TikTok Shop: Can TikTok’s move into e-commerce dethrone Shopee and Lazada?

TikTok Shop has seen rapid growth in Southeast Asia since its launch in 2021. What does this spell for the e-commerce industry?

It has only been a little under two years since TikTok Shop made its foray into Southeast Asia, but its rapid growth may just give Shopee and Lazada a run for their money.

While primarily known as a social media platform for short videos, TikTok began dipping its toes into e-commerce in late 2021. By 2022, TikTok Shop refocused its efforts on Southeast Asia, expanding to six countries in the region — Singapore, Malaysia, Indonesia, the Philippines, Vietnam, and Thailand.

On TikTok Shop, brands and influencers can link products to buy in videos or broadcast live to sell products available to purchase within the app.

The platform also ramped up its e-commerce efforts such as including new features, incentives for merchants, as well as partnerships with e-commerce enablers and logistics partners. Its efforts have certainly paid off — in 2022, TikTok Shop’s GMV in the region skyrocketed more than four times to US$4.4 billion.

Social commerce is on the rise

Social commerce, an e-commerce approach that allows businesses to sell products directly to consumers within the app, has changed the shopping habits of consumers.

Instagram Shop / Image Credit: Meta

Instagram Shop / Image Credit: MetaAccording to a report by McKinsey, consumers in Southeast Asia are shopping for products online across more diversified channels, including social commerce platforms such as TikTok Shop, Facebook Marketplace, and Instagram Shop.

The popularity of social commerce in the region has been accelerated by high rates of mobile internet penetration. This mobile-first generation spends much time on social media and increases engagement.

On a broader scale, a 2022 study by TikTok and Boston Consulting Group revealed that social commerce could uncover US$1 trillion in market value for brands in the Asia Pacific region by 2025, up from US$500 billion in 2022.

However, even among social commerce players such as Facebook Marketplace and Instagram Shop, TikTok Shop stands out from the rest.

For starters, TikTok Shop’s algorithm-driven content discovery system ensures that videos with potential sales value are exposed to the right target audience, which in turn increases the chances of conversions.

TikToker promoting products on a livestream / Image Credit: TikTok

TikToker promoting products on a livestream / Image Credit: TikTokThe platform also leverages on its popular video-sharing function to get a grip on online shoppers. Merchants can tout their wares directly through their TikTok accounts, with products recommended to users via livestreams and a showcase section on sellers’ profile pages.

Furthermore, while Gen Z makes up the majority of TikTok users, other demographics are also increasingly becoming users of the platform. A 2023 Statista report shows that Gen Zs make up 33.32 per cent of TikTok’s user base in Singapore, followed by millennials (28.65 per cent). Meanwhile, close to a fifth (18.19 per cent) of TikTok users in Singapore are over the age of 32.

TikTok’s perk as a short video app also helps it to come across as less aggressive when it comes to showcasing products users can purchase. A study by Nielsen in 2021 showed that users find TikTok content to be more authentic, genuine, unfiltered and trendsetting than other platforms.

At the same time, when looking specifically at advertising content, users still associated terms such as authentic and genuine, while adding honest, real, unique and fun. More than half (52 per cent) of TikTok’s global users — excluding the United States — say they search for products or shop on the platform.

How does TikTok Shop fare against Shopee and Lazada?

While the social media e-commerce model has been hugely successful in Asia, TikTok Shop has been failing to gain full traction with western consumers and content creators.

In particular, its live shopping feature which allows users to buy products from sellers during a live broadcast, appears to be failing to resonate with western consumers despite its huge popularity in Asia.

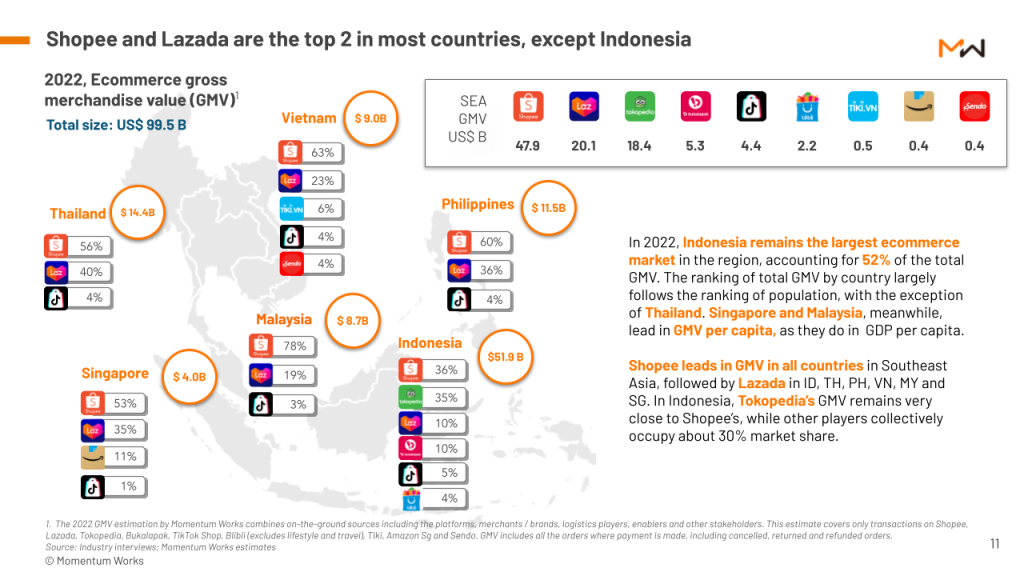

Image credit: Momentum Works

Image credit: Momentum WorksAdditionally, TikTok Shop’s rapid growth has yet to go neck and neck with its competitors. According to a 2023 report by Momentum Works, e-commerce GMV in the region was US$99.5 billion; of which TikTok Shop only accounted for US$4.4 billion. In comparison, competitors Shopee and Lazada saw a GMV of US$47.9 billion and US$20.1 billion respectively.

TikTok Shop has also yet to attain majority market share in any Southeast Asian country — it accounted for only one and three per cent of e-commerce GMV in Singapore and Malaysia respectively. The platform’s highest market share was clocked in Indonesia, albeit only five per cent.

In comparison, Shopee and Lazada saw a GMV of 53 per cent and 35 per cent in Singapore respectively. In Malaysia, Shopee dominated the market, making up for 78 per cent of e-commerce GMV, followed by Lazada which accounted for 19 per cent.

Despite its current shortcomings, TikTok Shop is still a potential threat to competitors like Shopee and Lazada, at least in the Southeast Asia market.

Although the platform only took up a small market share in the region, it was able to grow its estimated Southeast Asian GMV from US$600 million in 2021, the year of its launch, to US$4.4 billion in 2022 — the fastest growth rate among rival e-commerce platforms.

In comparison, Shopee’s GMV a year after its launch in the region was US$1.8 billion, while Lazada’s was only US$384 million. Despite owning the second-largest mart share in the region, Lazada is also beginning to see a decline as its estimated GMV fell from US$21 billion in 2021 to US$20.1 billion last year, according to Momentum Works’ report.

Furthermore, a survey conducted by online retail insights company Cube Asia revealed that consumers spending on TikTok Shop are reducing their spending on Shopee (51 per cent), Lazada (45 per cent) and offline (38 per cent).

Additionally, e-commerce platforms such as Shopee and Lazada charge more on commission, transaction and service fees. As such, merchants have to mark up their products to cover the fees — this makes products on TikTok Shop come off as relatively cheaper than other platforms.

What’s next for TikTok?

With over 250 million users in Southeast Asia, TikTok is in a rather undisputable position to lead the social commerce market.

At the same time, as e-commerce continues to be a driving force for the platform, it is now looking to introduce Project S. As part of the project, TikTok will introduce a dedicated section called Trendy Beat, which will offer items that have proven popular on videos, such as tools to extract ear wax or brush off pet hair from clothing.

However, this will operate similar to Amazon Basics, where TikTok’s parent company ByteDance sells its own version of these trending products. Through the launch of Trendy Beat, TikTok hopes to compete with established giants such as Shein and Amazon.

Featured image credit: Shutterstock / World Trademark Review / Lazada

Also read: The fastest flop in history? Data shows that Threads’ popularity crashed in just one week

Hollif

Hollif