Why You Should Stop Sending Checks in the Mail, Especially Now

If you’re dropping checks in the mail to your landlord or utility provider, it’s time to look for a different way to pay your bills. Check fraud and mail theft nearly doubled between 2021 and 2022, affecting hundreds of...

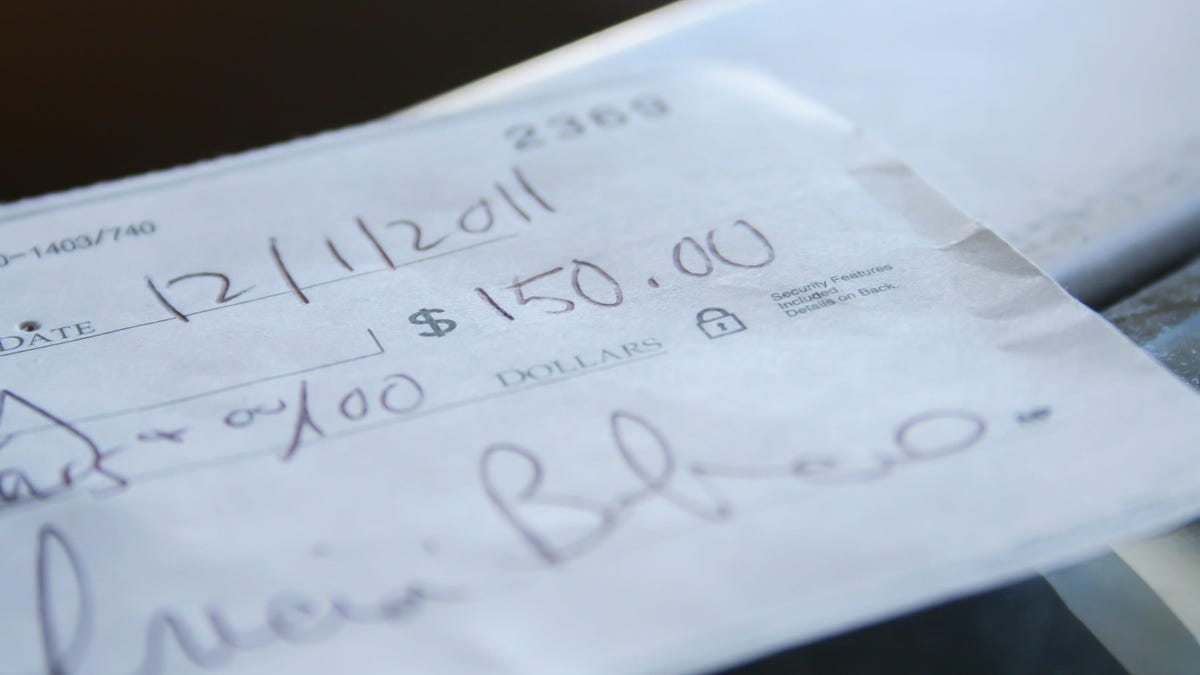

If you’re dropping checks in the mail to your landlord or utility provider, it’s time to look for a different way to pay your bills. Check fraud and mail theft nearly doubled between 2021 and 2022, affecting hundreds of thousands of Americans, according to reports from both the Financial Crimes Enforcement Network and the U.S. Postal Inspection Service.

Criminals are taking sophisticated steps to wash checks—stealing them from the mail and changing the payee’s name and payment amount—and conning banks into cashing them. This often involves creating fake identities using stolen personal information and then opening fraudulent bank accounts and writing new checks. Some are selling copies of washed checks online or using stolen mailbox keys to pick checks directly out of collection points.

While banks do refund check fraud victims for money lost, the AP reports that this process is slower than usual due to the significant increase in fraud cases.

Fewer Americans are writing and sending checks, but it’s still somewhat common. Here’s how to minimize the chance of becoming a victim.

Request an alternative payment method

If you’re writing checks to a business that offers a different method of payment—via a debit or credit card, an ACH or EFT transaction, or a service like PayPal, Zelle, or Venmo—you should almost certainly use one of these instead. You generally have greater fraud protection and visibility into the transaction recipient. Some businesses also work with e-checks, which eliminates the need to drop a paper check in the mail.

If these options aren’t already available but you have a personal relationship, such as with a landlord, you can probably convince them to consider a check alternative. It’s safer for you and for them: In addition to being stolen, checks can also get lost or bounce. You could also hand-deliver checks if the recipient is local.

How to protect your mailed checks, if you must

If you absolutely must mail a check, take every precaution to minimize the risk of it being boosted and washed. Don’t leave checks in your home mailbox with the flag raised for pickup. Don’t even use an outdoor collection box (and if you do, check the pickup time so your mail doesn’t sit out overnight). Ideally, walk your check into the post office and place it directly in the lobby dropbox or hand it to a USPS employee. This minimizes a few points where people can steal from you.

Once you’ve dropped a check in the mail, watch your bank account until you can confirm that it has been received and cashed by the intended recipient. Sign up for transaction notifications, if available, so you can catch suspicious activity as soon as it happens, as you may have only 30–60 days to report fraud and request a refund.

Finally, consider sending checks via certified mail or FedEx to require a recipient’s signature. While it won’t prevent theft, it at least raises red flags if your check doesn’t arrive as expected.

Koichiko

Koichiko