CheggMate via @sejournal, @Kevin_Indig

Is Chegg facing an inevitable decline due to AI? Discover the nuances behind its revenue drop and industry changes. The post CheggMate appeared first on Search Engine Journal.

The expected AIO-pocalypse hasn’t happened, at least not in the form we expected.

Instead of a meteor impact, it looks more like climate change: slowly raising temperatures that cause natural disasters. Chegg is one of the first victims.

Chegg is an ed-tech company that offers students homework help, textbook rentals, online tutoring, and career resources. Founded in 2005. IPO in 2013.

In 2024, it reported 6.6 million paying subscribers, and its revenue is down -14% YoY. The culprit: AI.

The big question I answer in this article is whether Chegg is an outlier (spoiler: it’s not) or the first of many. More companies are bleeding. And some direct competitors to Chegg are surprisingly thriving.

You should read this Memo if you want to understand:

The nuance behind Chegg’s decline. Who else is impacted by AI. How to tell if you’re at risk. How to build up immunity against AI. Image Credit: Lyna ™

Image Credit: Lyna ™

Boost your skills with Growth Memo’s weekly expert insights. Subscribe for Free!

AI Overviews Are Not The (Only) Problem

Chegg filed a lawsuit against Google for abusing its monopoly position in Search to force companies to provide content that it repurposes for AI answers or Featured Snippets.1

The accusation has legs. Showing answers in the search results directly competes with Chegg’s business model.

Chegg claims (rightfully) it cannot opt out of them without cutting off vital organic traffic and calls Search a “Hobson’s Choice”: you either block Google and lose all organic traffic or don’t, and Google takes your content to give answers in the search results.

Up to this point, I agree.

What we’re witnessing is the old ecosystem of Search falling apart. The generational deal was that websites would create good content and allow Google to crawl it.

In return, Google sends them websites and shows ads to searchers. Now that clicking on websites is redundant in some cases, this deal is falling apart.

In my meta analysis of AI Overviews, I showed how AI Overviews reduce click-through rates, but they also show up much less often and more for informational queries than when they first started.

Skeptical

But this isn’t the whole puzzle of Chegg’s problem. Months before the lawsuit, Chegg’s CEO said AI, not AI Overviews, is eating into subscriber growth (as I mentioned in my Q1 Marketplaces Deep Dive):

“Rosensweig said on a May earnings call that ChatGPT had begun eating into subscriber growth. Chegg pulled financial forecasts for the rest of the year, and its stock dropped 48% in a day.”2

The article goes on:

“But within months, Chegg’s internal data showed students were increasingly turning to ChatGPT as a studying aid. Employees found some of the answers provided by GPT-4, the technology behind ChatGPT, scored higher on internal evaluations than answers from Chegg’s human experts.”

The problem goes beyond AI Overviews. Students around the world are using AI instead of web platforms. And you can see it in the numbers as well.

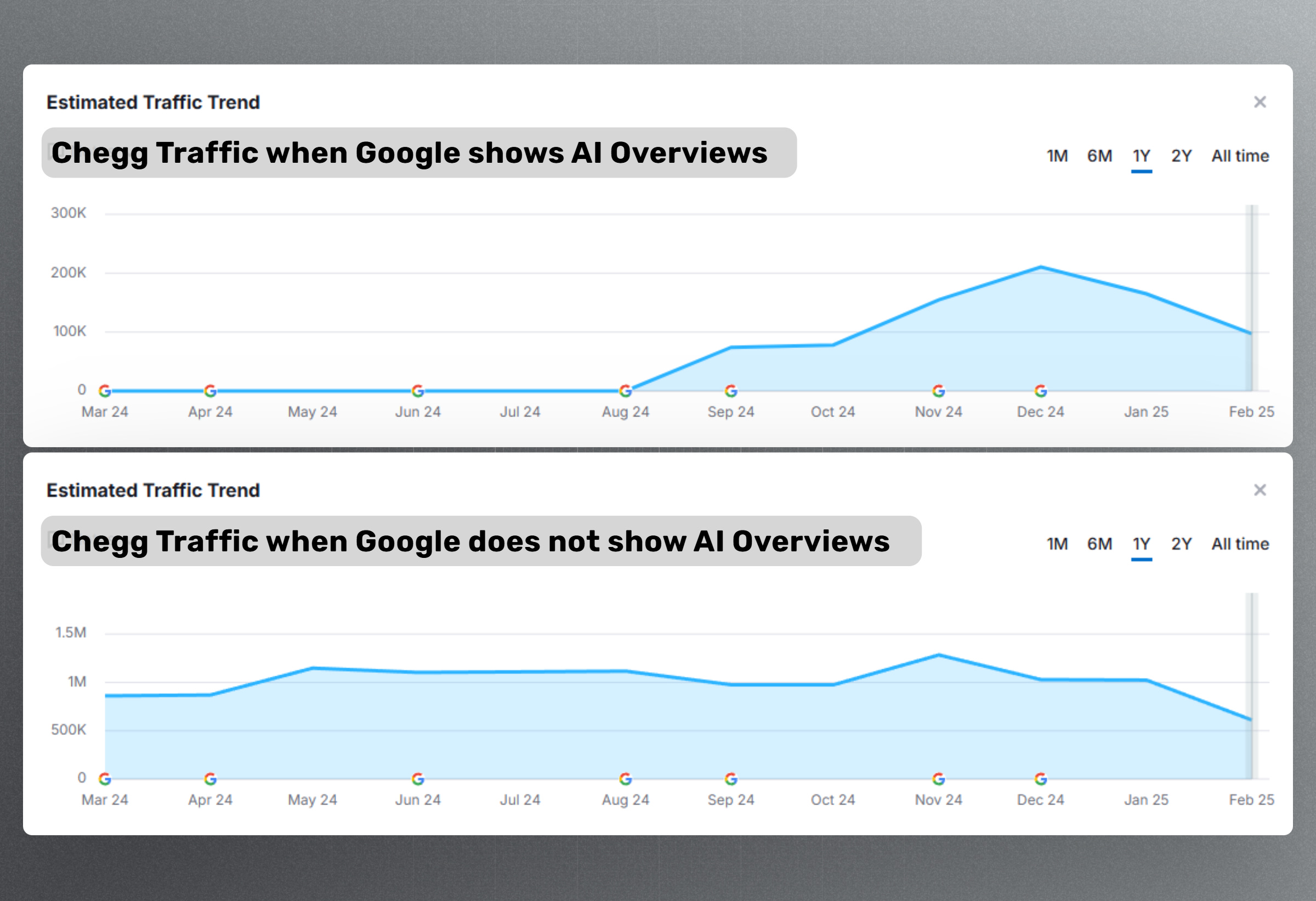

Image Credit: Kevin Indig

Image Credit: Kevin Indig

When you look at how much estimated traffic Chegg got from search results showing AI Overviews, you find it was only ~20% in December 2024, at its peak, and 15% in January 2025. Painful, but not enough to tank a company.

According to Semrush, Chegg’s organic traffic actually increased after May 2024, when AIOs launched, and only started tanking in October 2024.

According to Similarweb, total traffic declined before ChatGPT launched in November 2022.

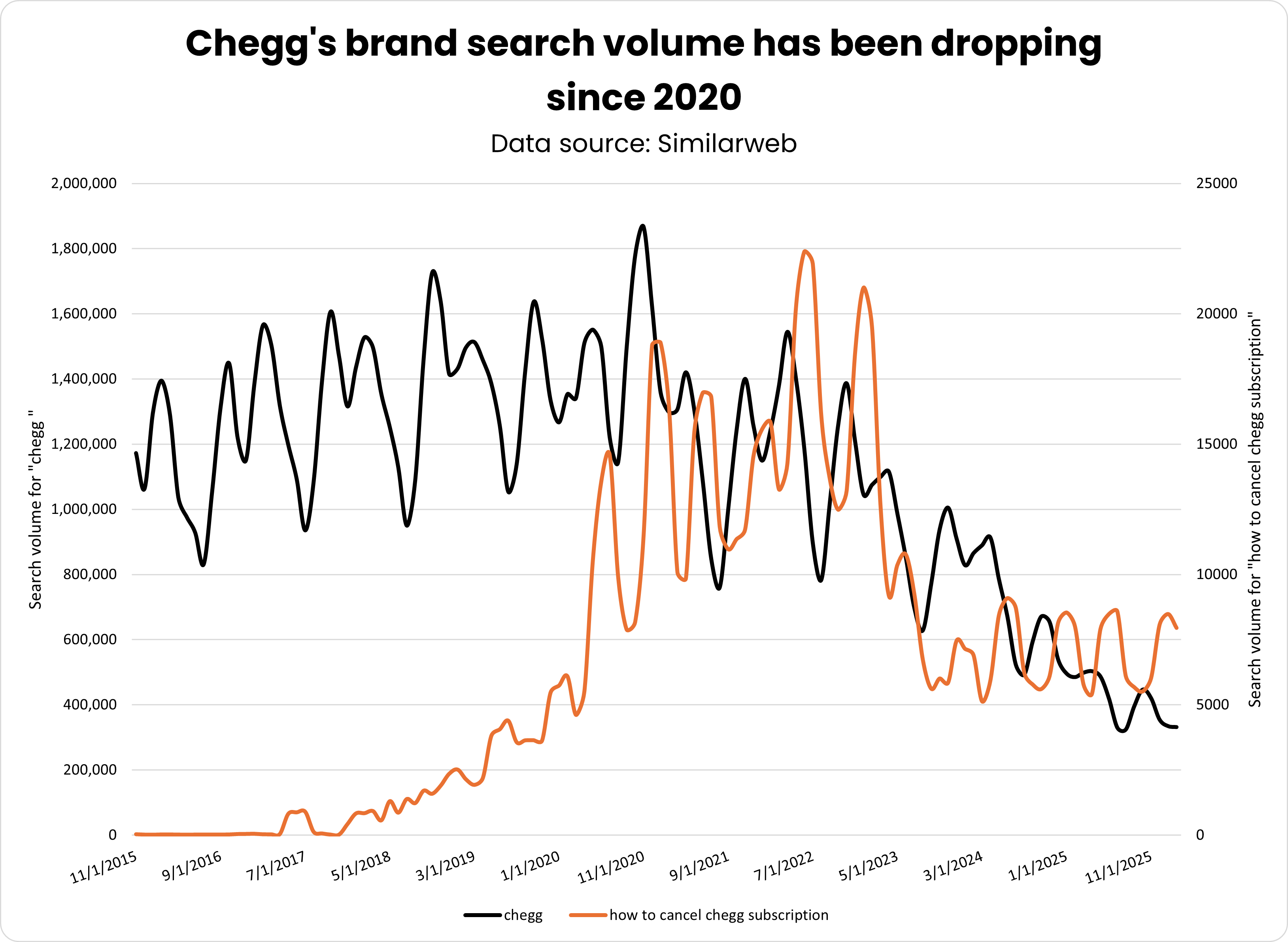

Image Credit: Kevin Indig

Image Credit: Kevin Indig

Declining brand search volume is a sign of shrinking brand awareness, product/market-fit and user retention.

The fact that brand search volume has been shrinking since 2020 and searches for cancellations have peaked before AI entered the mainstream makes me believe that the brand already had issues.

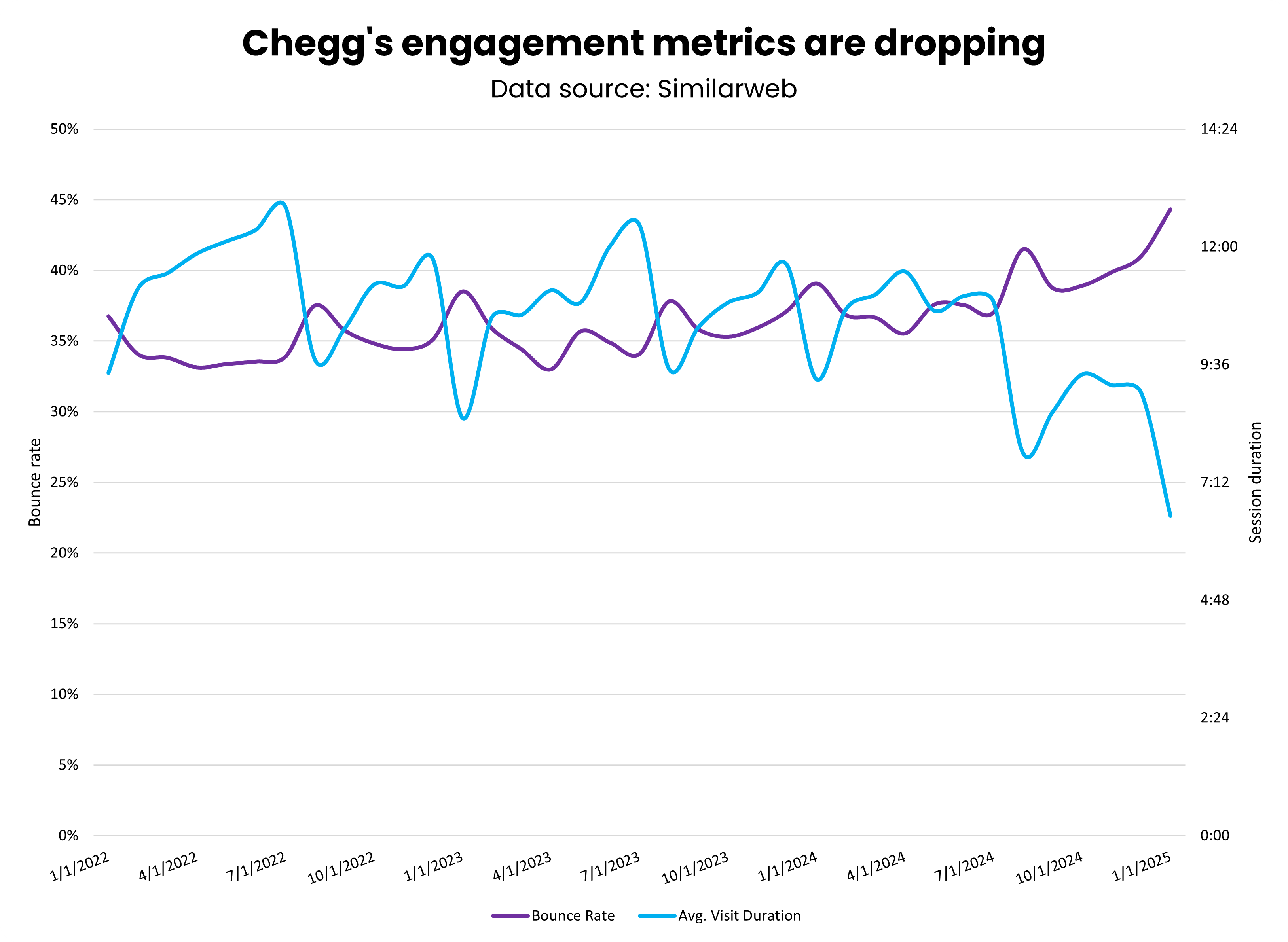

Image Credit: Kevin Indig

Image Credit: Kevin Indig

Chegg’s engagement metrics declined over the last 3 years, which is not good for SEO and not good for the business.

Bottom Line

Chegg struggled before AI. AI just accelerated the decline.

So, why doesn’t Chegg sue OpenAI & Co as well? Maybe, because AI Overviews and their impact are easier to measure.

Or, maybe because Chegg’s case could build on the lawsuit DoJ vs. Google, which already ruled Google a monopoly. The timing would fit, since the remedies are coming out in August.

Chegg could at least block LLM crawlers in their robots.txt.

Don’t get me wrong – Chegg’s lawsuit has a strong point. But I also see it as a story for investors: Chegg wants to signal that it needs to take the company private or sell (right call) because of a structural change to its business model that it’s not responsible for. The fact that the announcement was made during an earnings call supports that theory.

![google search for [homework help]](https://www.searchenginejournal.com/wp-content/uploads/2025/03/google-search-683.jpg) Image Credit: Kevin Indig

Image Credit: Kevin Indig

Symbolic: AI homework helper outranks Chegg for “homework help,” one of its most important keywords.

Who Else Is Impacted By AI

Chegg is a harbinger. I looked at other ed-tech sites that lean heavily on SEO and found that almost all of them saw significant traffic losses since ChatGPT came out:

CourseHero. Brainly. Studocu. Quizlet. Numerade. Wyzant. Khan Academy. Codepen. Study.com. W3schools. Stackoverflow.The traffic data is supported by research showing that students underwent significant behavior changes (first two quotes from the WSJ article linked above):

“A survey of college students by investment bank Needham found 30% intended to use Chegg this semester, down from 38% in the spring, and 62% planned to use ChatGPT, up from 43%.”

“Researchers at the University of Illinois at Urbana-Champaign conducted a study in the spring last year to see how ChatGPT had influenced cheating in an introductory programming course. They found students had overwhelmingly moved to ChatGPT from what the researchers called “plagiarism hubs” such as Chegg.”

“A survey of 1,000 students – both domestic and international – found there had been an “explosive increase” in the use of genAI in the past 12 months. Almost nine out of 10 (88%) in the 2025 poll said they used tools such as ChatGPT for their assessments, up from 53% last year.”3

ChatGPT & Co. destroy the value of online tutoring and study tools.

Red Flags

Chegg and the other affected sites show what red flags to watch out for:

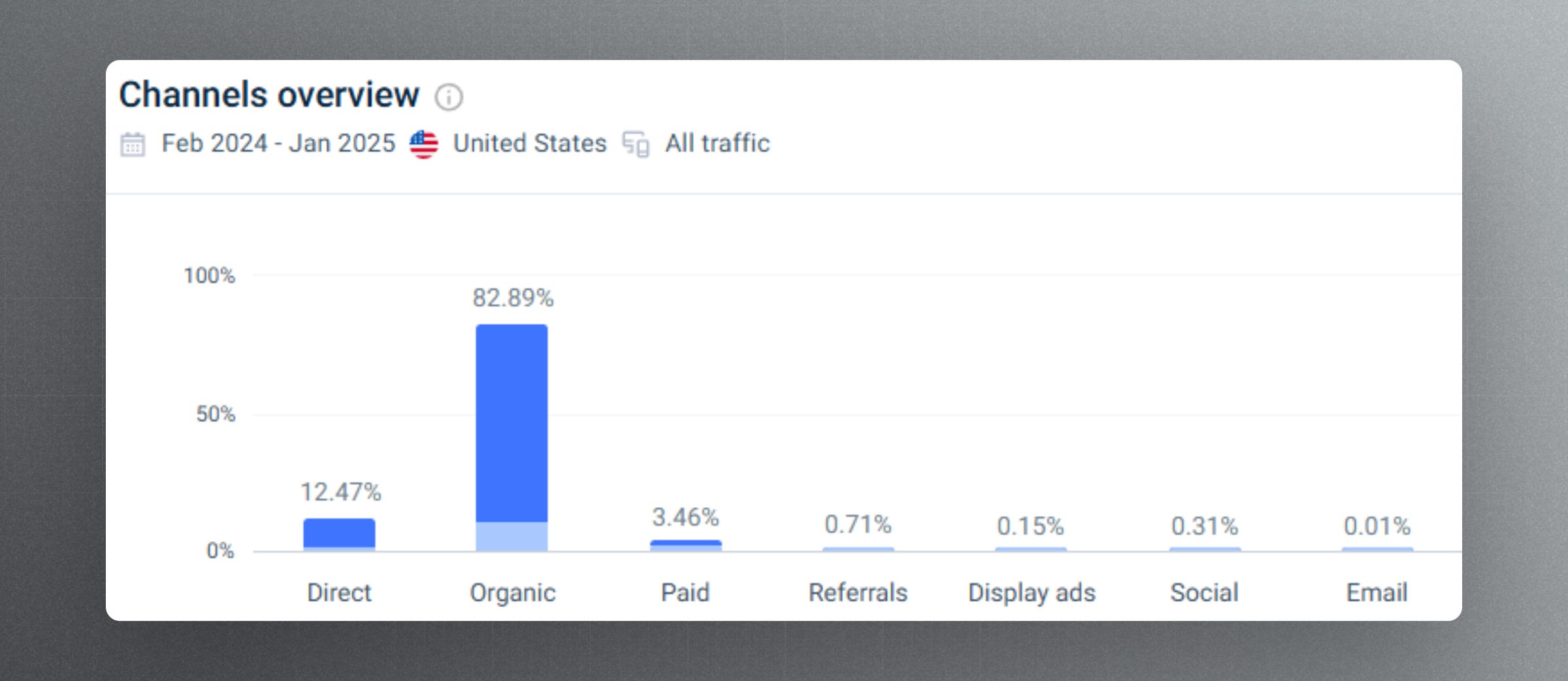

> 80% organic traffic. Young target audiences. Information sites, especially marketplaces.The companies that need to be most careful are overexposed to SEO, offer information as a product, and sell to young people.

Other industries that fit the bill and could be next on the list: Gig economy, Online Q&A, Quotes, lexica, encyclopedias, dictionaries.

Over 80% of Chegg’s traffic comes from SEO (Image Credit: Kevin Indig)

Over 80% of Chegg’s traffic comes from SEO (Image Credit: Kevin Indig)

How To Build AI Immunity Cells

Not every ed-tech company is in the red. Scribd, Coursera, Udemy, Pearson.

Pearson is especially interesting because it’s the UK equivalent of Chegg. Even though revenue is down -3%, and its CEO acknowledged “digital learning trends” (a.k.a. AI) as a challenge, traffic is thriving.

Why? Because it’s better diversified: 65% of traffic comes direct, 18% from organic. It doesn’t have to be that little.

Each company I listed at the beginning of the paragraph is either less reliant on SEO traffic or offers content that’s hard to copy (e.g., courses).

Turning around structural declines, where user behavior and the market significantly shift, is hard. Sometimes, impossible. I’ve learned my own fair share of lessons when Shopify went through the COVID hangover.

So, what can Chegg do except find a time machine and go back 10 years to fix its overexposure on SEO?

First, taking the company private to turn it around is a good first step. The pressure of quarterly results makes a strong pivot impossible.

Second, Chegg is already working on two smart pivots:4

Get away from content that’s easy for Google to copy/synthesize and focus on interactive tools and experience. The company already offers tools like a citation manager or a plagiarism checker, but it could do a lot more here. Explore related market. Chegg launched Busuu, a language learning service, and Chegg Skills, a pilot program to train students in business-relevant skills and connect them straight to businesses. But can it compete with Duolingo and Babbel? And, are new markets fruitful enough?I’m rooting for Chegg. I want it to be a turnaround story. Godspeed.

2How ChatGPT Brought Down an Online Education Giant

3UK universities warned to ‘stress-test’ assessments as 92% of students use AI

4Chegg Reports 2024 Fourth Quarter and Full Year Financial Results

Featured Image: Paulo Bobita/Search Engine Journal

ShanonG

ShanonG