India wants to become the top manufacturing alternative to China. But first it needs to beat Vietnam

India is expected to be the biggest beneficiary of the "China plus one" strategy, but the country still has ways to go before it can compete with Vietnam.

Workers at the Lava mobile phone manufacturing facility in Noida, India.

Hindustan Times | Hindustan Times | Getty Images

India wants to be the top manufacturer in Asia as companies shift away from China, but first it needs to lower taxes and improve supply chain efficiency if it wants to dethrone Vietnam.

The U.S. has pursued a "friendshoring" agenda as competition with China increases. The Biden administration has encouraged American companies to move electronics and technology manufacturing operations out of China and into friendlier countries, particularly Vietnam and India in Asia-Pacific.

"Both Democrats and Republicans see China as a challenge. And every boardroom in the U.S. is asking a CEO what their derisking strategy from China is," said Mukesh Aghi, president and CEO of the U.S.-India Strategic Partnership Forum.

Vietnam's head start

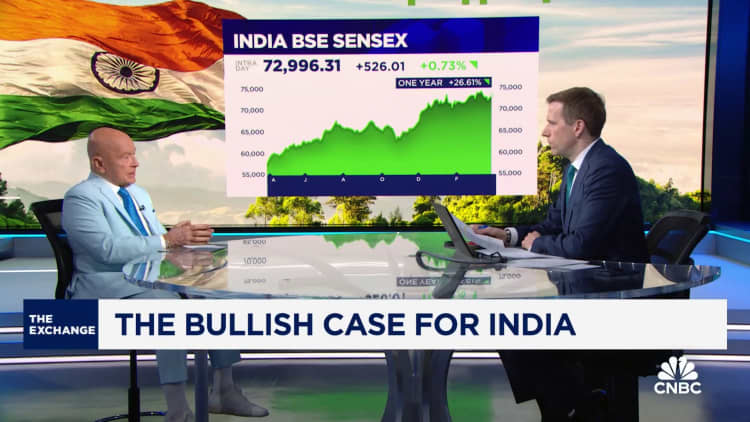

India and Vietnam are attractive manufacturing alternatives for foreign investors and companies, due in part to low labor costs. Between the two, however, Vietnam is still way ahead with 2023 exports totaling $96.99 billion, compared with India's $75.65 billion.

"Vietnam has been known for their ability to manufacture electronics. India is just getting into that game, so that provides Vietnam with a competitive advantage," said Samir Kapadia, CEO of India Index and managing principal at Vogel Group.

While India's relationship with the U.S. has warmed, especially after Prime Minister Narendra Modi's state visit to the White House in June, Vietnam has had a trade and investment deal with Washington since 2007.

Another key advantage for Vietnam is a more simple proposition compared with India, which Aghi noted has "29 states and every state has a policy which may be different."

"Vietnam has an upper hand when it comes to economies of scale manufacturing where its mostly manual labor," Nari Viswanathan, senior director of supply chain strategy at software firm Coupa.

Sectors that require intensive manual labor and have low profit margins such as apparel manufacturing are "not going to move the needle" for India," Viswanathan noted.

U.S. tech giants are increasingly bringing part of their supply chains to the South Asian country. The Financial Times reported in December that Apple told component suppliers it will source batteries from Indian factories for its upcoming iPhone 16. The company has weighed expanding operations in India since 2016, when CEO Tim Cook visited Indian Prime Minister Narendra Modi. Google is also set to begin Pixel phone production in India by the second quarter.

Import taxes remain high

One hurdle for India's manufacturing hub ambitions is the country's 10% import duty for information and communication technologies. This is higher than Vietnam's average import duties of around 5%, according to Andy Ho, chief investment officer at VinaCapital.

India's import taxes were intended to protect domestic manufacturers, but lowering those duties will be part of the government's efforts to attract foreign firms to manufacture goods within the country.

"2024 will be a year of Prime Minister Modi winding down many of these tariffs, but he's going to do it focused on an industry by industry basis, and not a country by country basis," Kapadia added.

For example, India in January lowered import taxes for certain metal and plastic parts used in manufacturing mobile phones from 15% to 10%. That benefits companies like Apple and Dixon Technologies, which manufactures phones for Xiaomi, Samsung and Motorola.

"Given Vietnam's stronghold over electronics manufacturing and exports to the United States, that's where we will see the most traction early on as India attempts to take market share. This includes all kinds of plastics, metal componentry and mechanical items," Kapadia said.

India's electronics exports to the U.S. reached $6.6 billion between January and September last year compared with $2.6 billion for the same period in 2022, according to a LinkedIn post by Pankaj Mahindroo, chairman of the India Cellular and Electronics Association.

But VinaCapital's Ho warned that lowering import duties is "not a source of sustainable advantage in attracting FDI investment over the long-term."

"What foreign investors tend to be more concerned about is ease-of-doing business issues — especially the flexibility to hire and fire workers — than taxes and tariffs. This is Vietnam's main source of long-term advantage over India," Ho told CNBC in an email.

Efficiency is key

Although India wants to be a developed economy by 2047, its infrastructure is still lacking, leading to lengthy shipment and road delivery times.

"A ship in Singapore can be unloaded in eight hours and be on a truck to prospective factories, but the same ship in India will be stuck in a custom warehouse for days," Aghi said, warning these delays lower the South Asian nation's appeal to foreign companies.

"China is probably 10 years ahead of India on its infrastructure, so the country needs to work harder to make sure infrastructure continues to get built," he added.

India's interim budget estimated that the federal government is set to spend 2.55 trillion rupees ($30.7 billion) to improve India's railway system.

"India is well on that path of modernizing systems in logistics to enhance on-demand supply chain models for importers and exporters and this factors in all kinds of new roads and ports. I think that will be a priority before automation," Kapadia said.

Vietnam's warming relations with China

Vietnam's warm relationship with China, however, offers India a key advantage, Kapadia highlighted.

"Vietnam could not be closer to China in so many different ways. And I think that will concern supply chain managers and U.S. corporates for the next 10 to 15 years," he warned.

China's President Xi Jinping visited Vietnam just three months after U.S. President Joe Biden did, signing agreements with Vietnam on areas like infrastructure, and trade and security.

"[China and Vietnam are] constantly shaking hands and handing each other medals every time they see each other," Kapadia said.

"I think the bigger players are going to be factoring in some of the political calculus regarding China's relationship with Vietnam, and holding back their decision making until India can prove that they can really compete in electronics manufacturing to date," he added.

JimMin

JimMin