Dow falls more than 300 points, Nasdaq sheds 2.6% as January wild trading continues

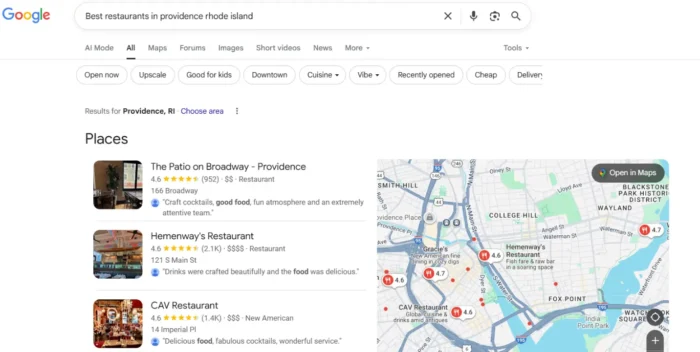

U.S. stocks fell Tuesday as market volatility continued after the major indexes on Monday notched one of the biggest comebacks in history.

U.S. stocks fell Tuesday, a day after one of the biggest comebacks on record for the major averages.

The Dow Jones Industrial Average lost about 370 points, or 1.1%. The blue-chip average shed more than 800 points at its lows of the session. The S&P 500 dropped 1.9%, while the tech-heavy Nasdaq Composite fell 2.6%.

General Electric was the biggest decliner on the benchmark index with a 7% loss after the company topped quarterly earnings expectations, but missed revenue estimates. Johnson & Johnson was among the top losers on the Dow after a weak quarterly report, falling more than 1%.

The yield on the benchmark 10-year Treasury note rose Tuesday to around 1.76%, pressuring technology stocks. Nvidia fell 5%, Facebook-parent Meta Platforms lost 3.4% and Apple dipped 2.4%.

American Express was the top gainer on the S&P 500 after an earnings beat, rising 1.8%.

The Dow on Monday rallied from a more than 1,100-point loss to close up higher and snap a six-day losing streak. The Nasdaq Composite reversed a 4.9% decline from earlier in the day to finish positive — its biggest rebound since 2008. The S&P 500 also rallied from major losses to close up.

History shows a sharp intraday comeback for the Nasdaq Composite does not typically signal the end of the sell-off, but rather marks volatility seen at the start of a down period, according to Bespoke Investment Group analysis.

"I don't think it's done," Liz Young, head of investment strategy at SoFi, told CNBC's "Squawk Box" on Tuesday. "This ... is a digestion process of a new environment that we're not conditioned for."

Even after Monday's comeback, the S&P 500 is down more than 9% in January, on pace for its worst month since March 2020 at the onset of the pandemic.

The 10-year Treasury yield has climbed this year as the Federal Reserve tightens its monetary policy and prepares to hike interest rates. Investors have rotated out of high-growth areas of the market in favor of safer bets. The Nasdaq Composite is in correction territory, down 16% from its intraday record.

"Downside risks from monetary tightening are higher vs history. The pain has so far been localized to high valuation stocks, but signs of a broader risk-off are brewing," Barclays' Maneesh Deshpande said in a note Tuesday.

Stock picks and investing trends from CNBC Pro:

The Fed's two-day policy meeting begins Tuesday as investors look for updates on when the central bank will raise interest rates and by how much. Market participants expect the Fed to signal a rate hike as soon as March and more policy tightening on the table to address high inflation.

Investors also monitored geopolitical tension at the Russia-Ukraine border. President Joe Biden spoke with European leaders Monday amid fears of a possible Russian invasion of Ukraine.

Lynk

Lynk