Millions of Brits to pay more in 'stealthy' taxes despite PM Truss's cuts, study finds

Millions of Brits are set to pay more in "stealthy" taxes even as new Prime Minister Liz Truss has pledged to ease the burden on households.

British Prime Minster Liz Truss' government has committed to freezing the threshold on the tax-free personal allowance until 2025-26, essentially pushing more workers into a higher tax bracket over time.

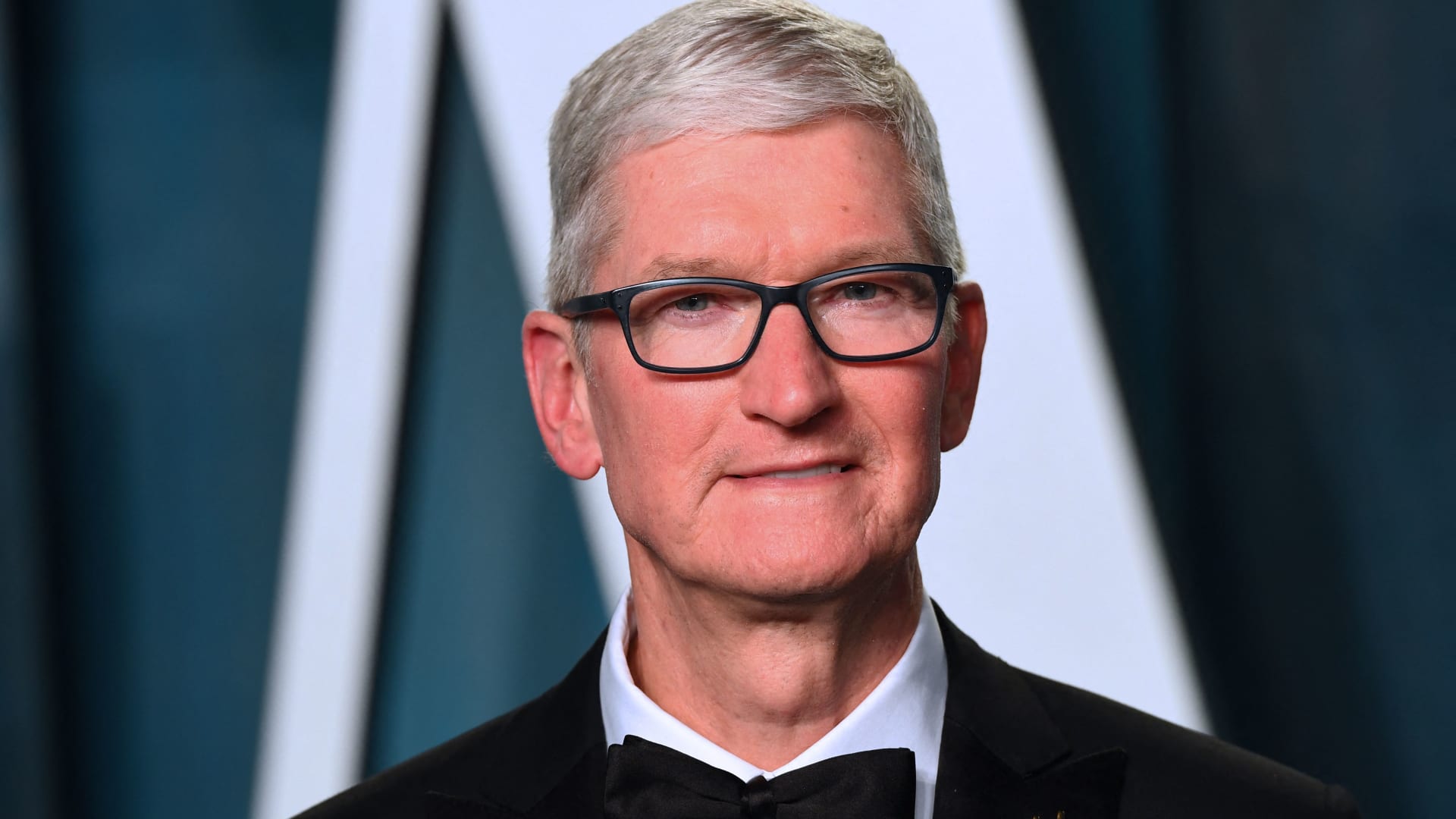

Jacob King | Pa Images | Getty Images

LONDON — Millions of U.K. workers are set to pay more in "stealthy" taxes over the coming years even as new Prime Minister Liz Truss pledged to ease the burden on households amid the country's worsening cost-of-living crisis, a new study found.

For every £1 ($1.12) given to workers under Truss' much-documented headline income tax cuts, £2 will be taken away through a freeze on the level at which they start paying tax on earnings, calculations released Thursday by the Institute for Fiscal Studies, the U.K.'s leading economic think tank, showed.

Under the Conservative Party's "growth-focused" economic agenda, the threshold on the tax-free personal allowance will be frozen at $12,570 until the fiscal year 2025-26, essentially pushing more workers into a higher tax bracket as their earnings increase over time. This tax rate level was frozen by the previous Finance Minister Rishi Sunak but the current administration hasn't indicated that this will change.

This comes as Truss and her government have promised to shield workers from soaring inflation with cuts to the basic rate of income tax and national insurance.

"By 2025–26, these freezes take away £2 for every £1 given to households through the headline personal tax cuts," the report found.

"Not only is this true overall, but households in every part of the income distribution will, on average, lose more from freezes over the next three years than they will gain from the headline cuts."

The U.K. Treasury did not immediately respond to CNBC's request for comment.

Typically, thresholds and allowances are uprated in line with inflation or, sometimes, earnings, meaning that they maintain their real value over time. The same is true for welfare benefits, which Truss has separately resisted committing to raise in line with inflation.

However, freezing them can "stealthily and unpredictably change the size and shape of the tax-benefit system," the report said. That is especially true when inflation — currently running at 9.9% in Britain — is high, it added.

"Giving with one hand and taking with the other in this way is opaque and stealthy – and when inflation is volatile the impact can vary hugely from what the government initially intended," Tom Wernham, IFS research economist and one of the report's authors, said.

According to the IFS's calculations, 1.4 million more workers will pay the basic tax rate by 2026, costing the total 35.4 million affected an extra £500 per year (in today's prices.)

Meantime,1.6 million more people will move into the 40% higher tax rate over the same period, causing the country's then 7.7 million higher earners to pay an extra £3,000 per year.

The additional cost will only be partially offset by the government's headline tax cuts, the report found.

"In total, the roll-outs and freezes will reduce household incomes (and strengthen the public finances) by £41 billion in aggregate in 2025–26, only half of which is offset by the discretionary tax changes," the report found.

The findings come a day after Truss used her landmark Conservative Party Conference speech to talk up her divisive tax-cutting policies, which have sparked party in-fighting and market turmoil.

The prime minister said Wednesday that "cutting taxes is the right thing to do morally and economically," adding that the Conservative Party "will always be the party of low taxes."

Hollif

Hollif