Plan for the unexpected: How to protect financial assets and welfare amid life’s uncertainties

LPA and ACP grant you the ability to assert your preferences regarding your financial and welfare matters, if and when you are unable to communicate your wishes.

A month after its co-founder, Derek Ong, tragically passed away, homegrown hospitality group Tipsy Collective finds itself at a crossroads.

The loss of a visionary leader, at the young age of 35, has cast a shadow of uncertainty over the group’s future. Derek and his close friend, David Gan, co-founded Tipsy Collective in 2018, and the launch of their highly-anticipated project were abruptly delayed by this unforeseen tragedy.

In an interview with Vulcan Post, David emphasised the impact of losing a key team member, but also highlighted their commitment to growth. In fact, the loss of Derek has inspired the group to redouble their efforts to honour his memory by carrying on their mission.

The story of Tipsy Collective illustrates that life can throw unexpected curveballs. This may not only pertain to the loss of a loved one, but also the potential loss of mental capacity, which can happen due to accidents, and medical conditions such as dementia.

This additional layer of unpredictability underscores the importance of comprehensive planning, including tools like Lasting Power of Attorney (LPA) and Advance Care Planning (ACP). They play a crucial role in safeguarding one’s assets and well-being in the face of unforeseen circumstances like mental capacity loss.

Just as Tipsy Collective must adapt and plan for the future without Derek, individuals should also plan for their own futures to prepare for life’s uncertainties.

What is LPA and ACP?

An LPA is a legal document that empowers you to appoint one or more trusted individuals, also known as Donees, to make financial and welfare decisions on your behalf in the event that you become mentally incapacitated.

This proactive step ensures that your hard-earned assets are managed according to your wishes even when you are unable to make decisions yourself.

Your Donee, often a family member or close friend, can assist in managing your care matters, investments, paying bills, and handling various financial transactions during this challenging period.

Without an LPA in place, your loved ones may have to go through a time-consuming and expensive process to obtain a court order granting them legal authority as a deputy to manage your matters for you.

This deputyship order enables the court to intervene in situations requiring crucial decisions when your capacity to make them has been compromised, and there is no pre-appointed individual (ie. Donee in the LPA) to act on your behalf.

When this court order is granted, it empowers the deputy with the authority to make decisions in your stead, ensuring that essential matters are addressed even when you cannot personally participate in the decision-making process.

As such, making an LPA in advance is the best form of protection.

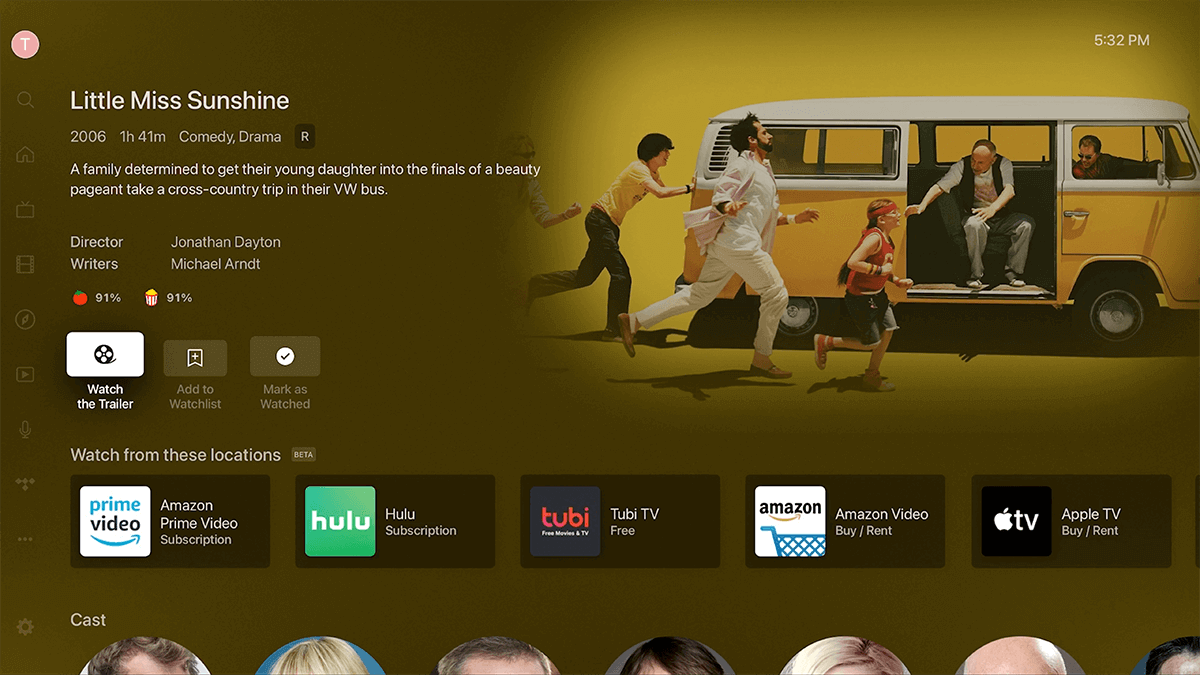

Image Credit: Vulcan Post

Image Credit: Vulcan PostWhile LPA focuses on giving the legal authority to your trusted person to make legal decisions on your behalf, ACP encompasses a broader spectrum of your values, preferences and decisions related to your care and well-being in the event of mental incapacity. This can include your desired treatment options for palliative care, medical interventions, and considerations regarding your quality of life.

Image Credit: My Legacy

Image Credit: My LegacyWhen you make an ACP, you can appoint up to two persons to be your Nominated Healthcare Spokesperson(s).

Such planning allows you to communicate your values and preferred medical treatments, reducing potential conflicts among family members and ensuring that you receive the care you would want.

ACP not only guides your loved ones in making difficult medical decisions, but also maintains your dignity and autonomy, even when you cannot directly express your wishes.

How to mitigate these risks?

Without a proper plan in place, the functioning and growth of a business can be seriously jeopardised.

An LPA guarantees that a trusted representative can seamlessly manage business affairs if the owner becomes incapacitated, preserving business interests.

Additionally, ACP indirectly supports the protection of one’s business endeavours by addressing personal welfare matters, reducing the potential for unexpected health-related disruptions to business leadership.

By establishing both an LPA and ACP, you are not only shielding yourself from potential financial risks, but also securing the stability of your business ventures. This holistic approach is essential to ensure a smoother transition and minimise potential negative impacts in such situations.

Image Credit: My Legacy

Image Credit: My LegacyFurthermore, one common misconception is that a will is the only document necessary to ensure one’s affairs are in order. Many believe that if they have a will in place, it adequately covers all aspects of their financial and medical decisions.

However, it’s essential to recognise that a will and an LPA serve distinct roles in safeguarding your interests during different stages of your life.

A will exclusively takes effect after an individual’s death, governing the distribution of assets and estate. Conversely, an LPA becomes operative only when an individual loses mental capacity, enabling Donee(s) to make decisions for the individual in his/her personal welfare as well as property and affairs matters.

If you possess a will but neglect to create an LPA, you forfeit control over the choice of person whom you trust to handle your matters should you lose mental capacity. This is because the will exclusively addresses post-mortem matters and does not extend to incapacity scenarios.

Conversely, if you establish an LPA but forgo creating a will, you cannot provide customised instructions for asset distribution upon your demise. The LPA exclusively functions in situations where mental capacity is lost.

Take charge of tomorrow

The importance of preparing for mental incapacity cannot be emphasised enough. Planning for the unexpected is not just a sound financial strategy – it’s a demonstration of prudence, responsibility, and care for oneself and one’s loved ones.

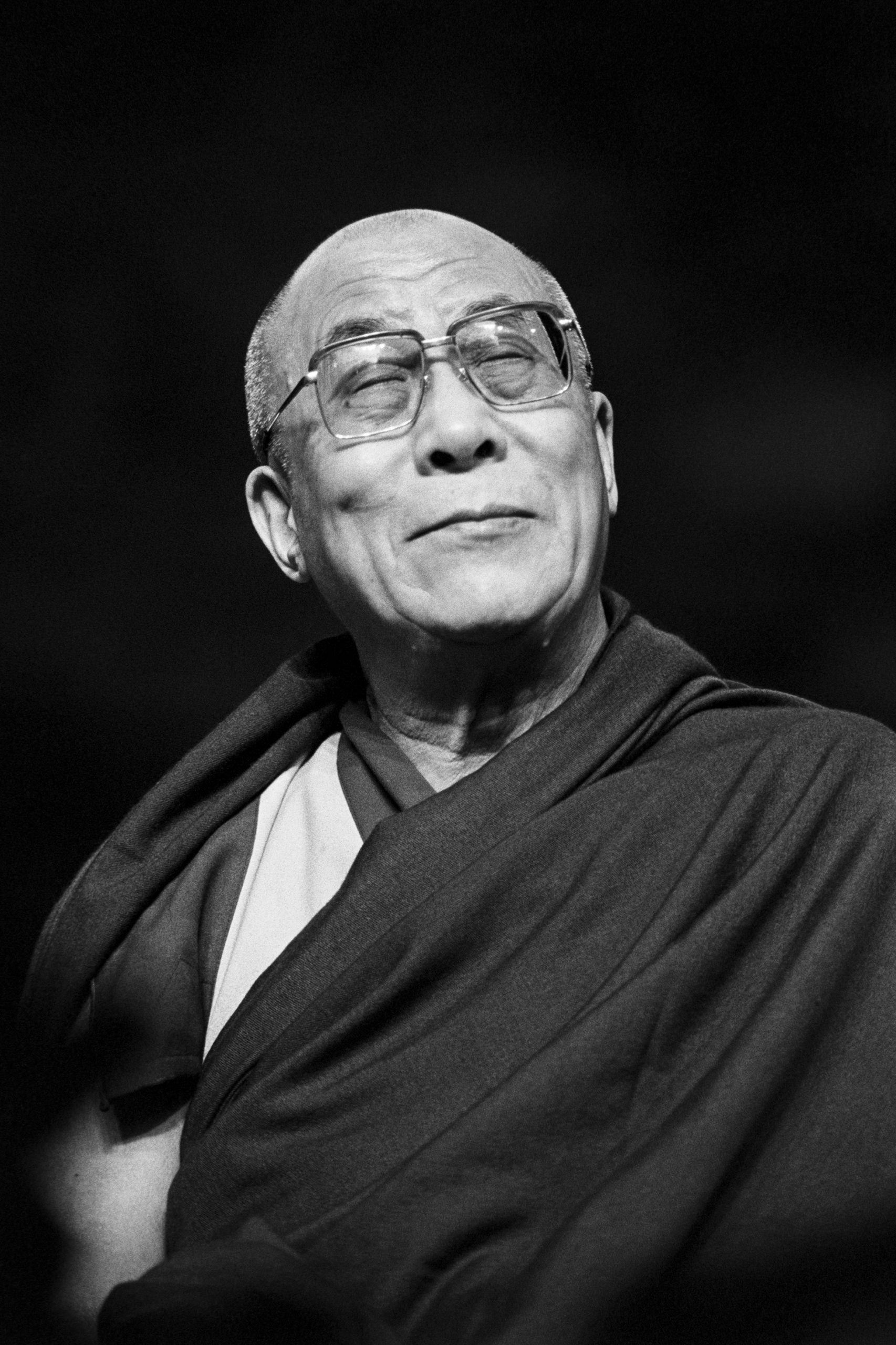

Image Credit: My Legacy

Image Credit: My LegacyWhile the possible loss of mental capacity is undoubtedly a sensitive and often considered a “taboo” topic, it is necessary to have conversations about planning ahead with your loved ones. If you’re unsure about where to start, here’s a guide that you can reference to get the conversation going.

The complexities of today’s financial landscapes make it essential to have a strategy in place to protect your interests. LPA and ACP are more than just legal formalities – they are tools that empower you to have a say in your financial and welfare matters, even when you are unable to articulate your desires.

Ultimately, comprehensive financial planning extends beyond investments and wealth accumulation. It includes safeguarding your assets and expressing your wishes for medical treatment in the event of mental incapacity.

Take control of your future and provide your loved ones with the Gift of Certainty and peace of mind. To find out more about LPA and ACP, and how to apply for them, you can also check out this website.

This article was written in collaboration with My Legacy.

Featured Image Credit: Getty Images

Lynk

Lynk