A Detailed Guide on CRM for Financial Services

Financial services now recognize that customer-first attitudes and a strong digital presence are crucial to providing better customer service, allowing customers to communicate across several channels cohesively. Customer interactions and satisfaction are very important for banks and other financial...

Financial services now recognize that customer-first attitudes and a strong digital presence are crucial to providing better customer service, allowing customers to communicate across several channels cohesively.

Customer interactions and satisfaction are very important for banks and other financial institutions. The finance industry is a very broad industry that encompasses everyone in the economic cycle. As a result, customer relations, as well as CRM tools for financial services, play a critical role in the industry.

How to Use CRM in Financial Services?

CRM’s goal is to support the establishment of strong, productive, and loyal relationships with customers by providing informed and superior customer experiences at every stage of the customer journey. The reason for this is to improve customer acquisition and retention. As both strategy and tool, CRM provides insight into these experiences.

The use of CRM solutions in financial services has expanded to obtain more data on the target audience. Finance CRM is no longer a niche market, but rather a required set of tools for financial advisors and companies to provide individualized and efficient financial planning services to their clients.

Since the nature of the industry makes it difficult to differentiate their products and services from their opponents, many financial companies are looking for a way to stand out. As a result, the essential solution for companies for sustainable revenue generation and to provide the requisite customer and financial service is a customer relationship management system, or CRM, for financial services.

Why Do You Need CRM for the Finance Industry?

Many institutions, especially banks, operate in the financial sector. Just like in other industries, customers have an important position in financial services as well. Transactions such as credit cards, bank loans, and factors affecting financial transactions such as interest rates should be used in a way that appeals to the customer. Especially in the marketing phase, the impact of CRM is quite high.

Marketing strategies and financial services that will meet the needs of the customer base and attract their attention can be implemented thanks to CRM for financial services. For this reason, it is of great importance that all companies in the financial sector benefit from CRM tools.

Here are some of the key features of a CRM for financial services that companies can benefit from:

Sales & Workflow AutomationMarketing AutomationCommunication ManagementSales Pipeline CultivationSales Management PlatformFlexibilityRemindersCustomer portfolio records of companies operating in the financial sector must be made without errors. According to the changes in the market price of a financial product, customer orders can be created instantly.

Because, for companies, instant customer operation should also be provided quickly. The necessary information as a result of daily transactions in the financial sector should be given to customers without any delay.

Benefits of Using CRM in Finance

As most industries become more digital, CRM Solutions for the finance industry and excellent customer service become equally crucial.

There are many benefits of using CRM in finance:

Customer EngagementSmooth Wealth ManagementImproved client relationshipReal-time tracking Contact ManagementRevenue GenerationTo provide a great customer experience, you need a complete view of the customer and the right data to put that view together. Customer relationship management systems aggregate data from a variety of sources, including email, web, physical stores, call centers, mobile sales, marketing, and advertising efforts.

The ultimate goal of using a CRM for financial services is to gain more customers and increase your customer retention rate. The details of your customer strategy are built on this foundation. Increasing customer acquisition and retention is achieved by providing experiences that keep your customers coming back to you. This strategy and CRM as a tool underpin these experiences.

Best CRM for Finance Industry

As customer relationship management is at the heart of the financial services industry, here is a list of successful and beneficial CRMs for the financial services industry:

CopperHubSpotmonday.comZendeskZoho CRMPipedriveWealthboxLet’s dive in!

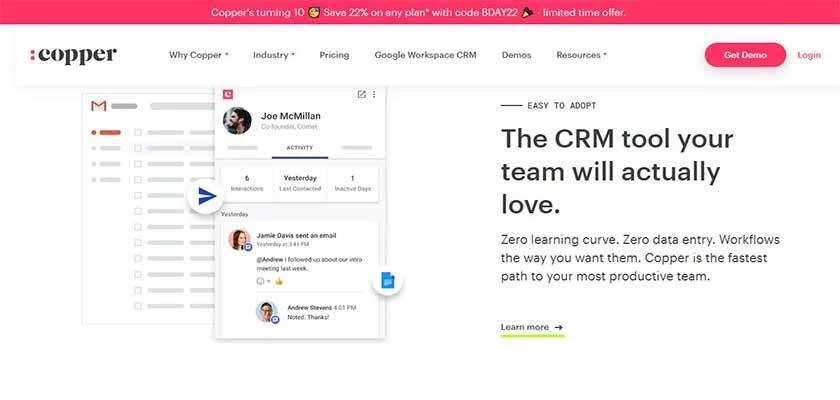

Copper

Copper as a CRM tool helps companies to provide and manage all the customer data in one place. It’s possible to run into problems with a running system, but Copper’s customer support team can quickly resolve any issue.

The main feature of Copper is that it allows you to easily track leads, contacts, account details, and follow-ups automatically. Also, Copper’s CRM provides a deal management system to drive growth.

When it comes to closing sales deals effectively, a proper deal management system becomes a necessity for the sales team. This is one of the features that sets Copper apart from other CRMs in the financial industry. While the system improves the customer experience, it also helps to conclude deals faster and easier.

HubSpot

HubSpot is a Customer Relationship Management solution that has everything you would need if you work in finance. Because one of the most important areas of finance is client relations, it’s critical to keep track of your data and progress with a successful CRM solution. You’re probably aware of the need of having a robust CRM to respond to leads quickly. HubSpot is without a doubt one of the most comprehensive services available.

HubSpot’s CRM platform provides all of the tools and integrations you’ll need for marketing, sales, content management, and customer service. Each platform product is useful on its own, but when you integrate them, the real magic happens. HubSpot CRM is a small business tool that includes a free CRM option. HubSpot CRM is primarily focused on giving each of its contacts, sales pipelines, fields, templates, and other elements a personalized experience.

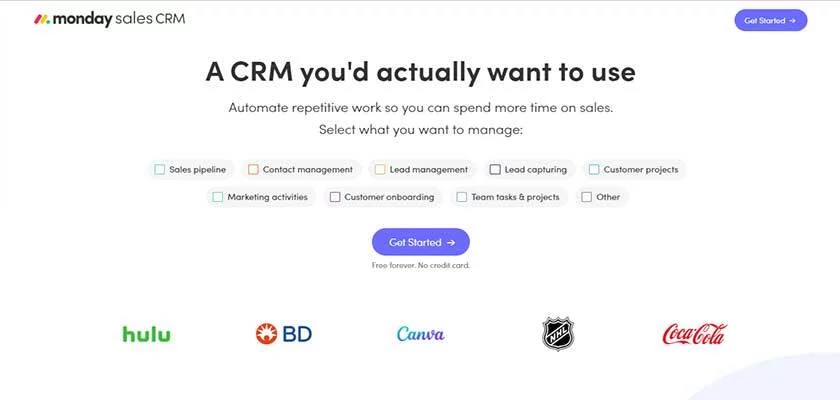

monday.com

monday.com is designed based on your needs, visualizing your entire process and ensuring that all of your deals are up to date and you don’t miss a thing, whether you want to track new clients or the sales pipeline. CRMs can be tricky and complicated but monday.com is the opposite of it.

You can manage all tasks such as communication management, customer projects, marketing activities, and sales processes in one place thanks to its simple setup and use. You can collect all of your data in one place, connect from anywhere in offline mode, and automate your workflow using monday.com.

Zendesk

Zendesk CRM is a user-friendly yet effective sales CRM that prioritizes customer relationships. Your entire team will have simple access to information thanks to their cloud-based CRM software. It places a premium on usability and CRM best practices, ensuring that members are well-versed in Zendesk’s services.

Zendesk is a support, sales, and customer interaction software platform that aims to improve customer retention. The ability to track communication and process gives users a consistent picture of transaction status, emails, and phone calls, among other things, thus maximizing productivity.

Zoho CRM

Zoho CRM has a simple user interface and requires no prior training. If you’re already using or haven’t used a CRM system before, Zoho can effortlessly import data from your spreadsheet or the existing CRM solution you’re using. Higher Adoption, Faster Implementation, and Better ROI are all strong features that Zoho offers.

Among its competitors, Zoho CRM is another excellent CRM tool for financial services. Customer connections are critical, but being able to reach out to your customers through all channels is equally crucial.

With Zoho CRM, you can reach your customers from every channel such as cell phone, email, social media, or live chat. Speaking of communication, Zoho assists you in evaluating the efficacy of your customer communication and determining the optimal time and channel to reach out to them. And for the times that things might get a little frustrating and complicated, Zoho CRM helps financial planners to stay on top of tasks.

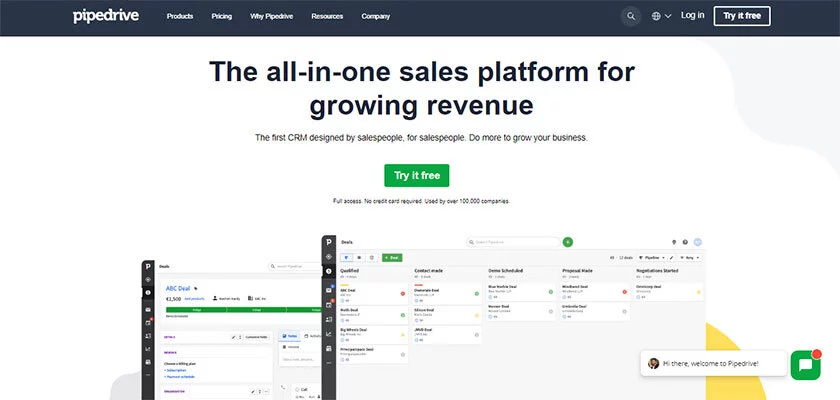

Pipedrive

Pipedrive has features that allow you to track your progress and several vital tasks. By offering additional information to your organization, the platform makes reporting easy. Data about current customers, their financial status, or conversion rates, for example. In addition to other company tasks, managing each contact and monitoring each listing may be too much to handle.

Pipedrive helps CRM for finance to easily segment, nurture, and keep its sales funnels engaged. It allows you to stay on track with your goals. The platform simplifies the reporting process by providing additional information like data on customers and conversion rates to your agency.

Wealthbox

Wealthbox is a user-friendly CRM with a variety of tools to help you improve your customer service. Your team will have no trouble getting accustomed to it because of its simple and intuitive UI.

Because of its simplicity, Wealthbox does not require any prior training. It offers a free 30-day trial with no credit card necessary, during which you can test out all of the features and invite an unlimited number of people.

Conclusion

If there are no customers, there would be no job to do. Because customers are the core of the business, regardless of industry, providing them with excellent service is critical.

CRM tools are important because it reduces the tasks you need to do and the data you need to follow, allowing you to provide excellent customer service. We’ve grown accustomed to everything being easy and digital in every part of our lives as everything around us grows increasingly digital every day. As a result, the expectation from the financial industry is no different.

To sum up, CRM tool integration should be the first step in digitizing financial services and providing excellent customer service.

Aliver

Aliver

![Benefits of Hiring a Fractional CMO – Manny Torres – [VIDEO]](https://www.digitalmarketer.com/wp-content/uploads/2022/04/YOUTUBETHUMB_FracCMO_1.jpg)