Asia-Pacific markets mixed; Singapore's travel-related stocks jump after easing of Covid measures

Singapore on Thursday announced plans to ease Covid restrictions.

SINGAPORE — Asia-Pacific markets struggled for direction on Thursday as oil prices saw volatile trading following yesterday's 5% jump.

Shares in Singapore outperformed the broader Asia-Pacific region, with the Straits Times index climbing around 0.8%, as of 4:12 p.m. local time. Those gains came as the country's prime minister on Thursday announced plans to ease Covid restrictions.

Shares of travel-related stocks were up, with Singapore Airlines and Sats — which provides ground-handling and in-flight catering services — jumping more than 3% each.

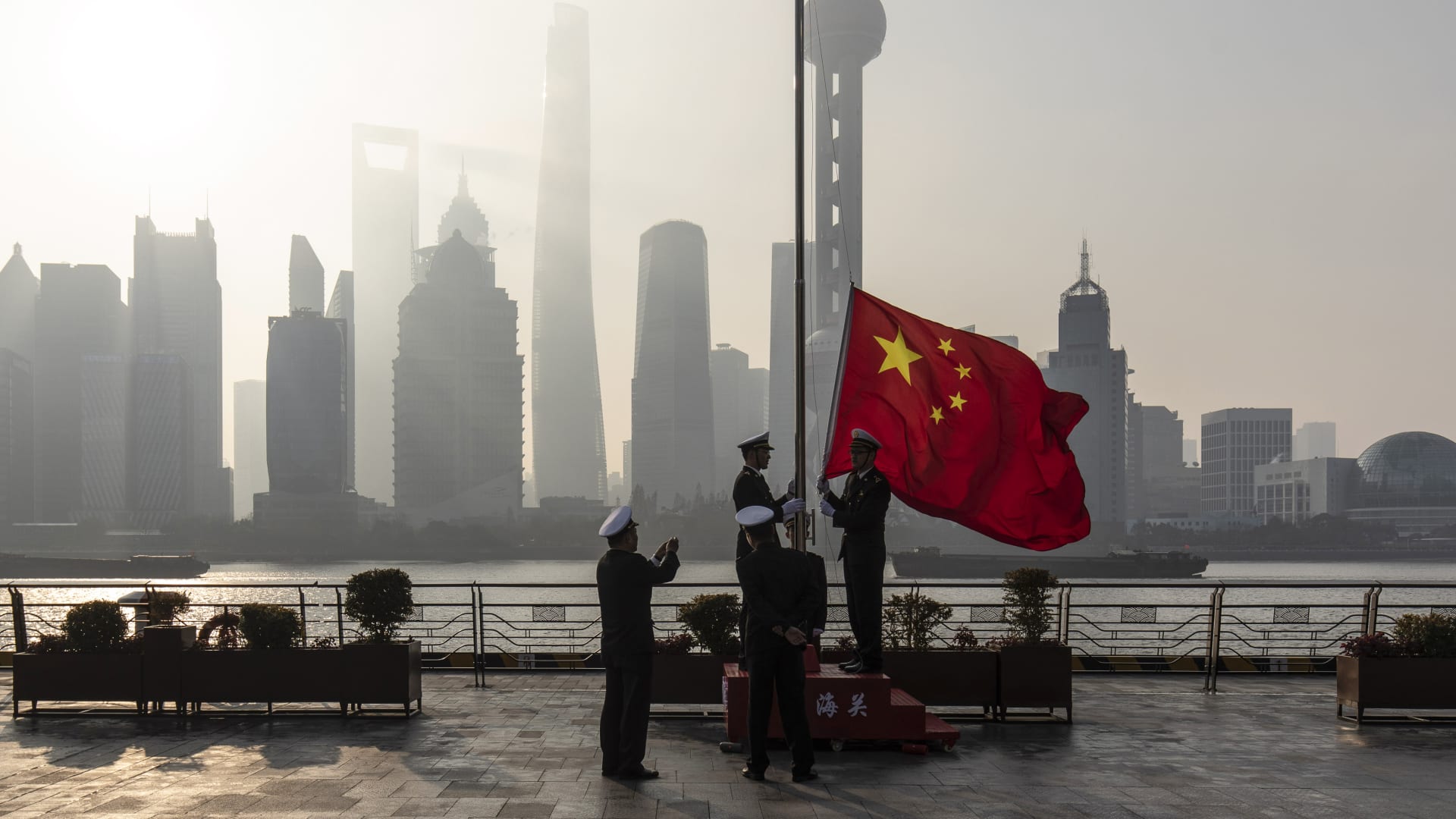

Hong Kong's Hang Seng index closed 0.94% lower at 21,945.95.

Shares of Chinese tech giant Tencent dropped 5.91% in Hong Kong after the firm on Wednesday posted its slowest revenue growth on record. Tencent also said it is 'exploring' a financial holding company for WeChat Pay if required by Chinese regulators.

Other Chinese tech stocks in Hong Kong were also lower, with Alibaba falling 3.23% and NetEase slipping 2.05%.

Bank of Communications International's Hao Hong said Chinese internet stocks are "very, very cheap" at the moment, citing Alibaba's recent announcement to up its share buyback program.

"If you have a longer-time horizon, even though the market is very volatile, it is still worthwhile to take a look at these names," Hong, managing director and head of research at the firm, told CNBC's "Street Signs Asia" on Thursday.

Stock picks and investing trends from CNBC Pro:

In mainland China, the Shanghai composite declined 0.63% to end the trading day at 3,250.26 while the Shenzhen component shed 0.831% to 12,305.50.

The Nikkei 225 in Japan recovered from earlier losses to close 0.25% higher at 28,110.39, adding to its 3% jump from Wednesday. The Topix index gained 0.14% to 1,981.56.

South Korea's Kospi slipped 0.2% on the day to 2,729.66. In Australia, the S&P/ASX 200 climbed 0.12%, finishing its trading day at 7,387.10.

MSCI's broadest index of Asia-Pacific shares outside Japan traded 0.54% lower.

Oil watch

Investors monitored oil moves, which saw choppy trading on Thursday.

In the afternoon of Asia trading hours on Thursday, international benchmark Brent crude futures gained 0.47% to $122.17 per barrel, still much higher than levels below $112 seen earlier in the week.

U.S. crude futures declined fractionally to $114.88 per barrel.

Oil prices have been volatile for weeks since Russia's invasion of Ukraine as investors assess the war's impact on oil supply along with other concerns such as a Covid outbreak in China.

The price of oil currently remains significantly elevated, with Brent more than 50% higher as compared to where it was early this year.

"I tend to think that we've had threats of supply interruptions but it's been more so trade disruptions that the market is really experiencing that is putting a floor [to a] high price level that we're experiencing right now," said Stephen Jones, senior vice president of oil markets strategy at Argus Media.

"The trade costs are escalating, the trade pattern disruptions, the cost of freight, the scarcity, if you will, for the countries that have sanctioned or are financially disallowed to do business is adding a lot … of cost structure to the outright prices," Jones said. "That's why we didn't see prices … fall much below, you know, the $109 level," he said.

Currencies

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 98.881 — still above the 98.4 level that is was below earlier this week.

The Japanese yen traded at 121.57 per dollar, weaker as compared with levels below 119.7 seen against the greenback earlier in the week. The Australian dollar changed hands at $0.7474, having risen from below $0.74 earlier this week.

AbJimroe

AbJimroe