Yen and bond yields rise after BOJ pledges more flexibility to yield curve control

The Japanese yen strengthened and 10-year JGB yield rose after the Bank of Japan said it would allow "greater flexibility" in its target range for 10-year yield.

The Japanese yen strengthened and 10-year JGB yield spiked after the Bank of Japan said it would allow "greater flexibility" in its target range for 10-year Japanese government bond yields.

Yields for 10-year Japanese government bonds rose to 0.575% for the first time since September 2014, before easing slightly to 0.56%. The yen was trading at 139.12 against the dollar as of 3:09 p.m. Hong Kong and Singapore time.

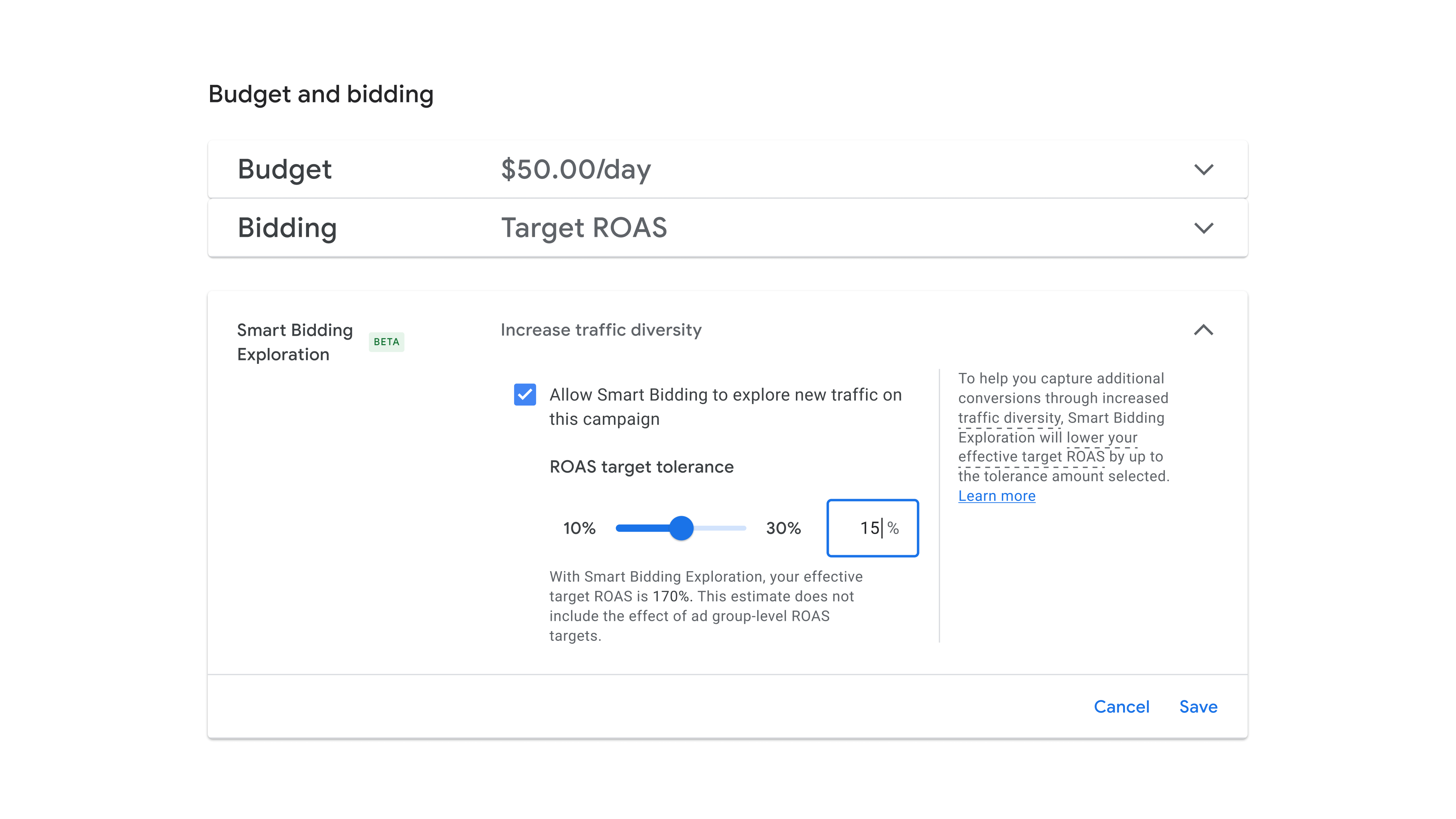

After a two-day policy meeting, the BOJ adjusted its stance on its yield curve control policy, saying it will continue to allow 10-year government bond yields to fluctuate in the range of around plus and minus 0.5%.

"The BOJ weakens its 'yield curve control' – but don't expect a big impact on global markets," Shane Oliver, head of investment strategy and chief economist at AMP, wrote in a note.

With Japan being a large holder of foreign bonds, allowing bond yields to rise further will put some "upwards pressure on global bond yields as we have seen in the last few days," he added.

But with "JGBs still set to offer much lower yields than in other markets," the impact is likely to be minor, Oliver said.

Japan's central bank also offered to buy 10-year JGBs at 1% every business day through fixed-rate operations, unless no bids are submitted. The move effectively expands its tolerance by another 50 basis points.

Under its yield curve control policy, the central bank targets short-term interest rates at -0.1% and the 10-year government bond yield at 0.5% above or below zero.

The BOJ has been facing growing pressure to allow yields to rise all year, with wages and inflation rising.

On Friday, the Tokyo's core consumer price index, which excludes volatile fresh food but includes fuel costs, rose 3.0% in July from a year ago. That's slightly more than the 2.9% expected in a Reuters consensus poll.

With inflation having exceeded the BOJ's 2% target, concerns are rising that Japan's relatively low interest rates have made the yen less attractive and vulnerable to selling.

Central banks around the world have raised rates aggressively to rein in on inflation, but Japan has continued to maintain an ultra-loose monetary policy and kept rates low.

"The BOJ has added further uncertainty to the policy outlook by clearly stating that achievement of the 2% inflation target in a sustainable and stable manner has not yet 'come in sight'," said Stephen Halmarick, Commonwealth Bank of Australia's chief economist in a note.

As a result, it will be difficult for the BOJ to tighten monetary policy "in a meaningful way in coming months, although further small increments of change and the implementation of further 'flexibility' cannot be ruled out," he added.

— CNBC's Lim Hui Jie contributed to this report.

JaneWalter

JaneWalter