Behind DTC tinned fish brand Fishwife’s rapid rise and entry into Whole Foods

The move marks Fishwife’s first national retail partnership.

Brands on the Rise is a regular Ad Age feature spotlighting the marketing and business tactics of successful challenger brands. Read other installments here.

Rebranding something boring into something beautiful has been the name of the direct-to-consumer game for years. So it’s surprising that it took this long for someone to catapult tinned fish from something downright fishy to a food trend that tastemakers can’t stop talking about.

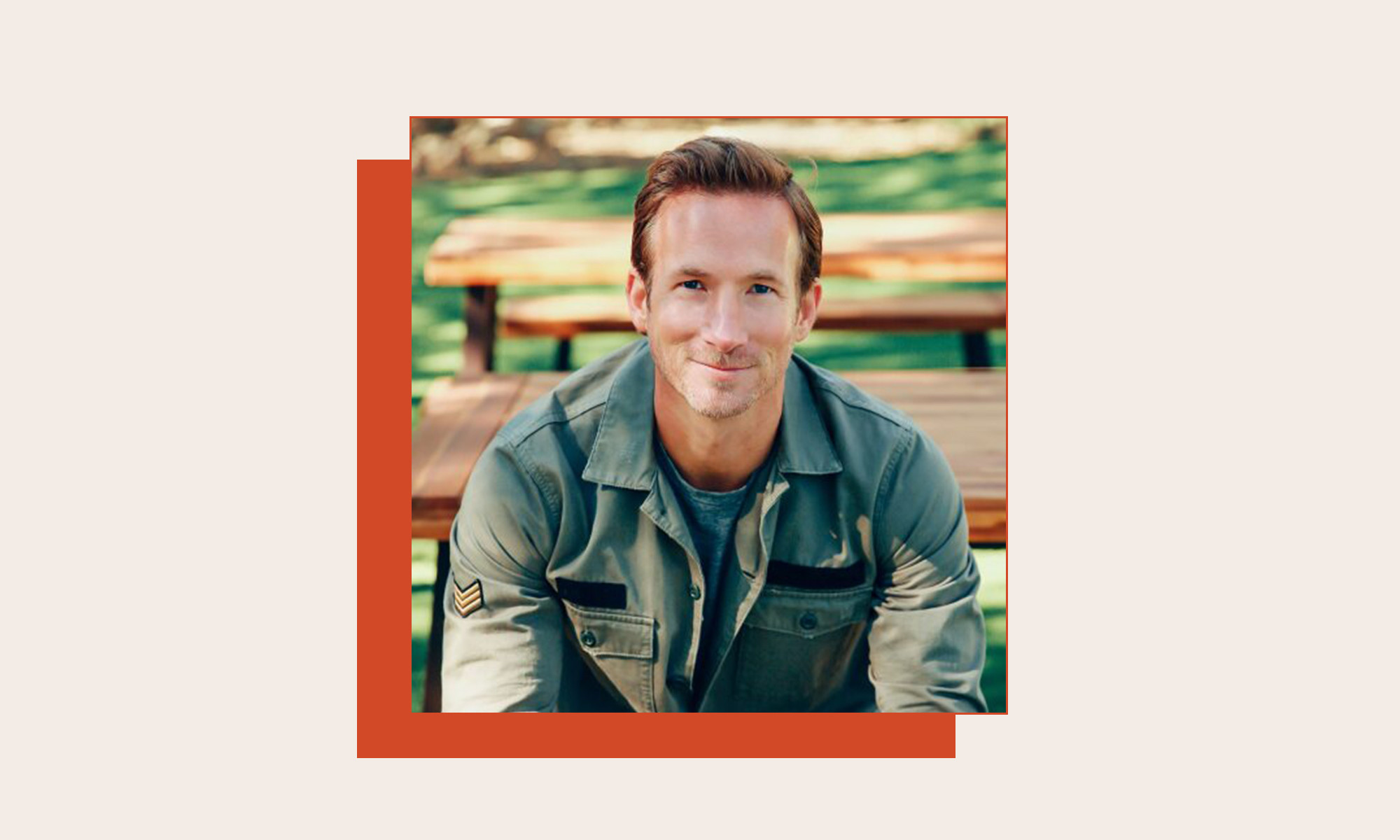

The trendsetter in question? A former music industry worker named Becca Millstein. In 2020, Millstein co-founded Fishwife, which makes ethically sourced, upscale, tinned seafood—such as its signature smoked rainbow trout. Sales are surging thanks, in part, to smart collaborations with other DTC food brands such as sauce company Fly By Jing and Graza olive oil.

Some experts argue that Fishwife is a driving force behind the tinned fish category’s recent growth. U.S. canned seafood sales rose 9.7% to $2.7 billion in 2022, according to Euromonitor International data cited in a recent Wall Street Journal article. Fishwife's annual revenue jumped more than 200% from 2021 to 2022, according to Millstein, who serves as its CEO. She noted that the brand is “still closing the 2022 books” and didn’t share exact figures.

Below, how Fishwife got its start, how it approaches marketing and where it’s headed next (spoiler alert: it’s Whole Foods).

How it started

During the early days of COVID-19 in the U.S., Millstein was living with her friend Caroline Goldfarb (who just so happened to have quite a few journalists following her on Instagram at the time—more on that later). The pair came up with the idea for Fishwife in April 2020, when they started to gravitate toward the tinned fish aisle on their limited grocery store visits.

“Tinned fish is one of the very few food products that is both shelf stable for many, many years, and offers really strong health benefits,” Millstein said.

She wasn’t trying to come up with a business idea at the time—it just occurred to her that there hadn’t been much innovation in the U.S. canned fish space … maybe ever. She’d also been tracking tinned fish’s strongest advocates over the years, from Alison Roman to Anthony Bourdain.

“Despite there being like this amazing culinary tradition around conservas in Spain, Portugal, and so many other parts of the world, that space remained pretty barren on American grocery store shelves. When you think of canned fish in the U.S., it’s like, canned tuna,” Millstein said. (Conservas is a phrase used to refer to canned fish in some countries.)

Millstein said she got “obsessed” with closing the “glaring gap” in the market. “Because there had been virtually no innovation in the category, when we launched in a very soft way there was a really, really strong response from future customers and media,” she said.

That summer, Fishwife soft-launched its “beta boxes,” which included three fish samples wrapped in Fishwife’s signature colorful illustrations. “They sold out in, like, 42 minutes or something like that,” Millstein said.

As a result, national press outlets including Vogue and Refinery29 reached out to cover the actual launch—perhaps, in part, because Goldfarb posted about the release on her well-followed Instagram meme account @officialseanpenn. The brand’s official launch came in December 2020.

The company had two investment rounds—a friends and family round, as well as a pre-seed round. While Millstein declined to share how much Fishwife raised in total, she noted that when Bonobos founder Andy Dunn came on as an investor during the friends and family round, it was a “surreal moment” for her.

Tipping point

Fishwife announced today that Whole Foods will serve as its first national retail partner—a journey that Millstein said started about five months post-launch.

Whole Foods reached out to Fishwife about getting the product in stores early in 2021, but the brand didn’t have a scalable supply chain ready for a big retail launch just yet, according to Millstein. Now, almost two years later, Millstein is excited to capitalize on that interest.

The brand isn’t rolling out in every single Whole Foods store across the country just yet (scalable supply chains are difficult to create for high-quality seafood, per Millstein). Fishwife started popping up in Whole Foods stores this month in areas including Southern California, Arizona and Hawaii.

Millstein said the Amazon-owned grocer was a “super obvious” partner for the brand, describing it as her “North Star” while building.

Stretching Fishwife beyond DTC fits its mission. “To make the impact we’re looking to make on the role of tinned fish in American culinary culture, it didn't make sense for us to stay just DTC,” Millstein said.

Marketing strategies

The company’s distinctive brand fuels its organic word of mouth, and press and influencer interest—at least according to its founder.

“We use the brand in so many ways. Our merch, for example, does very well for us—and that, of course, is always a great marketing tool, having people walk around with ‘Fishwife’ on the back of their shirts,” Millstein said.

The idea for the “Fishwife” name and avatar came from a woman named Grier Stockman, the head of marketing at Block Shop Textiles. In Fishwife’s early days, Millstein said she “called every entrepreneur” that she knew, because she “had no idea how to start a business. Stockman was likely Googling fish terminology on one of those calls when she stumbled upon the word fishwife,” Millstein suggested.

As a female-founded brand, Millstein thought the word was a perfect fit. “The term ‘fishwife’ is basically a gendered insult for women who are loud and swear a lot,” she said. “That term and its history gives us so much to play with.” Having the Fishwife as an avatar, Millstein said, is a “great guiding light for the brand.”

Millstein created the company’s visual brand alongside Danny Miller, who still works as Fishwife’s illustrator and is on retainer in perpetuity.

Millstein’s initial Fishwife mood board featured inspiration from traditional conservas brands, Topo Chico seltzer, coffee brand Cafe Bustelo, and more. She wanted Fishwife to be both timeless and modern with a universe of its own, where characters such as the Fishwife could tell stories on brand packaging. For instance, its spicy Fly By Jing collaboration product depicts the Fishwife smoking a pipe with a giant flame coming out of it.

Fishwife’s attention-grabbing brand design differentiates it from canned competitors, such as Bumble Bee and StarKist, possibly allowing it to spend less on marketing.

Fishwife sells its three-pack of “Wild-Caught Smoked Albacore Tuna” for $27 on its website, where there's an implication that consumers are paying for quality and sustainability—the product description includes phrases such as “each fish is caught by one fishing pole, one at a time, to minimize bycatch and maximize quality control,” and “hand-packed, and canned in British Columbia.”

A three-pack of Bumble Bee “chunk light tuna in water,” for comparison, doesn't come with any of those upscale descriptors—but it's also only $3 and change from Walmart.

Fishwife started experimenting with paid marketing in July 2022. During the experimental phase, it was spending around $2,000 per month on Google Shopping and Facebook, Millstein said.

Paid spend is “extremely insignificant in terms of where our customer acquisition comes from,” Millstein said, although she did not share exact figures. But spending could grow as Fishwife’s sales targets evolve, Millstein said.

“Not to brag, but we basically did 2X higher than we had projected for our highest projection for Q4. So we were already working very, very hard on the operational side to keep up with the demand that we were getting during the holiday season. We could have invested more, but there was no need,” Millstein said.

What the experts say

Kendall Dickieson, the founder of Flexible Creative who has worked with other DTC brands in Whole Foods such as Graza, said Fishwife had “a whole lot” to do with the tinned fish category’s recent uptick in popularity. Fishwife has loyal followers who would make a journey to Whole Foods just because the brand is there, Dickieson said.

That’s partly because Fishwife “stays close” to its customers through “surveys that are so overlooked by so many brands,” said Grace Clarke, who founded GGC Consulting and has also worked on brands such as Graza.

“They phrase their [survey] questions in such a way that they actually get real qualitative answers. … They truly want to understand what is motivating their customer deep down,” she continued. Additionally, “DTC brands on the shelf actually elevate existing categories that are slowing down,” Clarke explained.

People going to the canned fish aisle specifically to buy Fishwife probably haven’t visited that section ever before, so there’s potential to increase cart value for that whole section—as well as actually move foot traffic around a store, which could bolster other categories too, per Clarke.

“I think they also understand that the people who are in their community don’t need to be a buyer just yet,” Clarke added.

What’s next

Fishwife will continue expanding into more Whole Foods regions as the year goes on. The next rollout, according to Millstein, will be Northern California this summer. It will also use the Whole Foods marketing engine for ad support such as in-store signage and on-premise events.

For instance, Fishwife and Whole Foods are planning to host a Whole Foods event at a still-to-be-determined Southern California location.

“It’s going to be a huge anchovy-centric bash,” she explained—and what could be more Fishwife than that?

Troov

Troov