BoJ’s Expected Pivot from Negative Rates: Will the Yen Soar or Stumble Against USD?

Trader anticipation for a significant change is growing as the Bank of Japan (BoJ) wraps up its March monetary policy meeting. The BoJ, led by Governor Kazuo Ueda, is expected to raise the benchmark rate from the current -0.1%...

Trader anticipation for a significant change is growing as the Bank of Japan (BoJ) wraps up its March monetary policy meeting.

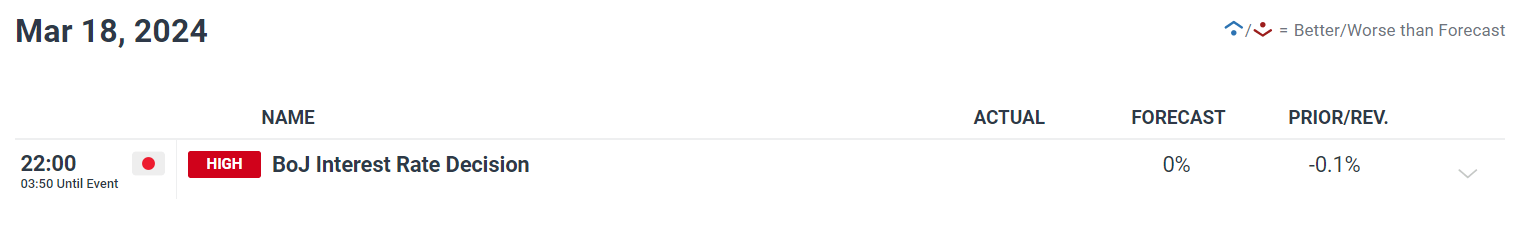

Source: DailyFX Economic Calendar via DailyFX

Source: DailyFX Economic Calendar via DailyFXThe BoJ, led by Governor Kazuo Ueda, is expected to raise the benchmark rate from the current -0.1% to 0.0%, capping its ten-year experiment with negative interest rates.

After having an ultra-dovish stance for so long, the BoJ’s anticipated move to raise rates will be the first since February 2007.

Terminating Yield Curve Control and Asset Purchases

The central bank is preparing to end its yield curve management program, which was implemented in 2016 and involved massive purchases of government bonds in an effort to normalize monetary policy.

Furthermore, included in the agenda is the termination of stock exchange-traded funds (ETFs) and other risk asset purchases, a strategy deployed for nearly 15 years.

Catalysts Behind the Policy Shift

With recent salary talks producing raises of 5.2%, the largest in three decades, this strategic pivot comes after recent salary negotiations yielded raises for Japanese workers. An inflationary cycle powered by strong domestic demand requires such wage rise.

Interest in the BoJ’s potential policy path for the future is growing as traders process these events. Although a hawkish surprise might set off a bullish spike in the Japanese currency and significantly affect pairs such as USD/JPY, a cautious approach to unwinding stimulus measures could weaken the yen.

USD/JPY Technical Analysis

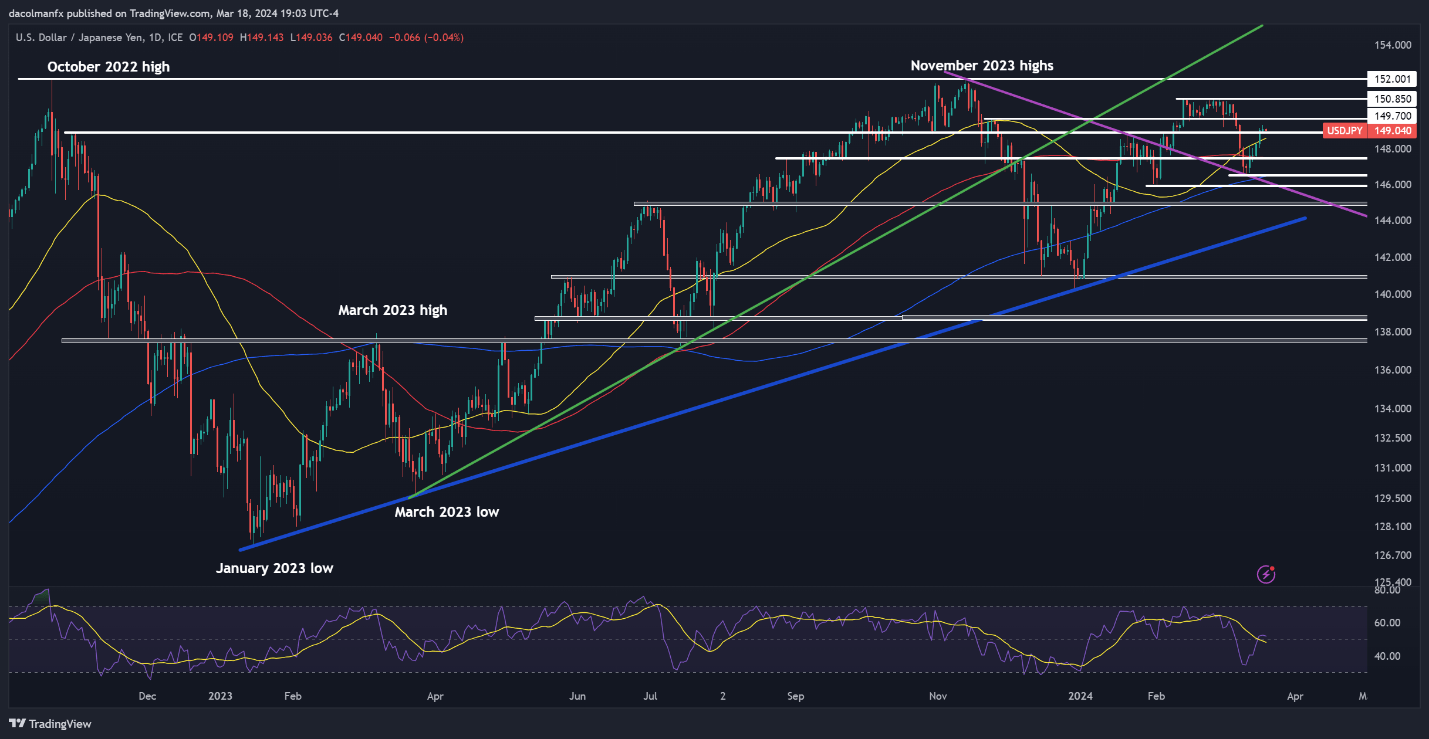

Source: Chart by TradingView Via DailyFX

Source: Chart by TradingView Via DailyFXFollowing its consolidation above the 149.00 threshold, the USD/JPY pair could encounter resistance at 149.70. If it continues higher, it could reach 150.85 and then 152.00 respectively.

On the other hand, a pullback below 149.00 could shift focus to key moving averages, with significant support levels at 147.50 and 146.50, corresponding to the 200-day simple moving average.

Background and Expectations

As the world economy tightens, especially after the US Federal Reserve and other central banks boosted interest rates in response to price increases brought on by geopolitical tensions, negative interest rates are expected to end.

Despite the global trend, the Bank of Japan persisted in its negative interest rate policy to promote lending and economic growth. This decision has weakened the yen and boosted Japan’s enormous debt payment expenses, which has had varying effects on exporters and consumers.

Final Thoughts

A change in policy is expected given the sustained high level of inflation over the BoJ’s 2% target and the recent large pay increases. According to a poll, more than 80% of economists expect a rate adjustment of zero to 0.1%.

A cautious but decisive step towards normalization is suggested by the possible end of purchases of real estate funds and exchange-traded funds (ETFs) while government bond purchases are still ongoing.

The activities of the BoJ may cause the yen to move significantly, which would present traders with both opportunities and risks in the currency markets. Traders should proceed with caution.

JaneWalter

JaneWalter