The easy formula to calculate true CAC across all your marketing channels

Most companies calculate their customer acquisition cost (CAC) incorrectly. They focus on individual channel metrics, such as $50 from paid ads, $30 from content marketing, and $75 from partnership, without understanding their true CAC across all channels. This incomplete...

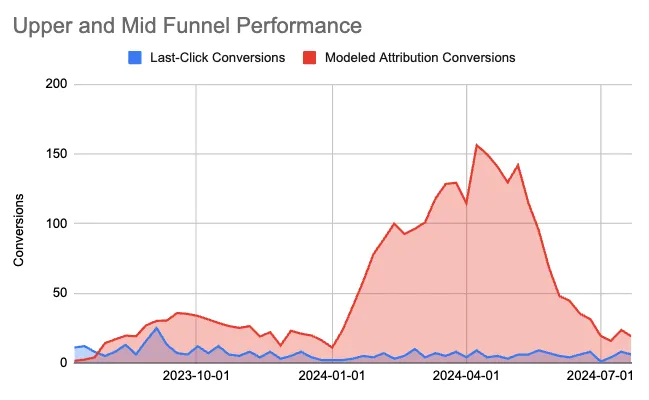

Most companies calculate their customer acquisition cost (CAC) incorrectly. They focus on individual channel metrics, such as $50 from paid ads, $30 from content marketing, and $75 from partnership, without understanding their true CAC across all channels. This incomplete picture leads to misallocated budgets, unrealistic growth projections, and investor presentations that don't hold up under scrutiny. If you‘re a CFO, VP of Growth, or financial decision-maker responsible for economics, this guide will show you how to calculate true CAC when combining paid ads, content, and partner channels. You’ll learn the formulas, cost allocation methods, and frameworks leading companies use to get accurate CAC measurements. Table of Contents Before diving into the formula, let's address why most CAC calculations miss the mark. Traditional approaches typically isolate each channel: This siloed approach ignores the reality of modern customer journeys. A customer might discover your brand through content, research on social media, and finally convert through a paid ad. While this is a win, it doesn't give the full story on its success. What other information could be left unconsidered, like, "Which channel gets credit?" or, “How do you account for brand marketing that supports all channels?”. The answer lies in calculating blended CAC and true CAC, which account for multi-channel complexity. Blended CAC gives you a high-level view by combining all marketing costs and dividing by the total customers acquired: Blended CAC = Total Marketing Spend ÷ Total New Customers Example: $230 (Blended CAC) = $115,000 (Total Spend) ÷ 500 (New Customers) While blended CAC provides a valuable benchmark, it doesn't help you optimize individual channels or allocate budget effectively. True CAC goes deeper by accounting for shared costs, attribution complexity, and indirect channel influence. Here's the comprehensive formula: True CAC = (Direct Channel Costs + Allocated Shared Costs + Sales Costs) ÷ Attributed Customers Let's break down each component. These are expenses directly tied to specific channels: Shared costs support multiple channels and must be allocated proportionally: Allocation method: Distribute shared costs based on each channel's percentage of total direct spend or customer volume. Example allocation: Include sales expenses that support customer acquisition: Pro tip: For B2B companies, sales costs often represent 20-40% of total acquisition costs. Read more on reducing customer acquisition costs here. The biggest challenge in true CAC calculation is attribution. Here are three approaches: Credits the first channel that introduced the customer to your brand. Credits the final channel before conversion. Distributes credit across all touchpoints in the customer journey. HubSpot's approach: Our analytics platform tracks the complete customer journey and uses a time-decay model that gives more credit to recent interactions while still acknowledging earlier touchpoints. Let's walk through a complete true CAC calculation for a SaaS company: Step 1: Allocate shared costs based on direct spend percentage Step 2: Add sales costs proportionally Step 3: Calculate true CAC per channel Paid Ads True CAC: ($75,000 + $12,500 + $19,200) ÷ 120 = $889 Content True CAC: ($45,000 + $7,500 + $12,800) ÷ 80 = $817 Partner True CAC: ($30,000 + $5,000 + $8,000) ÷ 50 = $860 Channel Simple CAC True CAC Difference Paid Ads $625 $889 +42% Content $563 $817 +45% Partners $600 $860 +43% This comparison reveals that simple CAC calculations underestimate true costs by 40-45%, leading to over-optimistic projections and budget misallocation. Different customer segments often have varying acquisition costs. Calculate true CAC separately for: When expanding globally, adjust CAC calculations for: Many businesses experience seasonal fluctuations in acquisition costs. Track CAC trends by: Mistake: Only counting direct ad spend or content costs Fix: Include all supporting costs like tools, personnel, and operations Mistake: Using too short or too long attribution windows Fix: Match attribution windows to your actual sales cycle length Mistake: Treating sales as separate from marketing acquisition Fix: Include sales costs that directly support customer acquisition Mistake: Mixing monthly costs with quarterly customer counts Fix: Ensure all metrics use consistent time periods Use either revenue-based allocation (each channel gets shared costs proportional to revenue generated) or volume-based allocation (proportional to customers acquired). Choose the method that best reflects how shared resources actually support each channel. Yes, but allocate content costs based on their purpose. If 70% of content is created for acquisition and 30% for retention, only include the 70% in your CAC calculation. Brand marketing creates a “halo effect” that reduces CAC across all channels. Include brand marketing costs in your shared cost allocation, but consider tracking brand-assisted conversions separately to measure this impact. Calculate true CAC monthly for tactical decisions and quarterly for strategic planning. Annual calculations are sufficient for long-term forecasting and investor presentations. Report both blended CAC and true CAC by channel. Blended CAC shows overall efficiency, while channel-specific true CAC demonstrates your understanding of acquisition dynamics and optimization opportunities. Calculating true CAC across paid ads, content, and partner channels isn‘t just an accounting exercise — it’s a strategic imperative. Companies that understand their real acquisition costs make better budget allocation decisions, set more realistic growth targets, and build sustainable unit economics. Start with the formulas and frameworks in this guide, implement multi-touch attribution, and begin tracking true CAC monthly. Your future growth decisions and investors will thank you. Ready to implement sophisticated CAC tracking? HubSpot's Marketing Hub provides the attribution and analytics capabilities you need to calculate true CAC across all your marketing channels.

Why Traditional CAC Calculations Fall Short

Understanding the Two Types of Multi-Channel CAC

Blended CAC: Your Starting Point

True CAC: The Complete Picture

The True CAC Formula Components

1. Direct Channel Costs

2. Allocated Shared Costs

3. Sales Costs

Handling Multi-Touch Attribution

First-Touch Attribution

Last-Touch Attribution

Multi-Touch Attribution (Recommended)

Real-World CAC Calculation Example

Monthly Costs

Paid advertising: $75,000

Content marketing: $45,000 (includes content creation, SEO tools)

Partner program: $30,000 (referral fees, partner management)

Shared costs: $25,000 (marketing ops, brand marketing, tools)

Sales costs: $40,000 (inside sales team supporting inbound leads)

Customer Acquisition

Paid ads: 120 customers (first-touch attribution)

Content: 80 customers (first-touch attribution)

Partners: 50 customers (direct referrals)

Multi-touch influenced: 180 customers (involved multiple channels)

Allocation Calculation

Comparison: Simple vs True CAC

Advanced Considerations for Financial Decision-Makers

CAC by Customer Segment

International Market Adjustments

Seasonal CAC Variations

Common CAC Calculation Mistakes to Avoid

1. Ignoring indirect costs.

2. Using the wrong attribution windows.

3. Excluding sales costs.

4. Inconsistent time periods.

The Impact of Accurate CAC on Business Decisions

Budget allocation: True CAC enables data-driven budget allocation across channels. Instead of cutting spend on channels with high simple CAC, you can identify which channels provide the best return when accounting for their full impact.

Investor relations: Investors increasingly scrutinize unit economics. Presenting true CAC demonstrates sophisticated financial understanding and provides confidence in your growth projections.

Pricing strategy: Understanding your real customer acquisition cost is crucial for setting prices that ensure sustainable unit economics and positive LTV:CAC ratios.

Frequently Asked Questions

How do I allocate shared costs fairly across channels?

Should I include content costs in CAC if content also supports retention?

What about brand marketing impact on CAC?

How often should I recalculate true CAC?

What CAC should I report to investors?

The True Cost of Customer Acquisition

JimMin

JimMin