Jim Cramer’s Secret to Early Retirement is Now Public

Jim Cramer’s approach has always been practical and positive about financial freedom after retirement. He runs the CNBC investing club, which helps people make worthy investment decisions to amplify their money. In addition, Cramer is the co-founder and chairperson of TheStreet....

Jim Cramer’s approach has always been practical and positive about financial freedom after retirement. He runs the CNBC investing club, which helps people make worthy investment decisions to amplify their money. In addition, Cramer is the co-founder and chairperson of TheStreet.

Born to creative parents, Cramer has always been appreciated for his unique ability to provide logical financial suggestions. Do you know what Cramer says about early retirement? This post unveils the secret – keep reading and learn the mysteries involved!

Jim Cramer published a book called ‘Real Money’ in 2005. On page number 66 of the said book, Cramer said — “the age-specific investment approach is your best option.” These lines reflect how crucial it was for Cramer to save for retirement. He believes everyone should start saving for retirement as early as possible.

Cramer started his career with the Tallasahi Democrat. In 1977, he got his first steady paycheck. However, when he left Talasahi, he passed through tough times. He was living in his car when he used to work as a reporter in Los Angeles. Impressively, dodging that adverse financial situation, Cramer managed to put $1500 away for his retirement.

He says he invested the money in the famous Peter Lynch at Fidelity Magellan Fund. According to Cramer, that money was being invested for multiple years consistently. This, in turn, helped him to compound the money to such an extent that it could provide a moderate retirement income to live lavishly for at least a half dozen years post-retirement.

In the dawn of 2023, Cramer’s ideology seems very relatable. Saving for retirement has never been this crucial – the job market has gone insanely unstable, and the economy craves oxygen because of inflation. This is high time to adopt an age-specific mindset, as Cramer explains – you should focus on growth stocks in your 20s because you have enough time to take and manage risks.

When you enter your 30s, you should pull the chain a little hard and switch to more stable stocks like dividends. Moving on to your 40s, bonds should make up a more significant portion of your portfolio since this is the time to prioritize capital preservation.

According to Cramer, given the disrupted economic scene in the USA, even highly curated plans for retirement may fail. Therefore, you should switch to the alternative of retiring early. However, how should you move towards early retirement?

How Should You Plan for Early Retirement?

Cramer articulates that sticking to a strategy from your early 20s may help you retire early and enjoy financial freedom. There are several elements to consider, including the following.

1. Know Your Style

When you are beginning, it’s crucial to know where you stand. Ideally, you will need 70% of your yearly income to fuel your yearly expenses after retirement. Therefore, identify your present financial position and look for ways to secure that percentage so you can retire early and not see poverty post-retirement.

2. Focus on Compounding

Only compound interest can grow your money substantially. If you want to estimate how quickly you can multiply your money, you just need to figure out the years needed to grow it at a given interest rate. For instance, if the interest rate is 10%, it will take approximately seven years to grow $1000 into $2000. If you want more benefits, you can consider high-yielding stocks.

3. Set Realistic Goals

Be realistic when carrying out the calculation. If you retire early, you will probably live a long time without work. Is the venture going to be riskier than you bargained for? Will you be able to manage enough money to enjoy your retirement? Reassess the factors before you say goodbye to your job. Remember, leaving your retirement entirely on double-digit investment returns is not wise. Hence, be careful!

4. Don’t Ignore the Health Factor

Everything about retirement may not be that juicy. You may experience health issues that can make a big hole in your pocket. Therefore, get health cover that can help you with your hospital bills.

5. Choose the Right Investment Vehicle

If you have decided to retire early, you are probably ready to compromise the comfort of your monthly salary. Therefore, you should utilize the limited time frame to save massively for your retirement years. For instance, if you started earning at the age of 18 and you are planning to retire in your 40s, you will have approximately 20-22 years to grow your money and save for your retirement.

Given this, you should be very particular when picking investment instruments. Always walk with the alternatives that ensure sizeable returns over time. Besides, they should be able to beat inflation. You can browse through equity-based alternatives or annuity plans to secure a regular flow of income.

6. Manage Your Portfolio Sensibly

Only consistency can help you reach your goal when it comes to retiring early. Therefore, be regular with your investment and manage your portfolio actively. If you truly want to maximize your returns, consider monitoring your investments closely. You should be able to figure out which investments will suit you and which won’t.

The investments you have made previously should also be reanalyzed. Check if they hold their ground in the present day and have helped combat inflation. If their performance doesn’t seem promising, take out your money and put them in the right instruments.

7. Calculate your Requirement

You can do this by referring to the rule of 25. This says that you should acquire 25X your planned annual spending before retiring. For instance, if you want to spend $40,000 during the first year of retirement, you should have $10,00,000 invested when you leave your job. When you invest your retirement nest egg, it will continue to grow. This way, they will be able to keep up with the inflation.

8. Know the 4% Theory

The 4% rule is a widely accepted idea for retirement planning. It suggests that you can withdraw 4% of your invested savings during the first year of retirement. Afterward, you can adjust the withdrawal amount for inflation every year. Although you don’t have to adhere strictly to the 4% rule, you can make adjustments based on your risk tolerance, market performance, and investment portfolio.

9. Use Low-cost Index Funds

Retiring early comes with two clear downsides – a shorter span to save and a longer period to spend. You need to achieve the best returns to dodge them, which can be done by building a balanced portfolio inclined to long-term growth. You can use low-cost index funds to achieve this goal. Usually, such funds come with allocations tilted toward stocks, and you are free to stomach them as long as you can.

10. Expense Check is Mandatory

Well, you may have done loads of homework to figure out how much you will need to spend your retirement comfortably. However, estimating the expenses could be a discussion. Generally, it starts in an innocent way – you throw that mandatory retirement party. After a few days, boredom hits, and you go out for a vacation. Then, you need a companion, so you get a dog. Well, now the 4% rule, as mentioned above, suddenly kicks in.

You should avoid this scenario. You decided to stick to that rule to beat inflation. It can never help you if you mindlessly spend much beyond your capacity. If you increase your recurring expenses in your retirement, you will likely run out of money soon.

11. Avoid Debts

Debts can be a hindrance to your early retirement efforts. When you are stuck with debt, you will find it challenging to acquire enough money to support your post-retirement life. Ideally, you should follow the fundamental 30:30:30:10 budgeting rule to avoid financial burdens.

As such, you should dedicate 30% of your monthly income to housing needs, 30% to groceries, utilities, and fuel, 10% to discretionary expenses, and 30% to your savings and investments. By following this rule, you will be able to save in a strategic and disciplined way.

12. Consider Passive Income

Building a passive income stream may help you retire early, and there are several ways to do so. For example, you can start taking up freelancing projects or invest in dividend assets. Besides these two, you can also consider several other ways to generate passive income. They may include real estate investing, affiliate marketing, and creating and selling digital products. The key is to find a method that works for you, and that aligns with your financial goals.

Facts About Early Retirement That You Shouldn’t Ignore

Now that you are familiar with the secrets of early retirement, here are some lesser-known facts that can help you make an informed decision. Remember, everything about retiring early is not sweet, and you should be prepared to embrace its bitter side as well.

1. Unpredicted Spending

As highlighted before, in retirement, you will typically need to spend only 70% of what you spent when you were working. For example, if you spend $10000 yearly when working, it is expected to become $7000 once you retire. There won’t be liabilities such as shoveling money into your retirement account, paying social security taxes, and bearing the communication cost for work. However, in the early years of retirement, you are expected to spend more than you planned to fuel your newly retired lifestyle.

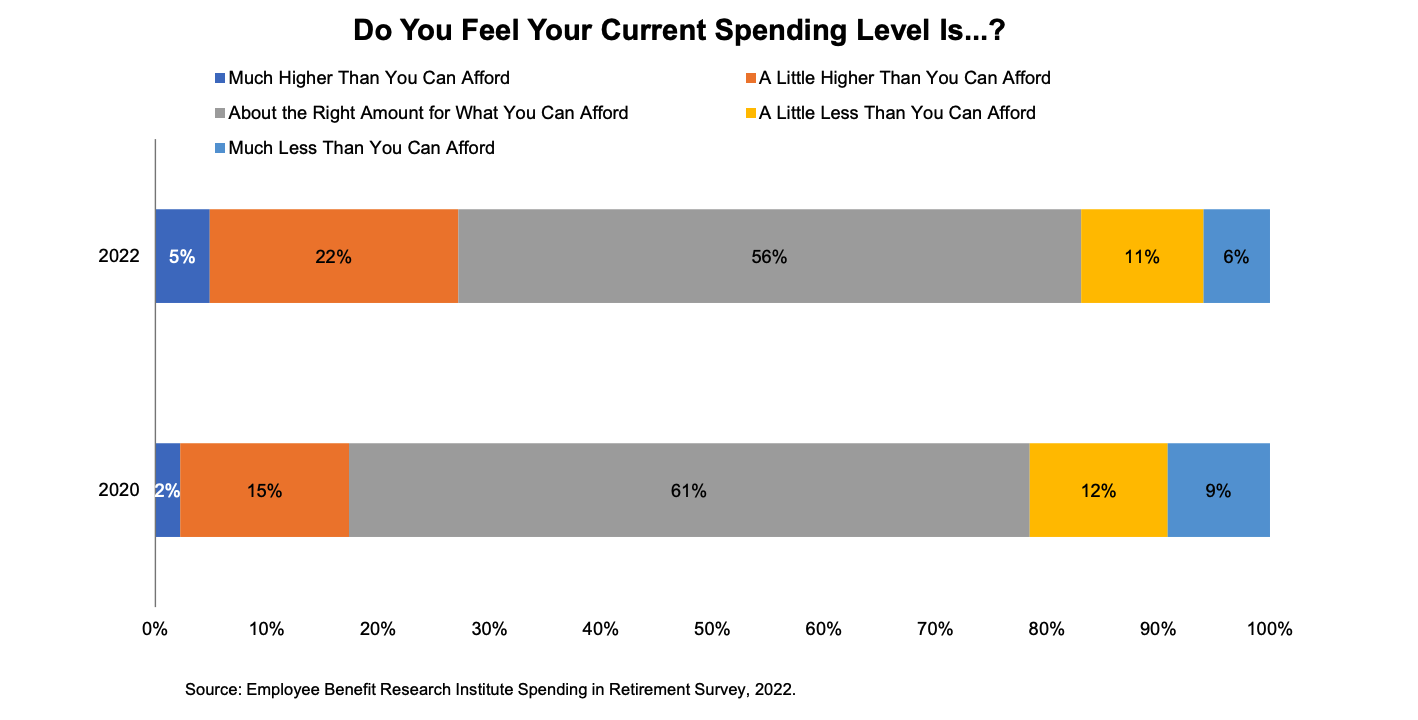

Moreover, the inflation rate is running at a red-hot 8.3% now. Nobody can say it will surge to what extent when you retire. Given this, you may need to revise your retirement savings plan considerably. EBRI reveals that 36% of retirees agree that their overall expenses have been higher than their calculations. Considering these facts, you should start saving even more rigidly to spend your retirement in comfort and peace.

2. Elevated Costs

Sometimes tapping your nest egg early may cost you significantly. Retiring before 59 makes you likely to pay a 10% early withdrawal penalty from tax-deferred accounts like 401 (K) plans and IRSs. Moreover, if you don’t have a Roth IRA, funded with after-tax contributions, your withdrawals from traditional accounts will be subjected to tax implementations.

For instance, if you withdraw $40,000 before you hit 59 and come under the 15% federal tax bracket, you are expected to pay $10,000 in penalties and taxes. This will leave you with $30,000 in hand.

3. Burdensome Housing Expenses

If you are retiring with a mortgage, your housing expenses won’t retire with you. Thus, you should always try paying off your mortgage before you say goodbye to your job. However, even if you manage to pay your mortgage, you should be careful about your property taxes and home maintenance costs and plan your retirement budget accordingly.

FAQs

1. What happens if you retire early?

Retiring early comes with a set of pros and cons. The benefits may include several elements. For instance, you can enjoy an opportunity to start a new career. Furthermore, early retirement allows you to spend more time traveling and exploring different dimensions of life. Most importantly, if you have planned strategically, early retirement can help you cherish financial freedom.

However, there are downsides as well. First, your social security benefits will be reduced. Next, you may struggle to make your retirement savings last longer. Finally, the lifestyle transition may affect your mental health.

2. What is the ideal age to retire?

Well, the answer is pretty self-explanatory. Most people believe the standard retirement age should range between 60 and 65. In fact, if you retire at this age, you can draw your full social security retirement benefits. However, depending on your financial situation, you may decide to retire early or late. There is no definitive formula that can help you find the right age for retirement. Thus, consider your goals when making the decision. You can also take professional help from financial advisors to make the right decision.

3. How can you comfortably prepare for early retirement?

To set yourself free before you hit your 59, you must plan your finances strategically. You should invest in the right instruments, keep track of your budget, and save adequately for your future. In addition, you should purchase health coverage to deal with unforeseen medical emergencies.

4. Should you retire early?

Yes and no! If you plan to start a new venture after your 40s and your job obstructs your way, you may consider the idea of early retirement. Similarly, you can retire early if you want to enjoy a burden-free life a little earlier than the standard norms. However, if you are burdened with loans and have not been able to manage your finances well so far, you should think thoroughly before deciding to retire early.

5. What did Cramer say about early retirement?

Jim Cramer has always been positive about the idea of early retirement. In fact, he considered it one of the best weapons to beat inflation and live a worry-free life. However, Cramer has recommended a few to-dos to obtain the best benefits of early retirement. They include strategic and consistent savings, awareness of the present financial condition, etc.

Published First on Due. Read Here.

Featured Image Credit: Photo by Mikhail Nilov; Pexels; Thank you!

Troov

Troov