As British Airways and Virgin Atlantic battle with Rolls-Royce, the real loser is the passenger

Analysis: BA’s Easter 2025 flights from Heathrow to Cape Town are selling at three times the fare to nearby Johannesburg after Virgin Atlantic cancelled flights

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.

Airlines like to make a song and dance about new or restored routes. So it proved with British Airways’ planned return to Kuala Lumpur.

BA announced in March this year that flights would resume this month, promising: “The airline will operate daily flights between the Malaysian capital city and London Heathrow on a 787-9 aircraft.”

But last month British Airways said the flights had been cancelled for the winter due to “delays to the delivery of engines and parts from Rolls-Royce”. At a stroke, 200,000 seats were removed from the available capacity between the UK and Southeast Asia.

Malaysia Airlines will continue through the winter as the only carrier on the Heathrow-KL route. The Malaysian carrier is making the most of the shortage of capacity and absence of nonstop competition, pricing festive flights at £2,744 return – for example out from London on 16 December, returning three weeks later.

Virgin Atlantic, too, is cancelling flights wholesale. Planned resumptions of flights from Heathrow to Accra in Ghana and Tel Aviv in Israel have been deferred until next winter.

“Our Cape Town schedule will also pause one month earlier than planned, on 31 March 2025,” a spokesperson tells me.

“It’s been necessary to make these changes due to reduced availability of Rolls Royce Trent 1000 engines, which are fitted to our Boeing 787-9 aircraft.”

Critical shortages of spare parts are affecting many airlines, with Covid being blamed. Given that even the long-closed US reopened to British visitors three years ago this week, attributing inadequate inventories to the virus may sound absurd.

Yet industry insiders say that, at the height of the pandemic, many manufacturers scaled back their operations and made staff redundant as demand for their precision-engineered components evaporated.

Rolls-Royce Trent 1000 engines fitted to relatively long-in-the-tooth Boeing 787s are now at the point when many components need to be replaced according to the stringent rules designed to ensure planes are safe.

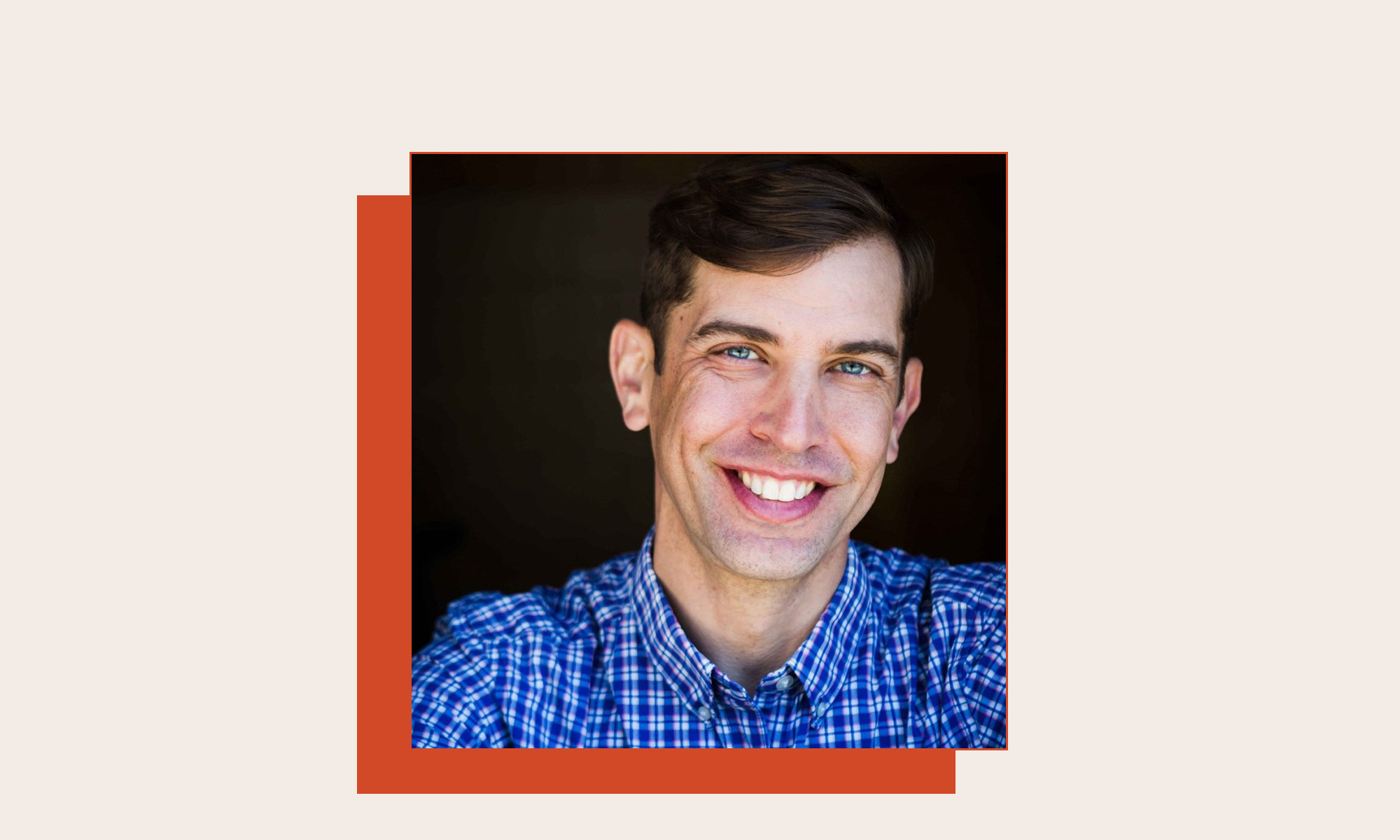

One of 15,000 passengers affected by the early termination of flights from Heathrow to Cape Town is Rob Burgess, founder of the Head for Points frequent-flyer website. We spoke an hour after he learnt his Easter 2025 trip on Virgin Atlantic to Cape Town had been cancelled.

Mr Burgess says that the axed flights to South Africa will cause significant problems, “falling during school holidays and over a period with two bank holidays”.

British Airways is continuing with the Heathrow-Cape Town route – and is extracting plenty of cash over Easter. On 11 April for a fortnight, for example, the “hand-baggage only” fare on BA is £2,922 return. That is almost three times the price on British Airways for the same dates to and from Johannesburg, on which competition prevails.

Airlines are frustrated and “struggling with grounded aircraft”, says Robert Boyle, former director of strategy at BA’s parent company, IAG. But he points out: “Aviation profitability is heavily driven by supply/demand balances and the shortages will help support overall pricing.”

During normal times, UK travellers benefit from the ferocious competition between British Airways and Virgin Atlantic on key intercontinental routes; French, German and Italian passengers enjoy no such choice of quality carriers from their home turf. But while both UK long-haul airlines complain loudly about their expensive aircraft sitting idle on the ground at Heathrow, they are also reaping the benefits of reduced supply and strong demand: the passenger is paying the increased price.

As BA and Virgin shuffle their fleets, they can turn to their US partners, American Airlines and Delta respectively, for assistance – with those giant carriers filling gaps in the UK airlines’ schedules. Next month I am flying from Atlanta to Heathrow not on a shiny Airbus A350 belonging to Virgin Atlantic, but a venerable Boeing 767 in the colours of Delta.

“BA and Virgin are being quite strategic in how they are handling this,” says Rob Burgess. “For BA, two US routes – Dallas and Miami – have been passed to American Airlines and there will be no capacity drop.”

“Virgin’s Accra route was new and so it’s capacity which never existed anyway, whilst Tel Aviv demand will remain depressed for some time.”

With fares soaring to way beyond pre-pandemic levels, the big question is: how long will this unhappy state of affairs continue? Insiders believe that 2025 will see “peak groundings” of aircraft. Boeing’s many woes include the ever-extending delays of deliveries of the first 777X aircraft, which were supposed to be in service as the workhorses for leading airlines.

The type is now expected to enter service in 2026, which may coincide with happier times for the Trent 1000 engine and its unhappy owners.

A spokesperson for Rolls-Royce says: “We continue to work with all our customers to minimise the impact of the limited availability of spares parts. All of the companies in our industry are suffering from this.

“We have been taking decisive action and moving quickly to prioritise the resources needed to reduce the impact created by the current industry wide supply chain constraints, it’s the highest priority for our Civil Aerospace division.

“Over the last 12 months we’ve introduced a number of initiatives to reduce the impact on our customers. Our Trent 1000 Task Force has been working at pace to deliver these improvements, drawing on our world-class engineering and technology capability.

“These changes are already having a positive impact. So far this year, we’ve increased Trent 1000 supply chain output by a third, making more components available and minimising the time engines spend in our Maintenance, Repair and Overhaul (MRO) centres.

“We’re confident that these bold changes coupled with our long-term investment plans will provide continuous improvement for our customers.”

In the year ahead, though, British travellers may just have to get used to paying twice or three times as much as they would wish for the privilege of nonstop flying on quality airlines.

MikeTyes

MikeTyes