The Plain-English Guide to Conjoint Analysis

Sometimes, commercials really get me.

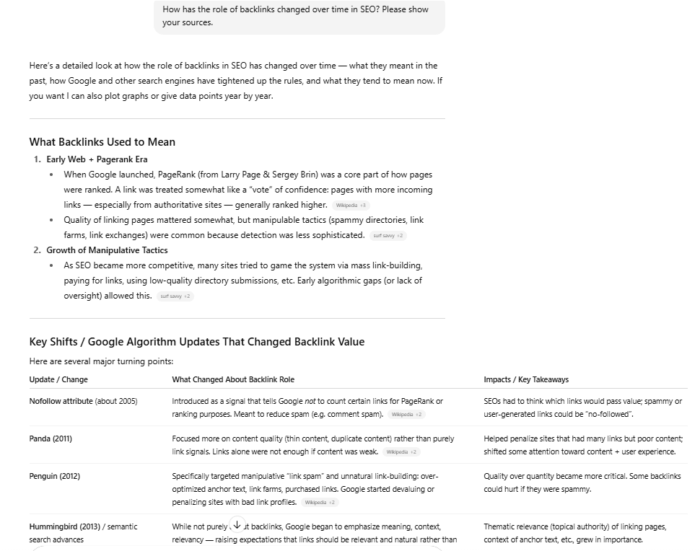

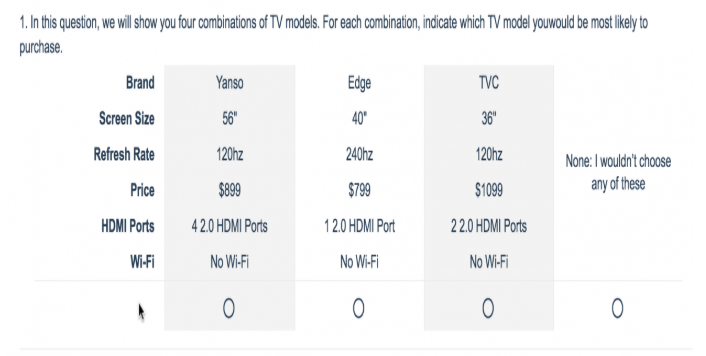

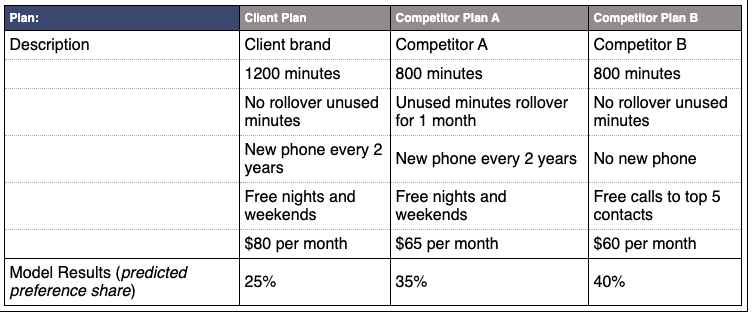

Sometimes, commercials really get me. T-Mobile's Super Bowl commercial this year is a prime example — "What's for Dinner?" demonstrates the infuriating process of choosing what to do for dinner for a young couple, and it's gold. The reason T-Mobile's ad was so relatable is because of their market research. They looked at what their target audiences wanted — including their thought processes, what informs their decisions, and the trade-offs they're willing to make for their products. To accomplish all of these important factors in one go, many companies use conjoint analysis. Conjoint analysis is a market research tactic that attempts to understand how people make decisions. A common approach, the conjoint analysis combines realistic hypothetical situations to measure buying decisions and consumer preferences. Think about buying a new phone. Attributes you might consider are color, size, and model. The reason phone companies include these specs in their marketing is due to research such as conjoint analysis. Would consumers purchase this product or service if brought to market? That's the question conjoint analysis strives to answer. It's a quantitative measure in marketing research, meaning it measures numbers rather than open-ended questions. Questions on the phone company survey would include price points, color preference, and camera quality. Surveys intended for conjoint analysis are formatted to reflect the buyer's journey. For instance, notice in this example for televisions, the specs are the options and the consumer picks what best reflects their lifestyle: This direct method of giving consumers multiple profiles to then analyze is how conjoint analysis got its name. These answers are helpful when determining how to market a new product. If answers on the phone company survey proved that their target audience of adults ages 18-25 wanted a green phone from $400-600 and a camera with portrait mode, advertisements can cater directly to that. The conjoint analysis shows what consumers are willing to give up in order to get what they need. For instance, some might be willing to pay a little more money for a larger model of a phone if their preference is larger text. Choice-based conjoint (CBC) and Adaptive Conjoint Analysis (ACA) are the two main types of conjoint analysis. Choice-based is the most common form because it asks consumers to mimic their buying habits. ACA is helpful for product design, offering more questions about specs of a product. Choice-based conjoint analysis questions are usually presented in a "Would you rather?" format. For example, "Would you rather take a ride-share service to a location 10 minutes away for $13 or walk 30 minutes for free?" The marketer for the ride-share service could use answers from this question to think of the upsides to show off in different campaigns. ACA leans towards a Likert-scale format (most likely to least likely) for its attribute-based questions. Respondents can base their preference on specs by showing how likely they are to buy a product with slight differences — for example, similar cars with different doors and manufacturers. To create a conjoint analysis, you'll first need to define a list of attributes about your product. Attributes are usually four to five items that describe your product or service. Consider color, size, price, and market-specific attributes, such as lenses if you're selling cameras. Additionally, try to keep in mind your ideal respondents. Who do you want to answer your survey? A group of adult men? A group of working mothers? Identify your respondent base and ask specific questions catered to that target market. The next step is to organize your questionnaire depending on the type of conjoint analysis you want to conduct. For instance, to run an adaptive conjoint analysis, you will present questions with a Likert-scale. You can use a conjoint analysis tool to create and modify your survey. Then, you can distribute your questionnaire through multiple channels, including email, SMS, and social media. For more ways to introduce product marketing into your company, check out our ultimate guide here. Sawtooth Software offers a great example of conjoint analysis for a phone company: The analysis puts three different phone services next to each other. The horizontal column of the model identifies which service is offering a certain program, described by the vertical values. The bottom row shows a percent value of consumers' preferences. QuestionPro offers this fun, interactive conjoint analysis template about retirement home options. The survey gives you a scenario and asks your course of action. For instance, it asks if you would sign a rental agreement for retirement home housing immediately, and considers specs like rent, meals, size, etc. Conjoint analysis isn't limited to existing products. They're also very helpful for figuring out if a brand-new product is worth developing. For instance, if surveys show that audiences would be into the idea of an app that chooses clothes for consumers, that could be a new venture for clothing companies in the future. Looking to create a conjoint analysis of your own? Check out our top four conjoint analysis tools below. Qualtrics is an easy-to-use survey tool that offers comprehensive product insights. You can create, modify, distribute, and analyze a conjoint analysis in one place. All it takes is four steps — define your attributes, build and modify your questions in the survey editor, distribute the survey, and analyze the results. What We Like: Qualtrics goes beyond product insights — this powerful software also captures customer, brand, and employee experience insights. Pro Tip: Leverage email to invite respondents to take your survey. With Qualtrics, you can embed a survey question directly in your email survey invite. Conjoint.ly offers a complete toolbox for product and pricing research — including a Product Description test, an A/B test, and a Price Sensitivity test. You can also source your own respondents for your survey or buy quality-assured respondents from Conjoint.ly. What We Like: Users can simply choose a tool that best fits their research question. These tools are organized under four main categories: pricing research, features and claims, range optimization, and concept testing. Pro Tip: If you want to "try before you buy," you can use Conjoint.ly's Quick Feedback tool. For a small price, you get around 50 respondents to provide feedback within a 6-hour window. 1000minds offers an adaptive conjoint analysis tool. Meaning, each time a choice is made, it adapts by formulating a new question to ask based on all previous choices. This makes the survey feel more like a conversation. What We Like: We're impressed by the scalability of 1000minds. The tool allows you to include as many participants as you like, potentially in the thousands. Pro Tip: You can use their conjoint analysis templates or build your own model from scratch. Q is analysis software that is specifically designed by market researchers. Its conjoint analysis tool is ideal for choice-based analyses. Users can create experimental designs, analyze the data, and generate reports. What We Like: Q cuts through the grunt work with automation — including cleaning and formatting data, updating surveys, and producing reports. Pro Tip: With just a few clicks, you can export any reports or visualizations from Q to PowerPoint and Excel. A conjoint analysis requires a solid survey design and analysis, but the extra effort is often worth it. By going the extra mile, you can access insights into your audience's preferences and buying decisions — which is invaluable when determining how to market a new product or service.What is Conjoint Analysis?

Types of Conjoint Analysis

How To Do A Conjoint Analysis

Examples of Conjoint Analysis

Conjoint Analysis Tools

1. Qualtrics

2. Cojoint.ly

3. 1000minds

4. Q Research Software

Originally published Feb 23, 2022 7:00:00 AM, updated February 23 2022

Tekef

Tekef ![Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

_1.jpg)