Blocking calls to reporting cases: How this app helps S’poreans ‘shield’ themselves from scams

Job scams are on the rise amid Covid-19: In the first half of 2021, S$6.5 million was lost to such scams, a 16-fold increase from 2020.

These days when you turn on the TV or log in online to read the news, it feels like the world is on fire.

There are nations at odds with one another, countries having military coups, and in our own backyard, there are heartless scammers who are on the prowl to cheat innocent victims of their life savings.

The pandemic has led to an explosion of scammers emerging to target the naive and unaware, disguising the scams in all ways possible – from job scams to bank scams, and even police impersonation scams.

The Singapore Police Force (SPF) said that for this year, job scams are on the rise, as more people are lured by the convenience of easy jobs promising high commissions. Such scams are occurring more frequently during the pandemic: In the first half of last year, S$6.5 million was lost to job scams, a 16-fold increase from 40 in 2020.

One victim even lost about S$676,000 in a job scam.

Scams sent via SMSes / Image Credit: Singapore Police Force

Scams sent via SMSes / Image Credit: Singapore Police ForceBank scams also made the headlines recently, where 470 OCBC bank customers lost at least S$8.5 million in total. Some customers were wiped out of their savings which amounted to six figures.

Then there are phishing scams, where scammers steal user data, login info, and credit card numbers by bluffing a victim into believing they are from legitimate sources. In an update this month, the police said they observed at least 900 cases of phishing scams since January.

As consumers, it’s natural to be fearful and want to seek remedies to prevent such scams from reaching us and our loved ones, especially vulnerable people like the elderly who may not be aware of these scams circulating.

Currently, telcos do not help you filter scam and spam calls and text messages. So relying on counter scam applications like ScamShield helps as a safeguard and prevention.

What is ScamShield

To reduce the risk of scams in recent years, ScamShield was launched in November 2020 by the government.

The app is a collaboration between the National Crime Prevention Council (NCPC), Open Government Products team (OGP) at the Government Technology Agency of Singapore (GovTech), and SPF.

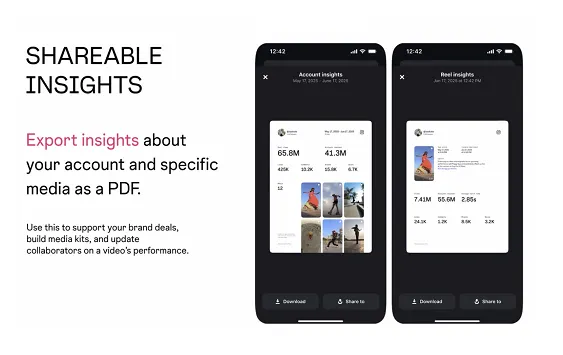

Image Credit: ScamShield app screengrab

Image Credit: ScamShield app screengrabThe app only blocks calls from ScamShield’s database of blocked numbers, managed centrally by the NCPC and SPF. It’s currently only available on iOS devices but the developers are currently working to roll out an Android version.

The application is only made available in Singapore. For users who are in another country/region, they have to change the country/region to Singapore on their Apple IDs to allow them to download ScamShield.

How does ScamShield block out scammers

How it works is that it compares calls and SMSes from unknown contacts against a list maintained by the SPF to determine if the number has been used for illegal purposes and blocks it.

The app does the job of filtering incoming calls and text messages from potential scammers. When you receive an incoming SMS from an unknown contact, ScamShield will determine if the SMS is a scam using an on-device algorithm and filter the messages to a junk SMS folder.

Scam SMSes will be sent to the NCPC and SPF for collation. This keeps the app updated and will help protect others from such scam calls and messages.

A junk SMS folder will be created on users’ phones. You will still be able to see those messages if you look for them under the junk folder.

Image Credit: Must Share News

Image Credit: Must Share NewsAs the app does not individually identify any users, nor does it access any other data on your phone, the user and the phone will not be at risk if the app is compromised.

According to ScamShield, iOS has strict privacy rules on what ScamShield can or cannot read.

“If a message comes from a known contact, iOS will not pass the SMS to ScamShield. If you have previously interacted with an unknown contact or decided to engage an unknown contact in conversation then ScamShield will not get to see the message either. Only messages sent by unknown persons via SMS will be read by the AI. The app also does not have any access to your location data or any personal data,” said ScamShield.

How to setup ScamShield

ScamShield mobile app is free to download. To set it up, users need to head over to the Apple store and search and download ScamShield.

Once the download is complete, open the app and there will be some basic steps to take to activate the app.

Setting up ScamShield to filter unwanted calls and SMSes:

To enable call blocking

Open SettingsTap PhoneTap Call Blocking & IdentificationEnable ScamShield Image Credit: ScamShield

Image Credit: ScamShieldTo enable SMS filtering

Open SettingsTap MessagesTap Unknown & SpamEnable ScamShield Image Credit: ScamShield

Image Credit: ScamShieldThe setup is complete and you will soon see the difference between having the “shield” installed and without.

According to users who previously received one scam call every other day and four to five scam messages a week, the app significantly reduces the scams received to close to zero of such disturbances every day.

Last year, the NCPC and SPF said a total of 722,865 SMSes have been reported and more than 5,537 phone numbers have been blocked on the ScamShield app since its inception six months ago.

The most common scams reported on the app are loan-related scams, illegal gambling, and online casino betting scams.

Reporting scams

For users who wish to report scam messages received, you can do so using ScamShield’s in-app reporting function.

You can also report scam messages from other chat apps such as WhatsApp, Wechat, IMO, and Viber. Just go to ScamShield’s in-app reporting function and forward the scam messages.

Scams evolving and becoming more sophisticated

The scam situation is becoming a larger problem as scammers grow bolder online. Recently, a type of phishing scam has re-emerged where scammers impersonate officers from the SPF, sending unsolicited calls via messaging applications such as WhatsApp.

The scammers then used the information to create an e-wallet using apps such as DBS PayLah!, Singtel Dash, or Grabpay with the name of the victim, to top up the e-wallets using the victim’s bank account.

Just last week, the police warned about the emergence of a new type of scam involving the scanning of Singpass QR codes to gain access to digital services for fraudulent purposes.

Scammers would request victims to scan a Singpass QR code with their Singpass app upon completing the surveys. The scammers claimed it was part of the verification process to retrieve their survey results for disbursement of the monetary rewards.

Image Credit: KGNS

Image Credit: KGNSScammers would proceed to misuse the access by signing up for online services like registering businesses, subscribing for new mobile lines, or opening new bank accounts under the victim’s name by scanning these codes and authorising transactions.

While counter-scam apps like ScamShield do help reduce the occurrence of scam calls and SMSes, it does not cover all forms of scams.

As scams continue to evolve in form and shape, consumers have to be ever vigilant and when unsure, they should verify the information by contacting the relevant authorities.

Some basic information one should never disclose include your personal or Internet banking details. This includes your NRIC issue date and one-time password, Singpass ID, and password details.

Featured Image Credit: Must Share News, Ximeiapp

UsenB

UsenB