Trump Media shares fall sharply after company reports net loss of $58 million in 2023

Trump Media, whose majority shareholder is former President Donald Trump, "expects to incur operating losses for the foreseeable future," the filing says.

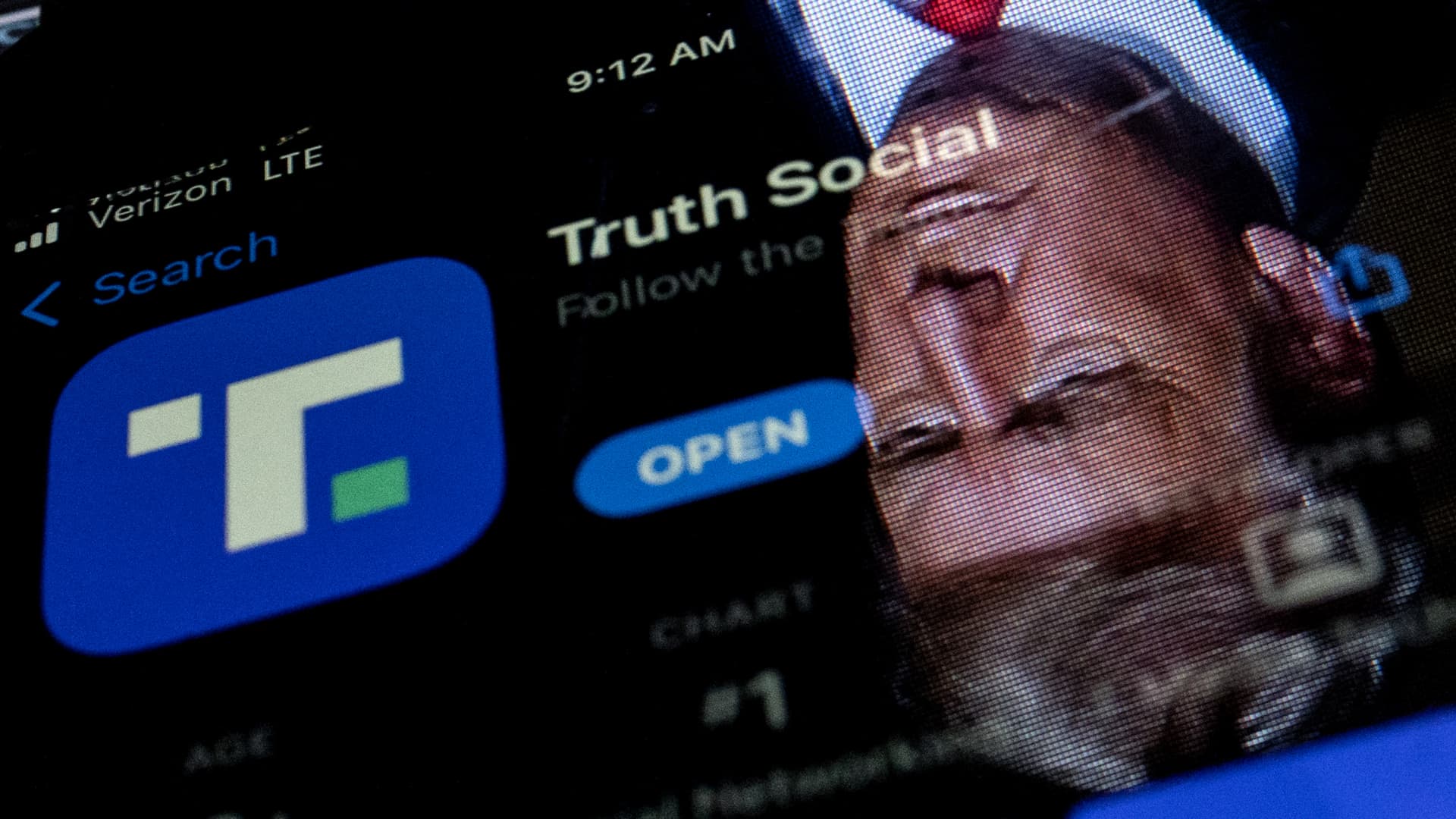

This photo illustration shows an image of former President Donald Trump reflected in a phone screen that is displaying the Truth Social app, in Washington, DC, on February 21, 2022.

Stefani Reynolds | AFP | Getty Images

Shares of Trump Media fell sharply Monday morning after the company reported a net loss of $58.2 million in 2023.

Donald Trump's newly publicly traded social media company has a market valuation of more than $6 billion. Its total revenue was $4.1 million in 2023, according to a filing with the Securities and Exchange Commission on Monday.

Much of the net loss appears to come from $39.4 million in interest expense, according to the 8-K filing by Trump Media & Technology Group.

A spokesperson for the company did not immediately reply to a request for comment on the new filing.

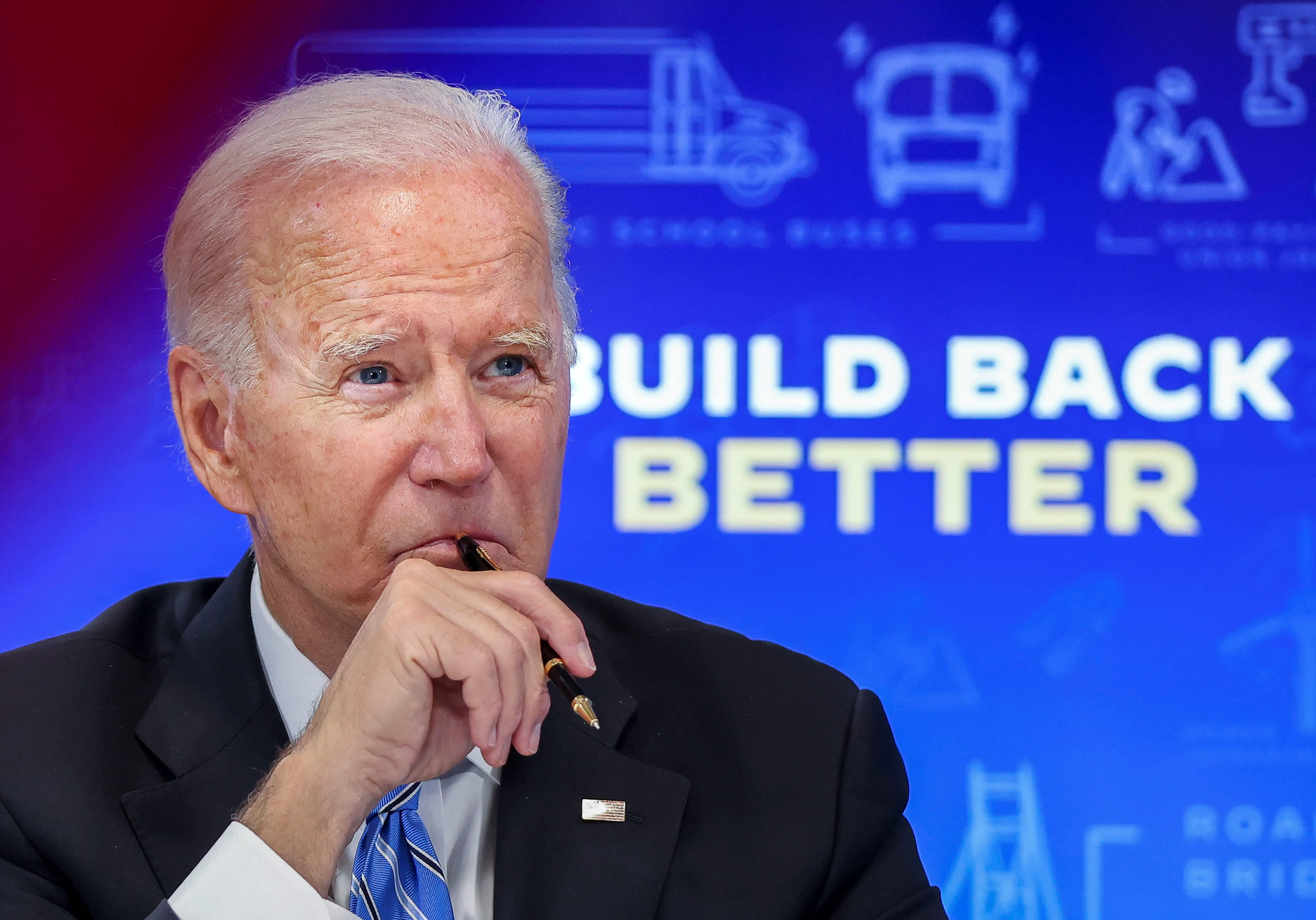

A year earlier, Trump Media reported a net profit of $50.5 million and total revenue of only $1.47 million.

The losses last year by Trump Media — the owner of the Truth Social app routinely used by the former president — could continue for some time, the company told regulators.

"TMTG expects to incur operating losses for the foreseeable future," says the filing, which came a week after the company began trading under the ticker DJT on the Nasdaq.

The filing also warns shareholders that Trump's involvement in the company could put it at greater risk than other social media companies.

TMTG also disclosed to regulators that the company had identified "material weaknesses in its internal control over financial reporting" when it prepared a previous financial statement for the first three quarters of 2023.

As of Monday, Trump Media said these "identified material weaknesses continue to exist."

Trump owns 57.3% of Trump Media shares, a stake valued at more than $4 billion.

He also stands to receive another 36 million shares of so-called "earn-out" shares over the next three years, as long as Trump Media's stock during that time hits a series of price benchmarks. These targets are all well below the company's stock price early Monday.

Read more CNBC politics coverage

Trump Media's share price rocketed when its stock began trading Tuesday, several days after the firm merged with a special purpose acquisition company, Digital World Acquisition Corp., which had been traded under the ticker DWAC. The newly merged company now trades under Trump's initials, DJT.

As of 10:45AM, the stock was around $53 a share, down nearly 15% since market open.

Analysts note that the company's high valuation is partly due to stock purchases by Trump's political supporters, who are enthusiastic about owning part of a company so closely associated with the presumptive Republican presidential nominee.

That enthusiasm creates unique risks for the company, however. The new 8-K filing says that Trump Media "may be subject to greater risks than typical social media platforms because of the focus of its offerings and the involvement of President Trump."

"These risks include active discouragement of users, harassment of advertisers or content providers, increased risk of hacking of TMTG's platform, lesser need for Truth Social if First Amendment speech is not suppressed, criticism of Truth Social for its moderation practices, and increased stockholder suits."

Aliver

Aliver