Bitcoin slides 7% to under $41,000 in volatile trading following early December rally

Bitcoin fell Monday as investors took profits after its December climb.

A worsening macroeconomic climate and the collapse of industry giants such as FTX and Terra have weighed on bitcoin's price this year.

STR | Nurphoto via Getty Images

Bitcoin fell Monday as investors took profits after its December rally.

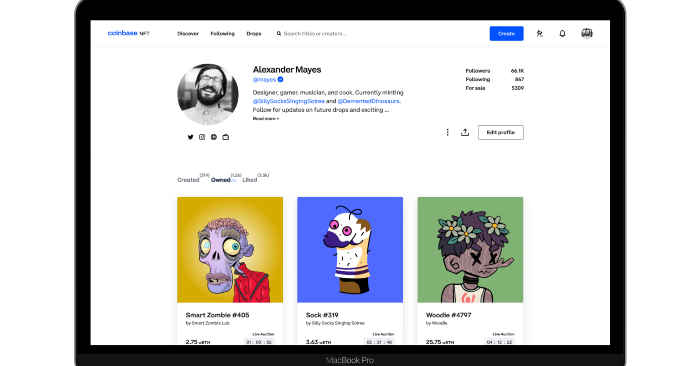

The price of the cryptocurrency was recently lower by more than 7% at $40,887.81, according to Coinbase, after a big drop Sunday night that at one point took it as low as $40,300. Bitcoin topped $44,000 last week and traded just below that level throughout the weekend.

Meanwhile, ether fell 7% Monday to $2,202.92. Solana's SOL token was down 7% as well while Ripple's XRP fell about 8%. According to Coin Metrics, bitcoin and ether are on pace for their worst days since Aug. 18 and March 9, respectively.

Crypto equities were dragged down, too. Coinbase fell about 5%, while MicroStrategy lost 7%. Bitcoin miners dropped double digits, with Riot Platforms and Marathon Digital, the largest mining stocks, lower by 11% and 12%, respectively. Wall Street favorites CleanSpark and Iris Energy were down nearly 15% and 14%, respectively.

The moves come after a 12% advance for bitcoin in December, according to Coin Metrics, as expectations grew that the U.S. Securities and Exchange Commission could approve the first spot bitcoin exchange-traded fund in early January. Galaxy Digital estimates the addressable market size of a U.S. bitcoin ETF to be about $14 trillion in the first year after a launch, growing to about $26 trillion in the second year.

Bitcoin drops sharply as investors take profits from recent rally

"Bitcoin continues to stay red hot," Wolfe Research's Rob Ginsberg said in a recent client note. "The coin seems to be trading with a fervor not seen since the early months of '21 when it ripped to its all-time high. The months of October and November saw price head another 56% higher."

Bitcoin has been on a steady climb in recent weeks, following a long period of market apathy that saw the price trade in a narrow range for months.

The sudden pullback triggered a spike in liquidations. According to CoinGlass, bitcoin has seen $146 million in long liquidations over the past 22 hours, while ether has seen $100 million.

FrankLin

FrankLin

![Are You Still Optimizing for Rankings? AI Search May Not Care. [Webinar] via @sejournal, @hethr_campbell](https://www.searchenginejournal.com/wp-content/uploads/2025/06/1-1-307.png)