Comcast shares slump as broadband subscriber growth continues to slow

Comcast beat on the top and bottom lines, but broadband growth continues to slow.

Comcast reported first-quarter earnings Thursday that beat analyst estimates on the top and bottom lines, though broadband growth continues to slow.

Comcast added 262,000 high-speed internet customers in the quarter, above the 229,000 average analyst estimate.

But about 80,000 of those subscribers were free Internet Essentials customers who are now counted in the total. Comcast said during its earnings conference call the broadband adds in the quarter without the free subscribers would have been about 180,000 — missing analyst estimates.

"This quarter's results reflect continued low move-related activity compared to historical levels as well as an uptick in the level of competitive activity resulting in lower connect volumes," said Comcast Chief Financial Officer Michael Cavanagh during the company's conference call.

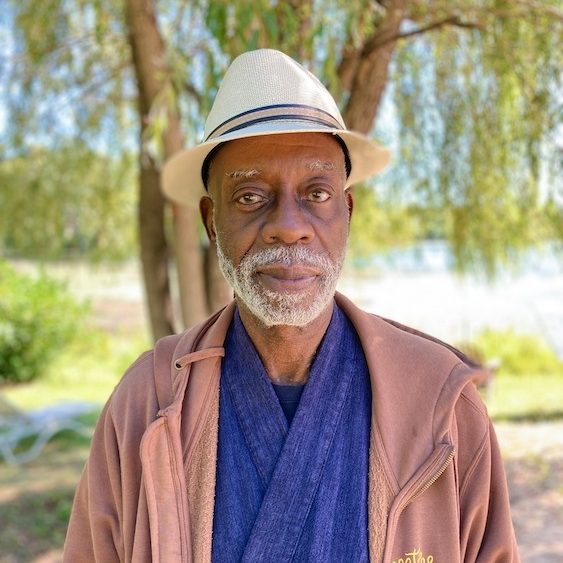

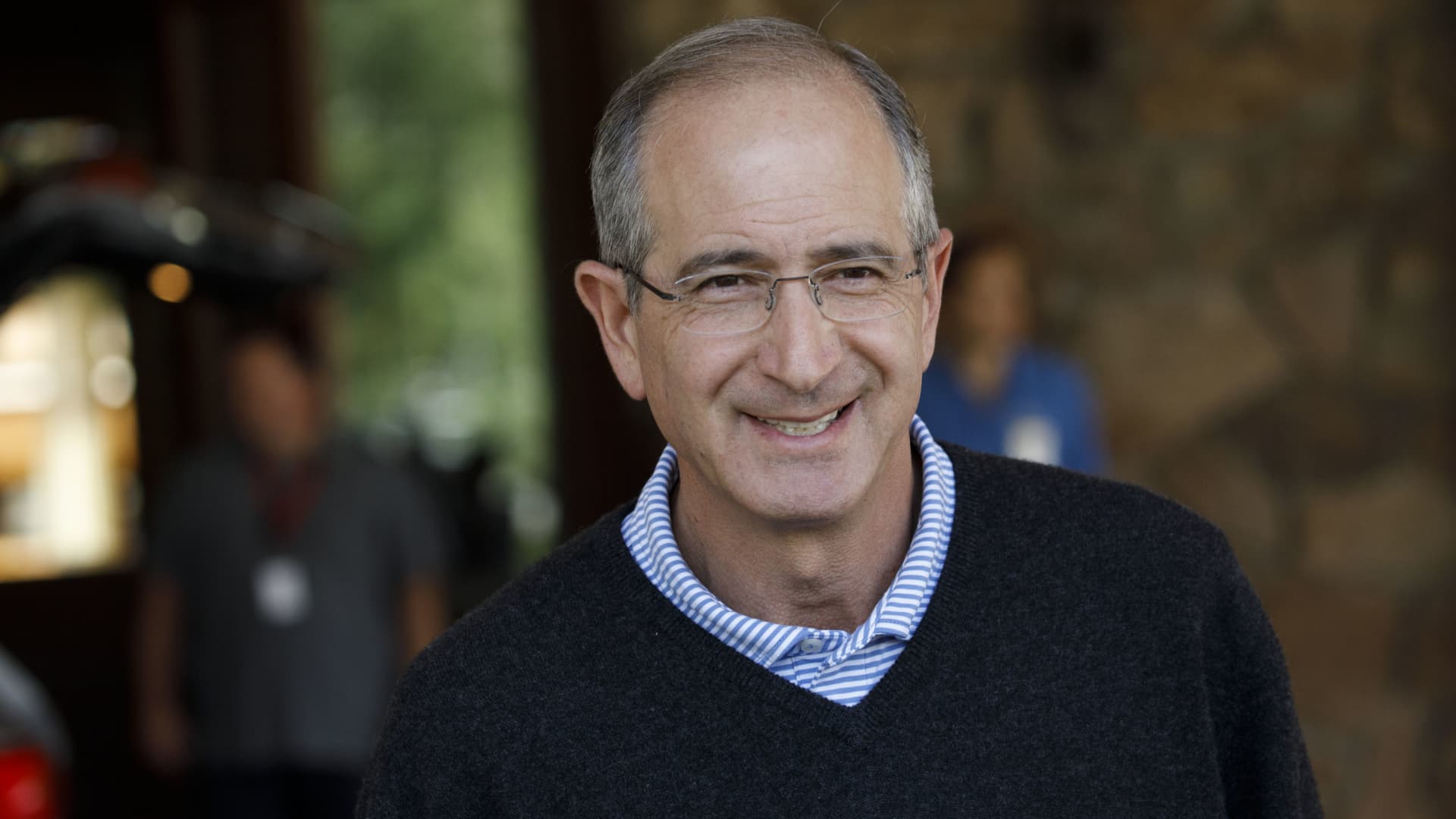

Brian Roberts, chairman and chief executive officer of Comcast Corp.

Patrick T. Fallon | Bloomberg | Getty Images

Comcast shares fell 4.3% to $42.57 in early trading.

Here are the key numbers:

Earnings per share: 86 cents, adjusted vs. 80 cents per share, according to RefinitivRevenue: $31.01 billion vs. $30.5 billion, according to RefinitivHigh-speed internet customers: 262,000 vs. 229,000 net additions, according to analysts surveyed by FactSet (Comcast said 180,000 ex-free subscribers).Excluding revenue from the Beijing Olympics and the Super Bowl, Comcast said its media division brought in $5.38 billion of revenue during the quarter, an increase of 6.9% year over year.

Roberts said during Comcast's earnings conference call that NBCUniversal's streaming platform Peacock added 4 million paid subscribers to 13 million total. Peacock has 28 million monthly active users, up from 24.5 million, though Roberts added that the Olympics and the Super Bowl last quarter led to a spike in Peacock growth that will likely subside in quarters to come.

Other divisions

The company's Europe-based Sky division saw its revenue slide 4.5% year over year to $4.8 billion, due to the impact of currency, as well as lower content revenue. Analysts surveyed by FactSet were projecting Sky revenue of $4.92 billion for the quarter.

Comcast's Universal theme park business continued to recover after extended shutdowns due to the coronavirus pandemic. Revenue in the division soared more than 151% year over year to $1.56 billion, which exceeded analysts' projected $1.44 billion, according to FactSet.

"Our recovery from the pandemic at theme parks has been fantastic and shows no signs of slowing down," Comcast CEO Brian Roberts said in a statement.

NBCUniversal saw a roughly 46% revenue rise in the first quarter, which included $1.5 billion from the Beijing Olympics and the Super Bowl.

Advertising revenue jumped 59.2% during the quarter, in large part because of those two events.

Here's how Comcast's divisions did for the quarter compared with a year earlier:

Cable Communications contributed $16.54 billion in revenue, up 4.7%Media brought in $6.87 billion in revenue, up 36.3%Studios contributed $2.76 billion in revenue, up 15.1%Theme Parks brought in $1.56 billion in revenue, up 151.9%Sky contributed $4.77 billion in revenue, down 4.5%The company reported an adjusted EBITDA loss of $456 million related to Peacock, compared with an adjusted EBITDA loss of $277 million in the year-ago period.

On Wednesday, Comcast announced a new joint venture with Charter Communications that will see its Xfinity Flex streaming hardware available to broadband subscribers of both companies.

"This partnership demonstrates the benefits of our focus on innovation and enables us to bring entertainment aggregation and streaming products that run off our global technology platform to millions more customers," Roberts said.

WATCH: 'The pendulum has swung too far to the negative on streaming,' says Guggenheim's Michael Morris

Disclosure: Comcast owns CNBC's parent NBCUniversal.

Lynk

Lynk