas