Bitcoin Faces Key Moment: Will $93,257 Support Hold Or Break Below?

Bitcoin stands at a critical crossroads, with its price hovering near the crucial $93,257 support level. This key price point has acted as a stronghold for the cryptocurrency during its recent ascent, but now, the market is facing mounting...

Bitcoin stands at a critical crossroads, with its price hovering near the crucial $93,257 support level. This key price point has acted as a stronghold for the cryptocurrency during its recent ascent, but now, the market is facing mounting pressure. Bearish strength is starting to gain traction, raising concerns that the $93,257 level might soon give way to further declines.

The Relative Strength Index (RSI) is beginning to show signs of weakness, suggesting that momentum is shifting in favor of the bears. If Bitcoin fails to hold this support, it could trigger a wave of sell-offs, pushing the price toward lower support levels. However, if the bulls step in and defend this level, it might provide a foundation for a fresh rally and reinforce the strength of the ongoing uptrend.

As Bitcoin tests this critical threshold, the next few days will be pivotal in determining its short-term trajectory. Will the bulls manage to regain control, or will the bears take charge and force a breakdown? This moment could set the tone for Bitcoin’s price action in the coming weeks, making it a crucial point to watch closely.

RSI Signals Weakness: A Red Flag For Bitcoin?

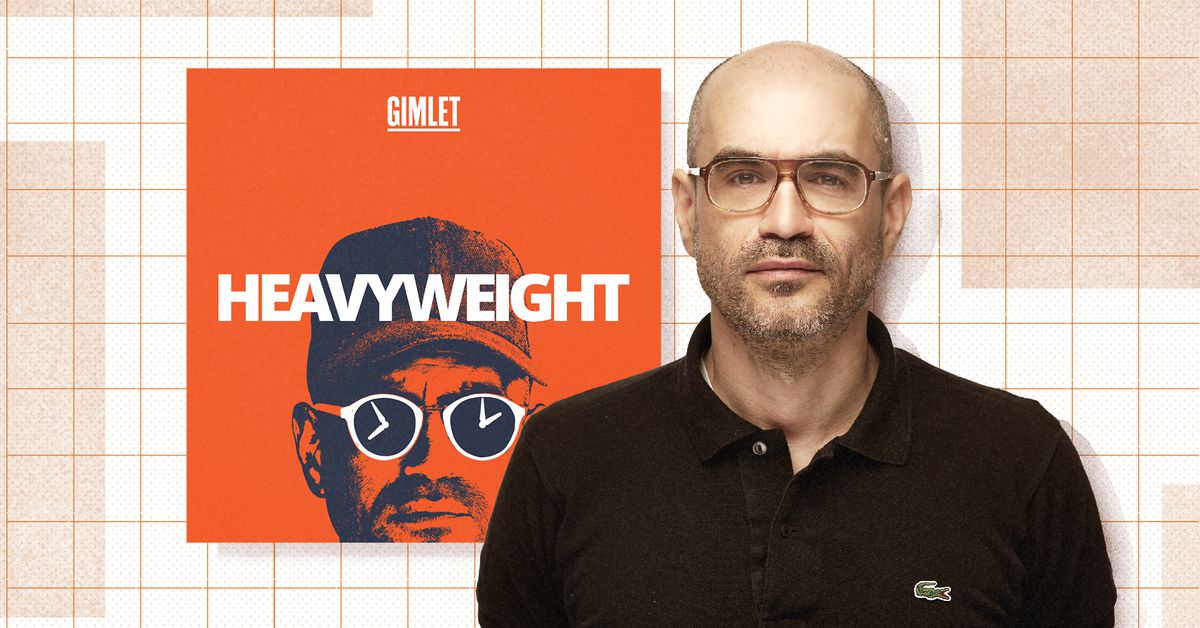

The Relative Strength Index is flashing a warning sign for Bitcoin as it shows signs of weakening strength. This technical indicator, which measures the strength and speed of price movements, has long been a reliable tool for predicting potential trend reversals. Currently, Bitcoin’s RSI is trending below 50%, indicating that the buying pressure is beginning to fade.

A weakening RSI suggests that Bitcoin could be losing its upward momentum, even though the price may not reflect this shift immediately. As Bitcoin approaches the $93,257 key support level, this divergence may be a precursor to a possible breakdown.

Bitcoin’s RSI displays a negative trend as prices drop to $93,257 support | Source: BTCUSDT on Tradingview.com

Bitcoin’s RSI displays a negative trend as prices drop to $93,257 support | Source: BTCUSDT on Tradingview.comIf Bitcoin’s RSI continues to decline, it might signal that the market is overextended and that further downside pressure might be on the horizon. A drop below this support mark could confirm this shift in momentum, leading to a deeper pullback.

What Happens If $93,257 Breaks? Potential Impact On BTC’s Price

If the critical $93,257 support level breaks, it could unleash significant downward movement, potentially driving the price toward the $85,211 support zone. A breach of this level would likely trigger a wave of selling activity, pushing Bitcoin down to the $73,919 support area, which could serve as the next key point of defense.

However, If the bulls successfully defend the $93,257 support, Bitcoin might regain momentum and continue its upward trend, aiming for the $99,575 resistance. Furthermore, a strong break above this level could open the door to more gains, driving the price toward the next resistance at $104,268 and beyond.

Featured image from Unsplash, chart from Tradingview.com

Konoly

Konoly