Bitcoin ETF: BTC price falls as traders await big SEC decision

A few days ago, the beginning of 2024 was marked, with Bitcoin blasting past the $45,000 mark for the first […] The post Bitcoin ETF: BTC price falls as traders await big SEC decision appeared first on ReadWrite.

A few days ago, the beginning of 2024 was marked, with Bitcoin blasting past the $45,000 mark for the first time since April, revealing a 7% increase. This trend in Bitcoin is because of the expectations surrounding the U.S. Securities and Exchange Commission. The U.S. spot bitcoin exchange-traded funds (ETFs) seem likely to launch after the exchanges that will list them have filed amended documents. The U.S. Securities and Exchange Commission will likely grant approval in the coming days. Major U.S. exchanges have posted the final Bitcoin ETF application filings, and more than a dozen applicants hope to launch their first spot in Bitcoin ETFs.

The anticipation about the filing is that it will be a big step for Bitcoin if approved — and will likely make Bitcoin more mainstream. This is also a significant step and matters because “The introduction of ETFs could usher in a new investor cohort from traditional finance, significantly improving market transparency and liquidity and bringing long-term capital inflow in the digital assets market,” says Matteo Greco, research analyst at Finequia International.

Why does everyone from BlackRock to Grayscale want a Bitcoin ETF?

Simply speaking, a spot Bitcoin ETF will create a compliant way to legally trade the price of Bitcoin that will be accessible on the markets that all investors already know about and trust. The past shows that many crypto-curious individuals want to buy crypto but view the process as intimidating, impenetrable, and nontransparent. Newcomers to the market often become skeptical or confused with the mere technical parts of holding Bitcoin — like the crypto wallets, the Bitcoin addresses, and private keys.

Jumping through the rigorous hoops of the U.S. Securities and Exchange Commission, if approved, the EFT hopefuls believe that this will be the “Day of the Bitcoin,” and all are eagerly awaiting the SEC decision.

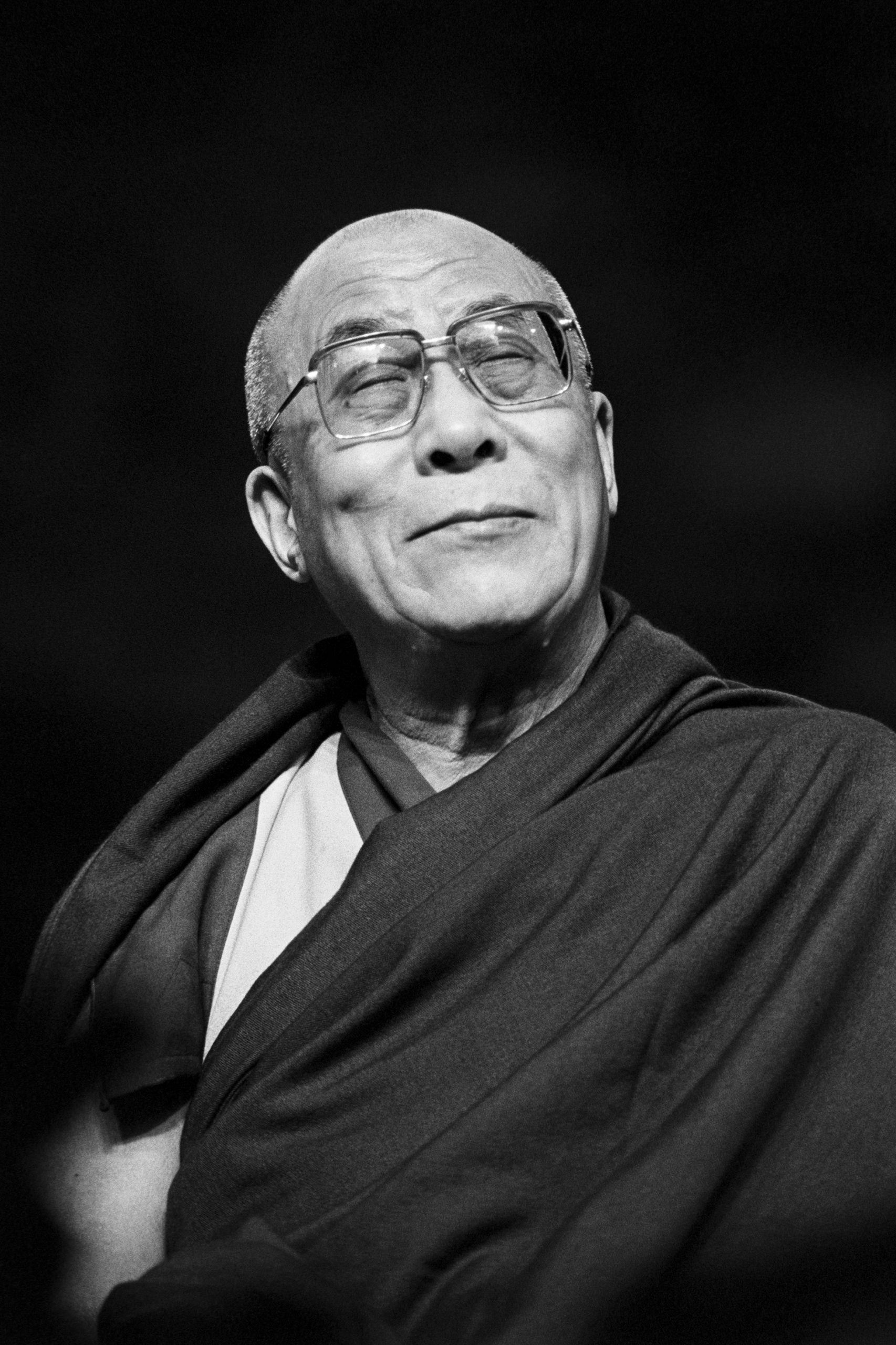

The amended 19b-4 filings, filed on behalf of BlackRock, Grayscale, Fidelity, and other issuers, join with last month’s amended S-1 filings. Jay Clayton, former chairperson of the U.S. Securities and Exchange Commission, discusses the reasons for this substantial move toward the Bitcoin ETF application below. He provides straightforward advice about handling your Bitcoin decisions.

It is an exciting day for spot Bitcoin and other crypto exchanges. We will keep you updated here as the news comes out from the U.S. Securities and Exchange Commission.

Featured Image Credit: Worldspectrum; Pexels

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Konoly

Konoly