Crypto startup Blockchain.com lays off 25% of staff as 3AC fallout spreads

Crypto firm Blockchain.com is laying off 25% of its staff, equivalent to about 150 roles.

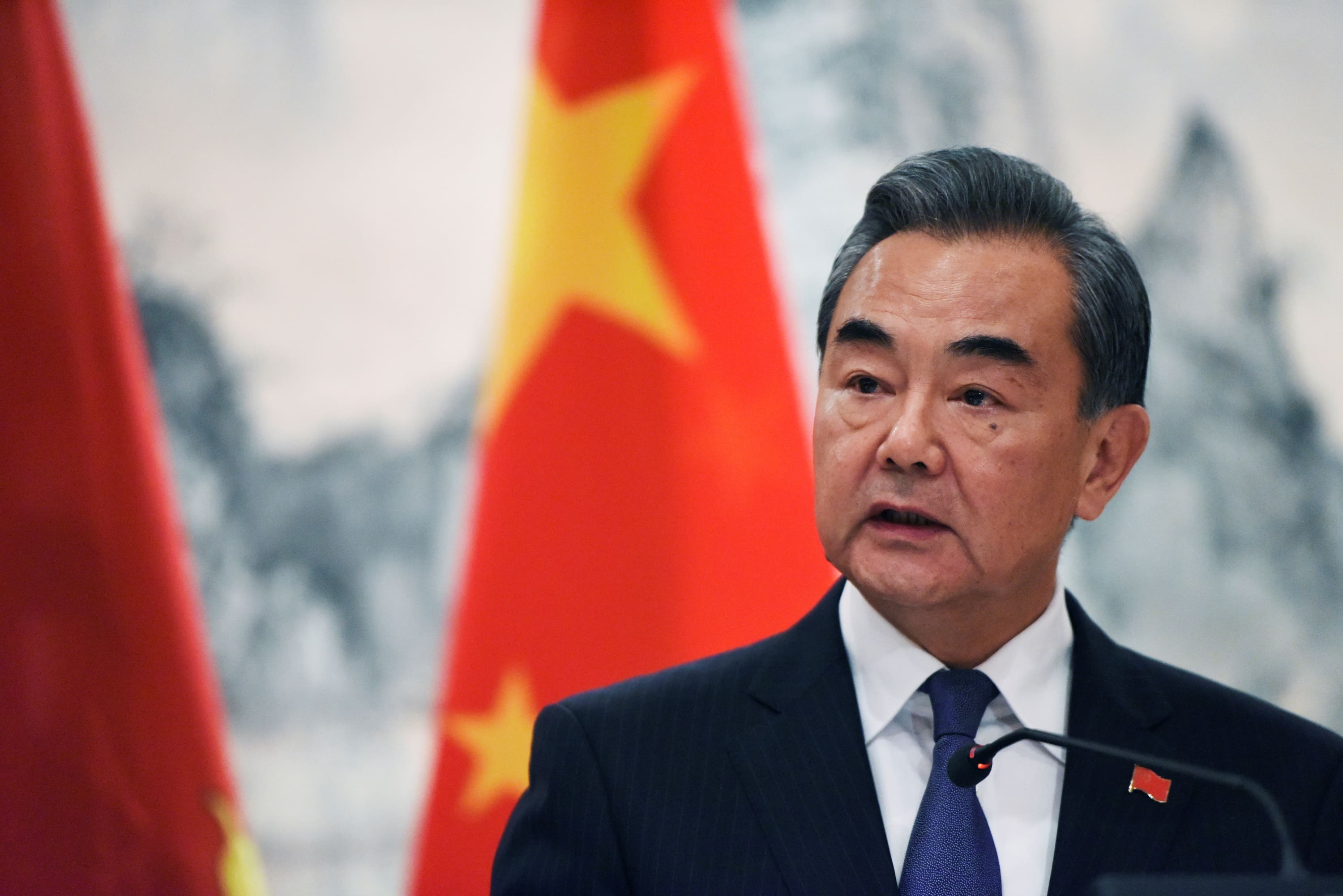

Blockchain co-founder and CEO Peter Smith speaks during the Web Summit tech conference in Lisbon, Portugal on November 6, 2018.

Pedro Fiúza | NurPhoto via Getty Images

Crypto startup Blockchain.com says it is laying off 25% of its staff, citing harsh market conditions.

The cuts translate to about 150 roles at the firm.

The company is also shutting down its Argentinian office and scrapping plans to expand in multiple countries.

Most of the layoffs — about 44% — affect employees in Argentina while 26% are based in the U.S. and 16% in the U.K. The company informed staff about the plans Thursday.

Industry website CoinDesk was first to report the news, which was later confirmed to CNBC by a Blockchain.com spokesperson.

Blockchain.com is one of many companies that got caught up in the fallout of crypto hedge fund Three Arrows Capital's collapse.

3AC filed for bankruptcy protection earlier this month, having owed crypto firms including Celsius and Voyager Digital hundreds of millions of dollars. The company's co-founders have since gone dark. Lawyers representing its creditors are trying to track their whereabouts.

Blockchain.com had itself lent 3AC $270 million in crypto and is expecting to lose that sum.

On Wednesday, crypto exchange Coinbase denied having any financing exposure to Celsius, Voyager or 3AC.

The collapse of the controversial Terra stablecoin in May had a spiral effect causing the downfall of crypto companies that made risky bets using borrowed funds.

Firms like Celsius and Voyager locked up user accounts after failing to meet redemption requests, before subsequently falling into bankruptcy.

Founded in 2012, Blockchain.com is a crypto exchange and wallet platform. The firm, which ranked No. 7 on this year's CNBC Disruptor 50 list, claims to be responsible for nearly a third of all bitcoin transactions through its wallet product.

The privately-held company was valued at $14 billion in a funding round announced earlier this year. Its backers include Baillie Gifford, American hedge fund manager Kyle Bass and British tycoon Richard Branson.

Astrong

Astrong