Part 6: A beginner’s guide to crypto for S’poreans: 10 free tools you can use in your crypto journey

From price analysis to portfolio tracking, here are 10 free tools which can help guide you along this ever-changing world of crypto.

For those of you who’ve been following along our beginner’s guide to crypto, you should feel fairly confident by now. We’ve gone over all the fundamentals – from how blockchain technology works, to the different types of cryptocurrencies, stablecoins, NFTs and DeFi.

In partnership with Luno, we’ve also stressed the importance of doing research the right way so that you can always be equipped to make informed decisions. While this space offers a lot of opportunities, there’s also a lot of risks and misinformation out there. Fraudulent projects and scams have become prevalent in the crypto space and learning how to spot red flags is essential.

At this stage, you’ve probably realised that investing in crypto can be a time-consuming process – even more so than in traditional finance, which is heavily regulated – and the responsibility to protect your assets remains primarily with yourself.

In the final edition of our series, we’ll look at 10 free tools which can help make life easier and guide you along this ever-changing world of crypto. These cover a wide range of uses including charting, price analysis, and portfolio tracking.

Price-tracking and portfolio management

When deciding to buy a crypto coin, you’ll want to check the price at which it’s trading and find a good entry point. CoinMarketCap and CoinGecko are two of the most widely-used websites for this purpose. The former tracks over 20,000 different coins, while the latter tracks around 12,000. Both websites list new coins on a daily basis.

Price information is free to access for all users with no sign-up required. It’s possible to look at the historical prices of coins, often dating back years or to whenever the coin was first introduced.

Along with this, both websites also report statistics such as the highest and lowest price which a coin has traded for in a given time period. This can be helpful in gauging the prevalent sentiment around a coin which you’re looking to invest in.

Screenshot of CoinMarketCap

Screenshot of CoinMarketCapBy creating a free account on either website, users can also access their respective portfolio trackers. These allow you to manually enter the coins which you’ve invested in – the quantity and price of purchase – and track their value over time.

For those who invest in equity markets as well, Delta is an all-in-one portfolio tracker to consider using. The app allows you to track your investments on-the-go – crypto, NFTs, and stocks – using the same interface. Delta is free to download on Google Play and the App Store, and it is only available for use on phones and tablets.

Analytics

One step beyond price-tracking is analytics. This involves using the wide range of information available on the blockchain – price movements, number of active wallets, transaction fees – to give you a sense about future performance.

Most crypto analytics platforms only offer real-time data analytics as part of their paid subscription plans. However, they may also have free plans which usually provide sufficient insights for retail investors.

Glassnode is a beginner-friendly platform, which provides access to fundamental metrics such as market cap, transaction rate, and transfer volume for free. There are descriptions which explain the purpose of each metric, and users are able to compare different metrics on the same graph as well.

Screenshot of Glassnode

Screenshot of GlassnodeUsing quantitative data is an important part of researching a cryptocurrency as it can help provide an objective view.

For example, if you see someone praising a crypto coin’s potential on Twitter, it’s tough to tell whether their insights are legitimate or if they are simply promoting the projects because they are invested in it and want to build hype.

The latter is a popular form of crypto promotion known as shilling. Communities try to draw attention to their project on social media, using information which may not always be true or positioned to optimise clicks, also known as clickbait.

People might even use fake accounts to make it seem like a project has more followers than it actually does. Through data analytics, you can check the number of wallets which actually hold said project’s cryptocurrency and make judgement by yourself. This can help prove whether or not the community is legitimate.

Santiment is another popular analytics tool which offers a free plan. Users can create their own personalised watchlists, and access up to two years’ worth of historical data, albeit with a 30-day lag.

Charting

If you’re looking to engage in your own technical analysis, TradingView is the ideal platform to read charts, draw indicators, and test strategies. The platform has long been popular among equity traders and over the years, it has introduced cryptocurrencies as well.

Screenshot of TradingView

Screenshot of TradingViewTradingView offers free access to a wide range of indicators, although users will have to look elsewhere to learn how to make sense of them. Those already familiar can get started immediately and begin plotting their investment strategy.

The platform allows the community to create and share their own scripts well. These are lines of code, which can interpret price information and prove useful in identifying future trends. Using these scripts, users are free to test out their theories about market movements and gauge how well their strategies would perform based on historical data.

Education

While this beginner’s guide gives you all you need to get started in crypto, there’ll always be a need to continue building your knowledge and learning about new trends, and even read back if things get a little fuzzy. The crypto space is ever-changing and to ensure you’re making the right investments, it’s important to stay informed.

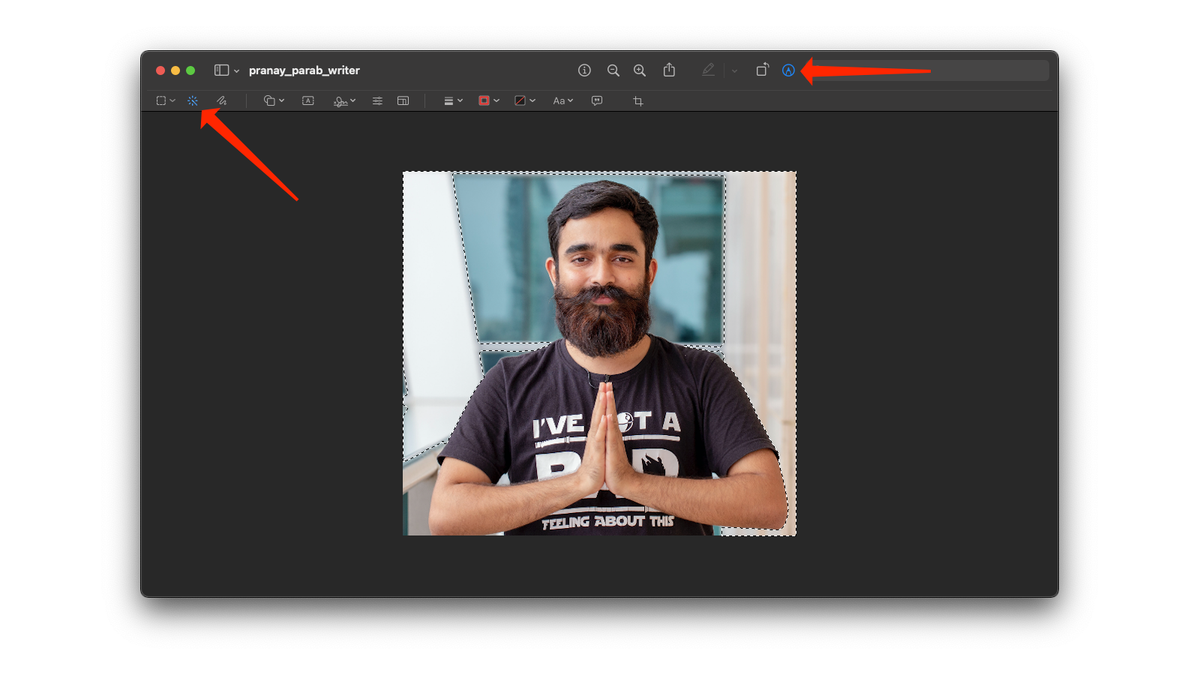

Screenshot of Luno Discover

Screenshot of Luno DiscoverLuno takes crypto education to the next level with Luno Discover. It offers daily crypto updates, weekly round-ups, development news, as well as a variety of guided content for both beginner and advanced crypto enthusiasts. The content is written to be easily digestible and jargon-free.

If you like to read on-the-go, Luno Discover is also available within the Luno app which is free to download. Even if you only have a minute to spare, there’s plenty which Luno Discover can teach you in that time.

For smaller on-the-go doses of crypto knowledge, it’s also worth subscribing to Luno’s Telegram channel and following them at @luno_sg on Instagram. It’s a way to stay up-to-date on all the headlines of the day and if any of them catch your attention, there’s always a link to read on and learn more. Challenge what you’ve learnt with their weekly pop quiz – if you get it wrong, don’t worry because explainers are always available.

NFT trackers

Finally, for those looking to invest in NFTs, knowing historical floor prices – the lowest price at which an NFT from a collection is listed for sale – can be helpful in making a buying decision. It also helps to know how many sales a collection sees per day. This can inform you of the demand for a particular NFT collection.

Different blockchains tend to have their own apps built for tracking NFT prices. NFT Price Floor and Solsniper are two popular trackers for the Ethereum and Solana blockchains respectively.

Screenshot of NFT Price Floor

Screenshot of NFT Price FloorSince NFTs can be listed on different marketplaces, these trackers can help ensure that you’re getting the best deal.

For example, the floor price for an NFT collection might be 20SOL on the Magic Eden marketplace, but 18SOL on OpenSea. Solsniper can save you the trouble of checking each marketplace individually and instead, let you know the lowest price for which you can buy an NFT.

Solsniper has TradingView’s charting tools built-in on its website, allowing users to carry out technical analysis on NFT price movements as well. The website also tracks the unique holders of each NFT collection, and the number of NFTs held by the top 50 holders.

If the supply of an NFT collection is concentrated among a few holders, there’s always the risk that they can dump their holdings and sway the price significantly. This is an important data point to consider when looking at NFTs. Just like with crypto, quantitative data can help you make better investing decisions here as well.

With that being said, we’ve come to the end of our beginner’s guide to crypto. You should now have everything you need to take your first steps into this exciting realm.

This guide was created as part of Luno’s ongoing mission to encourage responsible crypto participation. In this ever-growing space, it’s important to make education a priority and ensure that users – both new and experienced – are well-aware of making the right investment decisions. If you feel the need for a refresher, revisit the other parts of the guide linked down below.

This article is part of a six-part series to a no-hype beginner’s guide to crypto. You can check out the other articles here:

– Part 1: Blockchain and cryptocurrencies

– Part 2: Types of coins and its risks

– Part 3: NFTs, DeFi and metaverse

– Part 4: Stablecoins

– Part 5: How to ‘DYOR’

This article is written in collaboration with Luno.

This partnership between Vulcan Post and Luno is for educational purposes only. Luno Singapore has been awarded in-principle approval from the Monetary Authority of Singapore (MAS) under the Payment Services Act 2019. Cryptocurrency is a high-risk investment. The value of cryptocurrency can fluctuate significantly and you may lose the capital you invest. Before investing, we urge you to educate yourself about cryptocurrencies and to familiarise yourself with the risks involved, which are detailed in Luno’s Risk Warning.

Featured Image Credit: CoinGecko / Luno / Delta / Art Haus

FrankLin

FrankLin