China's Xi announces another infrastructure push to boost growth as Covid drags on

China has relied on infrastructure to boost growth on the past, and analysts said the approach can be effective near-term, but adds to long-term problems.

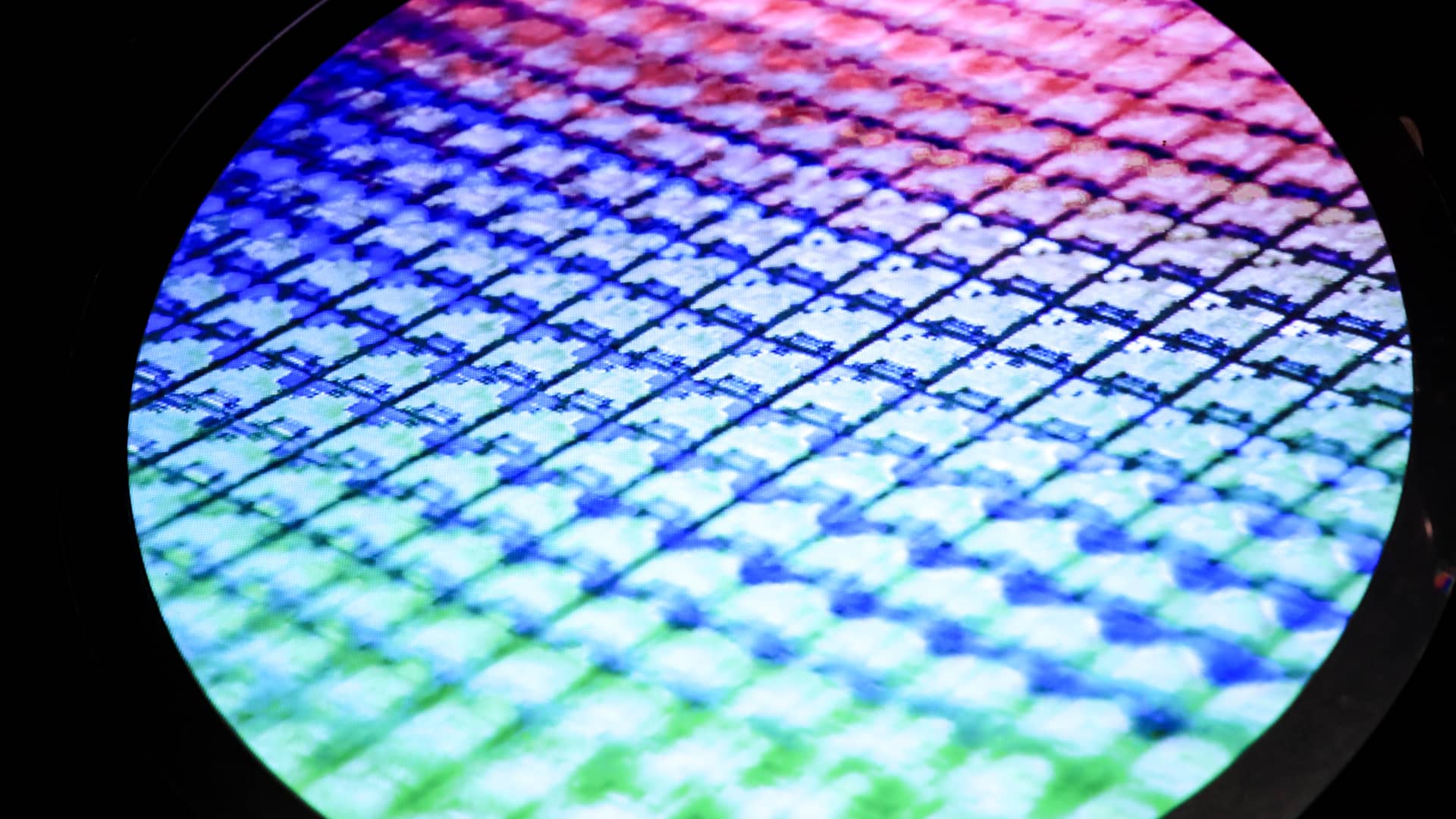

China had 37,900 kilometers (23,550 miles) of operational high-speed rail as of the end of 2020, which the country claims accounts for more than two-thirds of the world's total.

Zhang Bin | China News Service | Getty Images

BEIJING — As Covid controls drag down growth, China plans to boost its economy with more infrastructure investment.

That's the same approach the government has used in the past, and one that analysts say adds to problems for sustainable growth in the long term.

Chinese President Xi Jinping on Tuesday called for an "all-out" effort to construct infrastructure. Proposed projects range from waterways and railways to facilities for cloud computing.

Xi was speaking at a meeting of the Central Committee for Financial and Economic Affairs, a group he heads.

"The meeting suggests to us that Chinese policymakers have been increasingly aware of the strong growth headwinds from Covid restrictions and continued property downturn, and thus becoming more determined to ramp up policy easing measures," Lisheng Wang and a team at Goldman Sachs said in a note Wednesday.

"We believe infrastructure investment should be one key policy lever to stabilize growth," the Goldman analysts said, noting expectations for slowing growth in exports, weak private investment and the zero-Covid policy remaining in place for much of the year and hurting consumption and services.

The problem is that the more the country's growth relies on government-led spending on infrastructure, the more vulnerable it is to a slowdown.

Michael Pettis

Peking University, finance professor

Since March, mainland China has faced its worst outbreak of Covid-19 since the initial shock of the pandemic in early 2020.

Although first-quarter GDP topped expectations with 4.8% year-on-year growth, several investment banks have cut their full-year growth forecasts as travel restrictions and stay-home orders disrupt supply chains, especially in and around the metropolis of Shanghai, home to the world's busiest port.

Economists have pointed out how zero-Covid affects consumer spending far more than factories, which can sometimes maintain limited production under the policy.

Retail sales fell by 3.5% from a year ago in March — more than the 1.6% decline forecast by a Reuters poll.

Fixed asset investment for the first quarter grew more than expected, with that in infrastructure up by 8.5% from a year ago.

Can China meet its 5.5% GDP target?

"An even more forceful infrastructure push would help dampen some of the downward pressures on growth that are severely challenging China's ability to meet its 5.5% growth target," Louis Kuijs, APAC chief economist at S&P Global Ratings, said in an email.

However, "currently, China's Covid policy is the key bottleneck to growth." he said. "It will be really hard to get close to 5.5% growth this year without some easing of the Covid stance."

Xi's call for more infrastructure investment comes as local stocks have plunged on worries about growth in the world's second-largest economy. Among nine financial firms tracked by CNBC, the median GDP forecast is 4.5%, a full percentage point below China's official GDP target of around 5.5% announced in early March.

"The extent of the lockdown and continuing weakness in the property sector are making it increasingly difficult for China to meet the GDP growth target this year, but I expect them to make a major effort in the second and third quarters," Michael Pettis, a finance professor at Peking University in Beijing, said in an email.

Ahead of the official target's release, Pettis accurately predicted Chinese officials would set a GDP target between 5% and 5.5%.

"The problem is that the more the country's growth relies on government-led spending on infrastructure, the more vulnerable it is to a slowdown," he said, noting how infrastructure investment feeds into a cycle of higher growth expectations, which in turn requires more investment.

Pettis said in a report in March there are limits to the extent infrastructure investment can boost developing countries' growth. He said he believes China passed that point more than a decade ago and what's now needed is much harder institutional change.

Read more about China from CNBC Pro

Real estate, manufacturing and infrastructure construction have contributed significantly to China's economic growth over the past decades. The country has built up an extensive network of high-speed trains and airports.

Over the last several years, the central government has tried to boost consumption as a bigger driver of growth.

But China still has some ways to go before consumers can drive its economy. The country's official per capita disposable income of 35,128 yuan ($5,488) in 2021 remained a fraction of that in the U.S., which stood around $46,000 as of the end of last year.

Xi and other Chinese leaders on Tuesday also called for modernizing infrastructure in rural areas and in agriculture, according to an official meeting readout. They also stressed the need "to support national security infrastructure and improve the country's capability to cope with extreme situations."

More debt for growth

Analysts expect more debt will be used to fund the new infrastructure projects, reversing government attempts in recent years to rein in heavy reliance on debt for growth.

The net issuance of special local government bonds year-to-date has exceeded 35% of the full-year target, much higher than the 10% to 30% rate of the past three years, Monica Li, director of equities at Fidelity International, said in an email.

She said her team expects greater issuance of the bonds in the first half of the year relative to the second half in order for an "early start" of infrastructure projects. "Aside from more active fiscal spending, multiple funding sources will be tapped to fund for infrastructure, including public-private partnerships."

The Goldman analysts also pointed out the official release about Tuesday's economic and financial committee meeting did not mention measures for preventing an increase in hidden local government debt. That refers primarily to off-balance sheet bonds issued by local governments.

In the near-term, the plans for more infrastructure investment may help lift sentiment. Mainland Chinese stocks turned higher Wednesday in an attempt to stabilize after sharp losses to start the week

"The turning point for real policy actions may have arrived, and stimulus will likely come through more obviously from late Q2," Citi analysts said in a report Wednesday. "We tend to think the current overwhelming growth pessimism is perhaps overdone."

Koichiko

Koichiko