Comcast and Charter may need new focus as broadband growth stalls amid competition

The cable industry has had steady high-speed broadband growth for decades, but the end of an era may be approaching.

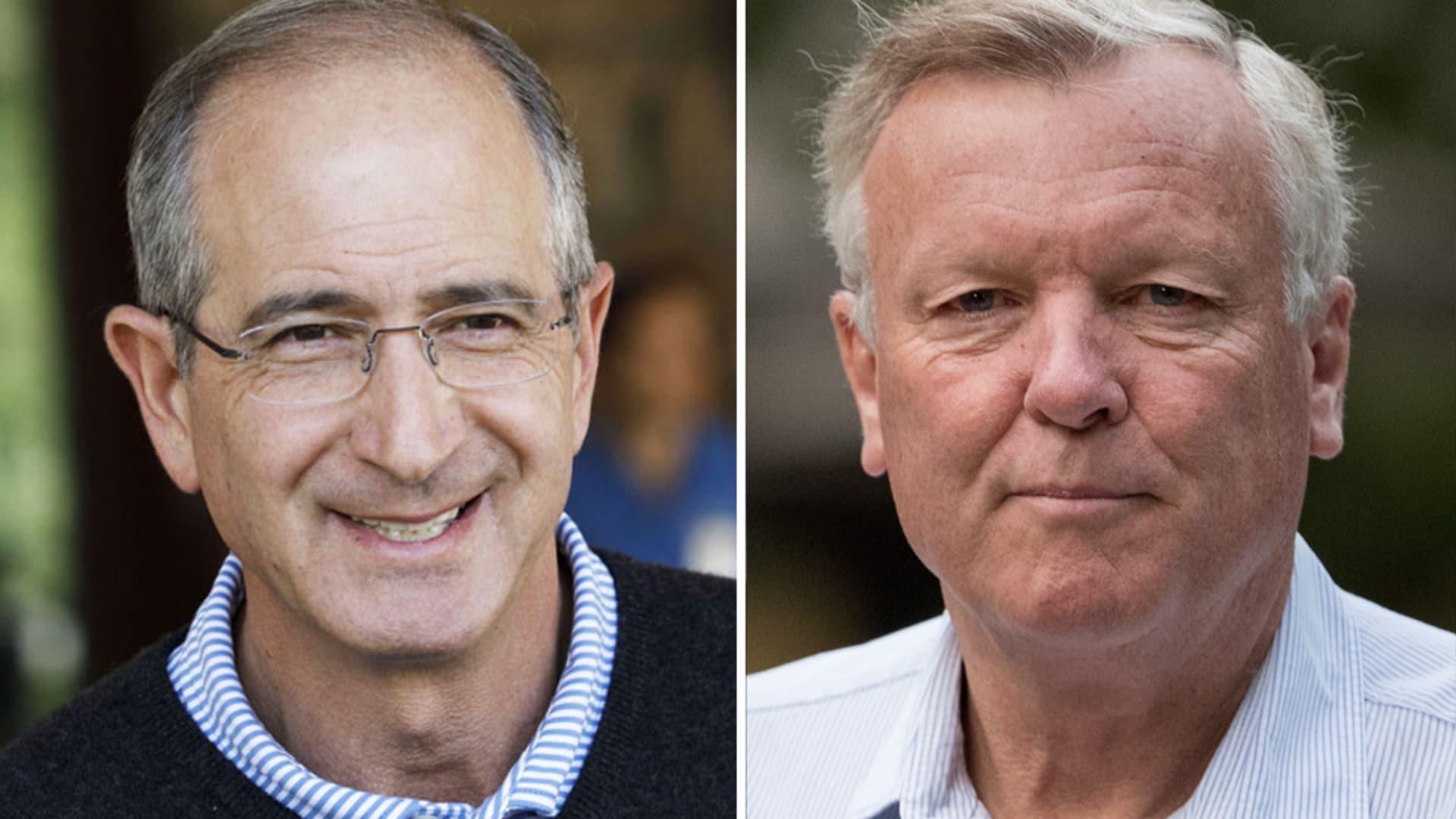

Brian Roberts, CEO of Comcast (L), and Tom Rutledge, chief executive officer of Charter Communications

Drew Angerer | Getty Images

Comcast and Charter, the two largest U.S. cable companies, have a broadband growth problem.

As tens of millions of Americans canceled their cable TV subscriptions in the past decade, the cable industry focused on the more profitable business of selling broadband internet.

Now, the number of U.S. households paying Comcast and Charter for high-speed Internet is falling for the first time, with both companies reporting residential broadband declines in the second quarter. Comcast lost 10,000 residential customers and noted it's down an another 30,000 in July. Charter dropped 42,000.

Comcast CEO Brian Roberts and Charter counterpart Tom Rutledge blamed macroeconomic trends and stronger than normal gains during the pandemic as primary reasons for the losses. Comcast specifically pointed to fewer people moving as the main reason for lower connections.

"There's been a dramatic slowdown in moves across our footprint," said Roberts during Comcast's earnings conference call last month. In the first year of the pandemic, he noted the company added nearly 50% more customers than its prior annual average growth.

The abrupt end to the streak of broadband growth is a major concern for investors in Comcast and Charter, which are trading near two-year lows. Comcast shares are off about 25% year to date, while Charter is down about 33%.

And while pandemic and macroeconomic trends may ease with time, Roberts also acknowledged in the earnings call another reason for the broadband dip: new competition.

The rise of fixed wireless

For decades, cable companies enjoyed having little competition in many regions of the country for high-speed internet.

Then about three years ago, T-Mobile launched its fixed wireless product, a 5G high-speed broadband product that functions as an alternative to cable broadband. As of April, T-Mobile high speed internet is available to more than 40 million households across the country. Verizon said earlier this year it plans to have between 4 million and 5 million fixed wireless customers by the end of 2025.

In March, Roberts dismissed fixed wireless as "an inferior product." T-Mobile has promised half the country will get speeds of at least 100 megabits per second by the end of 2024. Standard cable (and fiber) broadband can typically deliver speeds about twice as fast. Moreover, fixed wireless is constrained by congestion on 5G airwaves. Cable, which runs wires directly to the home, has no such limitation.

"We've seen lower price, lower speed offerings before. And in the long run, I don't know how viable the technology holds up," Roberts said at the Morgan Stanley Technology, Media & Telecom Conference.

T-Mobile charges a flat $50 monthly fee for its fixed wireless service. New Street Research estimated average monthly cable broadband revenue per use is nearly $70, and will likely rise to more than $75 by 2025.

Just as T-Mobile grew in the wireless industry by offering lower prices, it appears to be doing the same to cable. In the second quarter, T-Mobile added a whopping 560,000 new fixed wireless customers as Comcast and Charter lost broadband subscribers. T-Mobile said more than half its new customers switched from cable.

"Demand continues to build from dissatisfied suburban cable customers to underserved customers in smaller markets and rural areas," T-Mobile CEO Mike Sievert said during the company's earnings conference call. T-Mobile also noted that results of Ookla's nationwide speed test in July that showed its 5G network (187.33 Mpbs) topped Comcast and Charter broadband (184.08 and 183.74, respectively) in terms of average speed.

Roberts disputed that customers are ditching Comcast for any fixed service, claiming T-Mobile's growth is based on new customers.

"We are not seeing fixed wireless have any discernible impact on our churn," Roberts said during Comcast's earnings conference call July 28.

Still, if fixed wireless continues to eat into cable broadband growth, Comcast and Charter will need to convince investors there's another reason to put their money in cable, said Chris Marangi, a portfolio manager at Gabelli Funds.

"There's not an obvious catalyst," said Marangi. "You're probably not going to get reinvigorated broadband growth in the next six months."

Gabelli Funds own Charter, Comcast, Verizon and T-Mobile.

The cable investment fear

The fear among cable shareholders isn't just that Comcast and Charter may be at the end of an era where it comes to broadband growth. It's also that new competition will lead to lower prices. The combination of promotional pricing and stalled growth may end up turning broadband into something that looks more similar to the wireless business, which has been stymied by price wars and low profit margins for years.

It's too early to tell if fixed wireless will take market share away from cable companies in coming years or if congestion issues force wireless providers to constrain the number of users, said Craig Moffett, a telecom analyst at MoffettNathanson. Moffett noted that fixed wireless uses far more data than mobile wireless but only generates about 20% more revenue based on current pricing.

"Time will tell if this migration to fixed wireless is just a temporary opportunity," Moffett said.

It's possible that fixed wireless is simply having "a moment" and customers will reject the service over time as being too unreliable or lacking in speed, said Walt Piecyk, an analyst at LightShed Partners.

"Right now, it looks like it works. They're taking cable customers," said Piecyk. "We'll see if this is sustainable two or three quarters from now."

Cable's technological advantages may swing investor sentiment back toward Comcast and Charter if fixed wireless growth subsides.

"While the narrative of slowing connects ahead of increasing competition does not bode well for sentiment, we believe cable's network advantage across the majority of its footprint will drive sub growth," JP Morgan analyst Philip Cusick wrote in a note to clients.

Cable moves to wireless

As TV declines and broadband growth slows, the next chapter for cable will be wireless, predicted Moffett.

Wireless has become cable's new growth story, as Comcast and Charter have used a shared network agreement with Verizon to boost their own mobile services. Comcast's wireless revenue grew 30% year over year in the second quarter and more than 80% from two years ago. Charter's wireless quarterly sales grew 40% from the year-earlier period; two years ago, the company didn't even break out wireless revenue because the business was so new.

Comcast and Charter have to share wireless with Verizon under the constructs of their network agreement, pushing margins lower. A well-run mobile virtual network operator still only has margins of about 10%, Moffett said. But that could grow over time, he said.

"Wireless may not be a better business than broadband, but it is a much bigger business," Moffett said.

Charter Chief Financial Officer Chris Winfrey said during the company's second-quarter earnings conference call that the potential of cable wireless is underestimated.

Given the push among wireless companies into broadband, along with the movement by cable companies into mobile service, some think it's inevitable the two industries will merge.

"It just doesn't make any sense not to, purely from an operational synergies, from a capital-allocation synergies, from a branding-synergies standpoint," Altice CEO Dexter Goei told CNBC last year. Altice is the fourth-largest U.S. cable provider behind Comcast, Charter and Cox.

The more services customers have from the same provider, the less likely they are to leave, Goei said.

M&A as last resort

A merger between Comcast or Charter with T-Mobile, Verizon and AT&T is unrealistic given the U.S. regulatory stance on market power, Moffett said. Still, different presidential administrations can have varied viewpoints on what is acceptable. For example, Sprint and T-Mobile were able to merge under the Trump administration after years of being told by government officials not to bother even trying.

"Never say never, right?" Goei said. "Strategic transactions where you have different services, I don't understand why that should not be something that should be allowed by the antitrust division."

If a wireless-cable merger isn't in the cards, there are other potential ways deals could renew investor interest.

Regional cable operator WideOpenWest and Suddenlink, an asset owned by Altice USA, are both in talks with potential buyers, according to people familiar with the matter. A transaction could lift publicly traded cable stocks by resetting the valuation multiple on the companies higher, said Gabelli's Marangi.

Charter or Comcast could also buy a non-cable asset to bring renewed investor excitement to their companies.

"It's Management 101; when companies go ex-growth, they look to M&A," said Piecyk of LightShed Partners.

It's also possible investors would view an outside acquisition as a distraction rather than a new opportunity, however. Shareholders would likely resist deals for media assets, such as Comcast's past acquisitions of Sky and NBCUniversal, Moffett said.

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC.

WATCH: Comcast reports flat broadband subscribers

KickT

KickT