China stocks lead gains in mixed Asia trading as Alibaba shares rebound

The Chinese producer price index for May jumped 6.4% as compared with a year earlier, official data showed Friday.

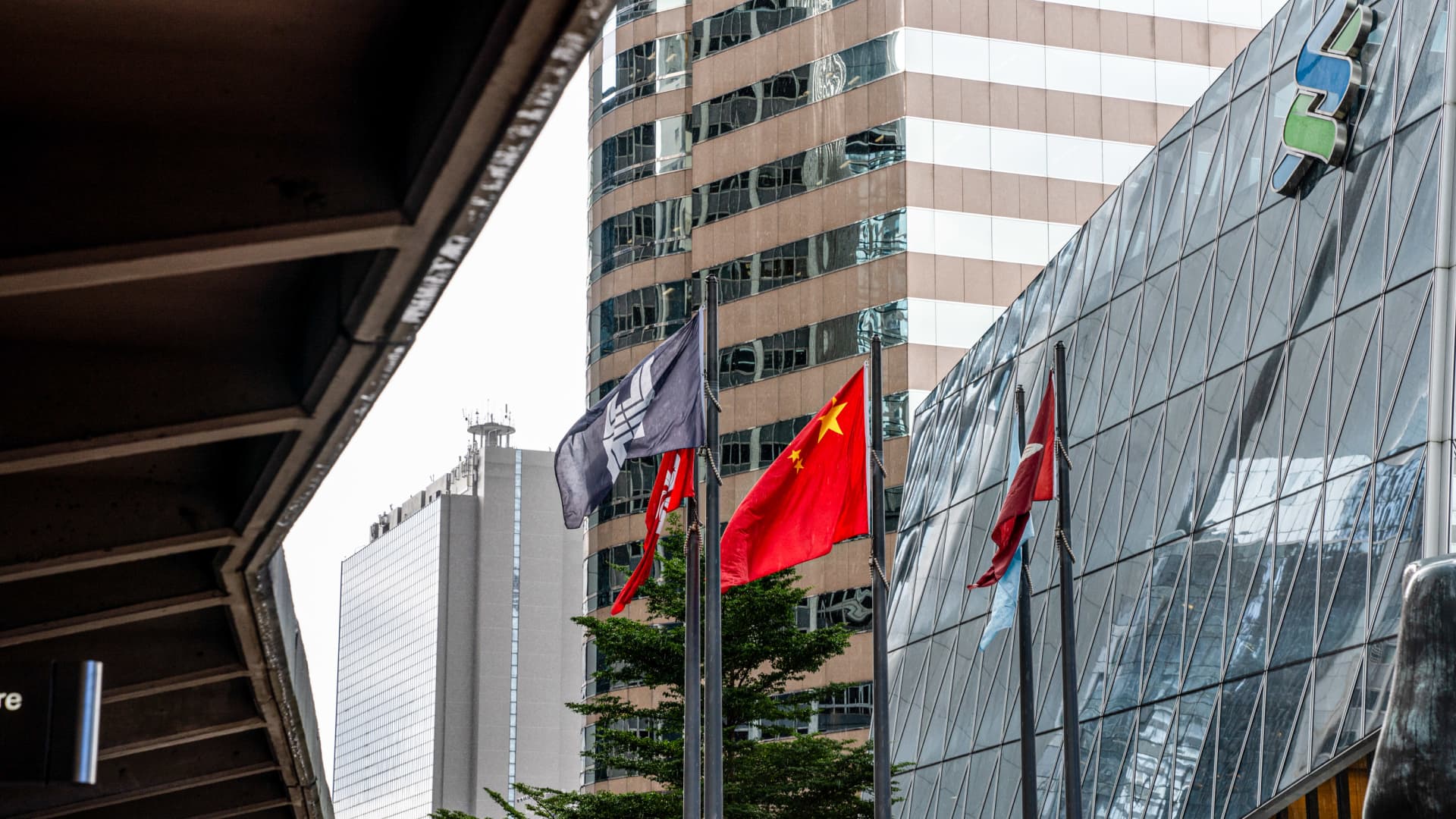

SINGAPORE — Shares in Asia-Pacific were mixed on Friday as Chinese inflation data for May came in largely in line with expectations. Investors also looked ahead to the release of U.S. inflation data later stateside.

Hong Kong's Hang Seng index slipped 0.29% to close at 21,806.18.

Hong Kong-listed shares of Alibaba turned around, closing 1.35% higher after falling nearly 4% earlier. That was in contrast to U.S.-listed shares of Alibaba, which dropped 8.13% on Thursday after Jack Ma's Ant Group and Chinese regulators squashed talk of reviving Ant's public listing.

In mainland China, the Shanghai Composite gained 1.42% to close at 3,284.83 while the Shenzhen component jumped 1.901% to 12,035.15.

Chinese producer inflation in May rose in line with expectations, official data showed Friday. The Chinese producer price index for May jumped 6.4% as compared with a year earlier, according to data by the country's Bureau of Statistics. That matched expectations in a Reuters poll.

"I expect the [Chinese] government will roll out more stimulus in the next few months, including interest rate cut."

Zhang Zhiwei

chief economist, Pinpoint Asset Management

Meanwhile, Chinese consumer inflation in May also saw an increase that was close to expectations. The consumer price index climbed 2.1% from a year ago, just below the forecast in a Reuters poll for a 2.2% increase.

"As [producer price index] inflation is already on a downward trend, inflation is unlikely to be a constraint for further policy easing," Zhang Zhiwei, president and chief economist at Pinpoint Asset Management, wrote in a Friday note following the data release.

"I expect the government will roll out more stimulus in the next few months, including interest rate cut," Zhang said.

The rise in Chinese stocks came despite authorities reimposing some restrictions in the major cities of Beijing and Shanghai.

Stock picks and investing trends from CNBC Pro:

Japan's Nikkei 225 shed 1.49% to close at 27,824.29 as shares of SoftBank Group dropped 2.01%, while the Topix index declined 1.32% to 1,943.09. South Korea's Kospi fell 1.13% to end the trading day at 2,595.87.

The S&P/ASX 200 in Australia dipped 1.25%, closing at 6,932. MSCI's broadest index of Asia-Pacific shares outside Japan dipped 0.84%.

Looking ahead, the U.S. is set to announce its May consumer price index report later Friday stateside.

Overnight stateside, the S&P 500 slipped 2.38% to 4,017.82. The Dow Jones Industrial Average plunged 638.11 points, or 1.94%, to 32,272.79. The tech-heavy Nasdaq Composite dropped 2.75% to 11,754.23.

Currencies and oil

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 103.19 after recently crossing the 103 level.

The Japanese yen traded at 133.70 per dollar, struggling to recover after weakening from levels below 132 against the greenback earlier this week. The Australian dollar was at $0.713 following a recent drop from above $0.714.

Oil prices were lower in the afternoon of Asia trading hours, with international benchmark Brent crude futures down 0.54% to $122.41 per barrel. U.S. crude futures slipped 0.51% to $120.89 per barrel.

Konoly

Konoly