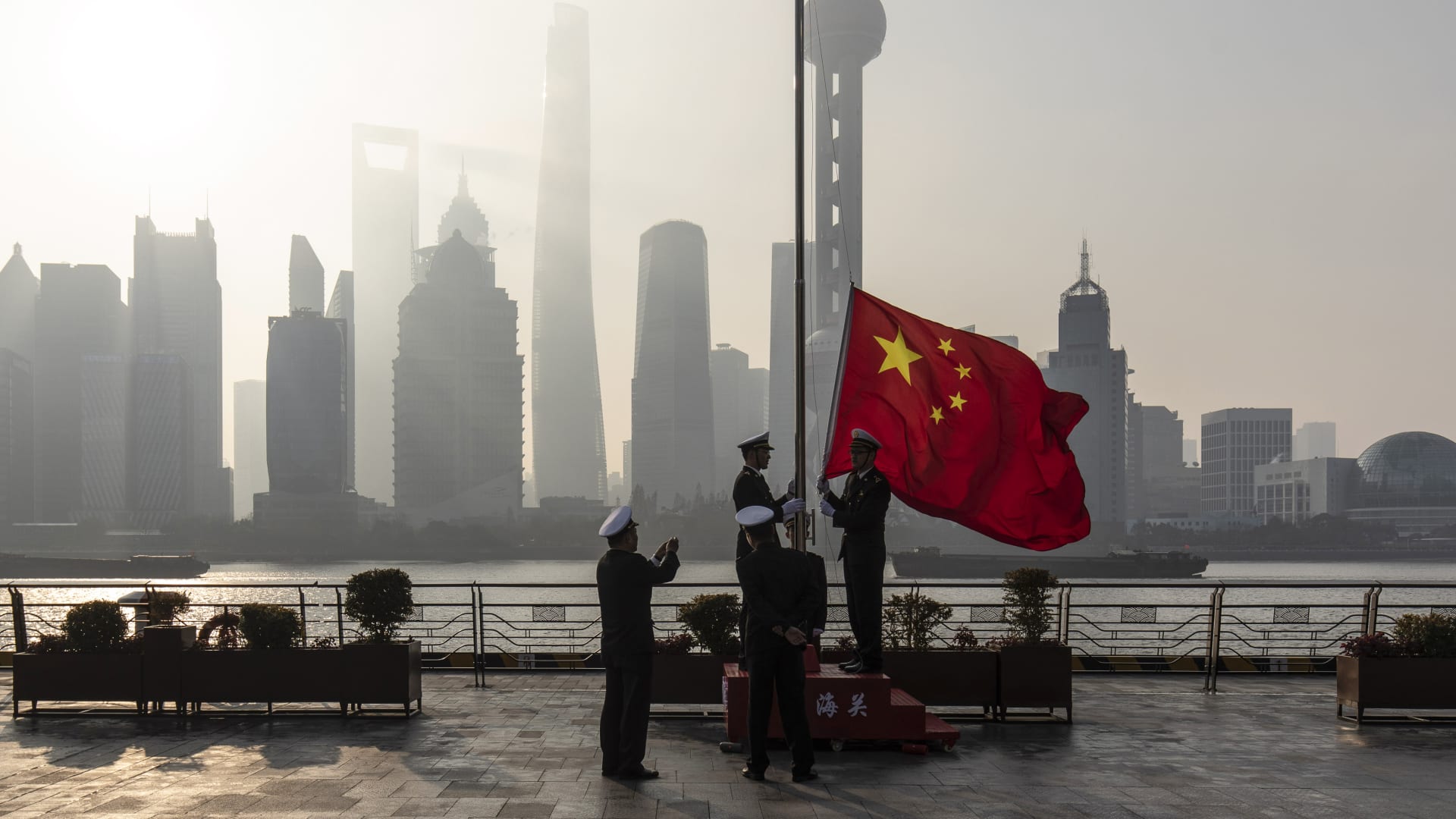

A new investing rule may attract hesitant investors to China. Here’s how

It’s a regulation that could make China more investable. A deal with Beijing regulators could allow an oversight board to audit U.S. listed Chinese companies.

It's a regulation that could make China more investable.

A deal with Beijing regulators could allow the Public Company Accounting Oversight Board to audit U.S. listed Chinese companies. This could help resolve the Holding Foreign Companies Accountable Act, which could see Chinese companies delisted in 2024.

This rule would go a long way toward dealing with investor reluctance to get involved in Chinese companies, KraneShares' Brendan Ahern said on CNBC's "ETF Edge" on Monday.

"People are going to take a very conservative path," the firm's chief investment officer said. "It's certainly weighed on the space in a very significant manner over the course of the last year."

Ahern's firm runs the CSI China Internet ETF (KWEB), which consists of China-based stocks focusing on internet-related technology. KraneShares reports its ETF exposure is 67.1% in Hong Kong and 30.9% in U.S. ADRs.

Ahern contends these U.S.-listed Chinese ADRs act as the growth engine within emerging markets.

"We've moved [Chinese ADRs] completely out of the U.S. share class. We're stewards of our investors' capital," he said. "We protected our shareholders and continue to monitor this on a daily basis."

Although there is high political and regulatory risk involved with investing in China, some investors don't seem to be too concerned with those factors.

So far this month, KWEB flows are strong. Plus, the ETF is up nearly 21% since its March 2022 low.

"We have companies like Tencent in the last nine trading days that have been buying almost a million shares a day," Ahern said. "The companies themselves see a lot of value in the shares, and we definitely agree with that assessment."

Astrong

Astrong