54 million Americans have been in credit card debt for at least a year. Here are the best payoff strategies

More cardholders are carrying more credit card debt than ever before, and, on top of that, they're paying record high interest rates.

Credit cards are one of the most expensive ways to borrow money from month to month, and yet many Americans continue to take on ever-increasing amounts of this debt.

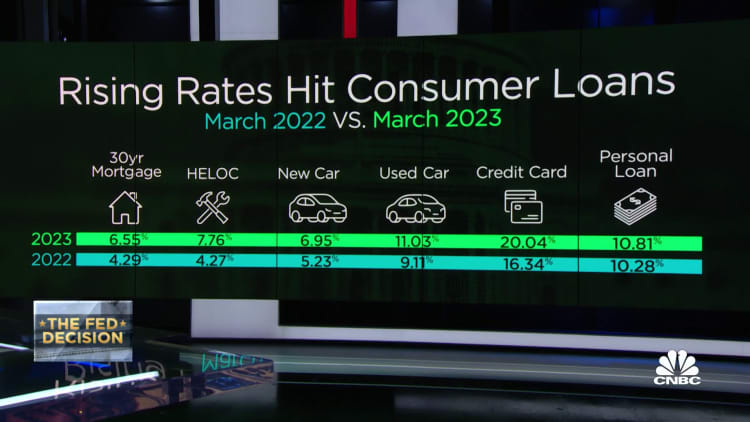

On the heels of another rate hike by the Federal Reserve, the average credit card rate is now more than 20% on average, an all-time high, making it even harder to dig out of debt.

While balances are higher, more cardholders are also carrying debt from month to month, according to a new Bankrate report.

More from Personal Finance:

Paying in cash helps shoppers 'forget' guilty pleasures

61% of Americans live paycheck to paycheck

How the Fed's quarter-point interest rate hike affects you

Now, 47% of borrowers carry over card balances each month, the report found. And of those who are carrying a balance, 60%, or roughly 54 million people, have been in debt for at least a year.

"The situation is noticeably worse than it was a few years ago," said Ted Rossman, senior industry analyst at Bankrate. "More people are carrying more debt and at very high interest rates."

How to tackle high-interest credit card debt

1. Snag a 0% balance transfer credit card

"My top tip is to sign up for a 0% balance transfer card," Rossman said. "These allow you to avoid interest for up to 21 months, and that's a tremendous tailwind that can power your debt payoff journey."

Cards offering 12, 15 or even 21 months with no interest on transferred balances are one of the best weapons Americans have in the battle against credit card debt, added Matt Schulz, LendingTree's chief credit analyst.

To make the most of a balance transfer, aggressively pay down the balance during the introductory period. Otherwise, the remaining balance will have a new annual percentage rate applied to it, which is about 24%, on average, in line with the rates for new credit, according to Schulz.

Further, there can be limits on how much you can transfer and fees attached. Most cards have a one-time balance transfer fee, which is usually around 3% of the tab, but there can be an annual fee for the card, as well.

2. Pick a repayment strategy

There are two ways you could approach repayment: prioritize the highest-interest debt or pay off your debt from smallest to largest balance. Those strategies are known as the avalanche or snowball method, respectively. Using either can help consumers pay off debt as much as 100 months sooner, according to a separate analysis by LendingTree.

The avalanche method lists your debts from highest to lowest by interest rate. That way, you pay off the debts that rack up the most in interest first. The snowball method prioritizes your smallest debts first, regardless of interest rate, to help gain momentum as the debts are paid off.

With either strategy, you'll make the minimum payments each month on all your debts and put any extra cash toward accelerating repayment on one debt of your choice.

"People may tell you there's an absolute right answer as to which method is best," Schulz said. "They're wrong. There's not. It's heavily dependent on each individual's financial circumstances and even their own personal styles. And, ultimately, if you start with one method and don't like it, nothing says you can't switch strategies."

Hollif

Hollif