How 'SECURE 2.0' Could Boost Your Retirement Plans

SECURE 2.0 was signed into law at the end of 2022. Standing for “Setting Every Community Up for Retirement Enhancement,” the second version of this act is designed to keep building on improvements to the U.S. retirement system. Whether...

Photo: Colin Dewar (Shutterstock)

SECURE 2.0 was signed into law at the end of 2022. Standing for “Setting Every Community Up for Retirement Enhancement,” the second version of this act is designed to keep building on improvements to the U.S. retirement system. Whether retirement is far off or fast approaching for you, here’s what to know about how SECURE 2.0 will impact your retirement planning.

Changes to required minimum distributions

Required minimum distributions (RMDs) are the IRS-mandated amount of money you must withdraw from your retirement account each year. SECURE 2.0 lessens the blow of RMDs in several ways.

First off, the age to start taking RMDs increased to 73 in 2023 and will increase again to 75 in 2033. This gives savers an extra year for tax deferral (the previous age was 70.5 years old in 2022).

Previously, failure to take your RMD before the deadline would result in a 50% penalty. Under SECURE 2.0, the penalty for failing to take an RMD decreased to 25% of the RMD amount. If the error is corrected in a reasonable and timely manner, the penalty may be further reduced to 10%. What’s more, if you can demonstrate that your failure to take an RMD was the result of an understandable error, you might be able to get the penalty waived entirely. And starting in 2024, RMDs will no longer be required from Roth accounts in employer retirement plans. These relaxed rules are great news for the many savers who may miss deadlines due to simple oversight.

G/O Media may get a commission

Up to $100 credit

Samsung Reserve

Reserve the next gen Samsung device

All you need to do is sign up with your email and boom: credit for your preorder on a new Samsung device.

Changes to the size of catch-up contributions for older workers

Currently, if you’re at least 50 years old, the catch-up contribution rules let you add more money in your retirement savings accounts than the standard contribution limit for the year. Come 2025, these catch-up contributions will increase for 401(k), 403(b), governmental plans, and IRA account holders. This gives anyone who delayed retirement contributions (or who haven’t begun saving yet) the ability to “catch up” before reaching retirement age.

For traditional and Roth IRAs, the catch-up contribution amount was previously stuck at $1,000. Starting in 2024, the $1,000 amount will be adjusted annually for inflation (like the base amount already is).

For 401(k) and other employer-sponsored plans, the 2022 catch-up contribution limit for workers age 50 and up was $6,500 and is $7,500 for 2023. Under SECURE 2.0, for the most part the special catch-up contribution maximum for workers 60 to 63 years old is the greater of $10,000 or 150% of the “standard” catch-up contribution amount for 2024. The $10,000 amount will be adjusted for inflation each year starting in 2026.

Changes for younger workers, too

Even if retirement is decades away, the provisions in SECURE 2.0 may impact how you maximize your long-term savings.

Automatic 401(k) enrollment

Starting in 2025, employers offering a 401(k) plan will be required to auto-enroll their employees into the plan unless employees choose to opt out. The auto-enroll rate will be between 3-10%.

Greater access to emergency savings

One of SECURE 2.0's highlights is the ability for employees withdraw up to $1,000 from their retirement account for emergency expenses without having to pay the typical 10% tax penalty for early withdrawal if they are under age 59½. Companies also could let workers set up an emergency savings account through automatic payroll deductions, with a cap of $2,500.

For a full summary of all the provisions included in SECURE 2.0, you can read more information here. While it’s clear that this act offers more flexibility and greater protections for savers, everyone’s retirement plan is different. Make sure you consult a financial advisor or tax professional to understand how SECURE 2.0 changes apply to you personally.

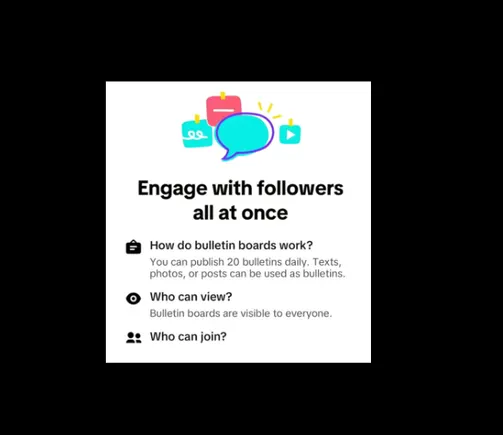

FrankLin

FrankLin