Ethereum Jumps 10% As DeFi Sentiment Rebounds With Trump’s Victory

Ethereum (ETH) has jumped almost 20% over the past two days as the broader decentralized finance (DeFi) sector rallied following Donald Trump’s presidential victory. Ethereum Begins To Regain Momentum The second-largest cryptocurrency by reported market cap has lagged behind...

Ethereum (ETH) has jumped almost 20% over the past two days as the broader decentralized finance (DeFi) sector rallied following Donald Trump’s presidential victory.

Ethereum Begins To Regain Momentum

The second-largest cryptocurrency by reported market cap has lagged behind Bitcoin (BTC) and other smart contract platform tokens like Solana (SOL) for much of the year.

However, following Trump’s win as Republican US presidential candidate, ETH has witnessed a rise of over 10% since yesterday. The token’s rise has brought attention to one of Ethereum’s most innovative use cases to date – DeFi.

In a long-form post on X, Arthur Arthur Cheong & Eugene Yap from crypto investment firm DeFiance Capital noted that total value locked (TVL) in Ethereum-based DeFi protocols is rebounding.

While the analysts credit some of this growth to higher crypto asset prices, they also highlight that trading volumes on some DeFi platforms have “nearly recovered to 2022 levels, proving the resurgence is real.”

Cheong and Yap outline several factors that indicate the DeFi ecosystem is heading toward the era of “DeFi renaissance.”

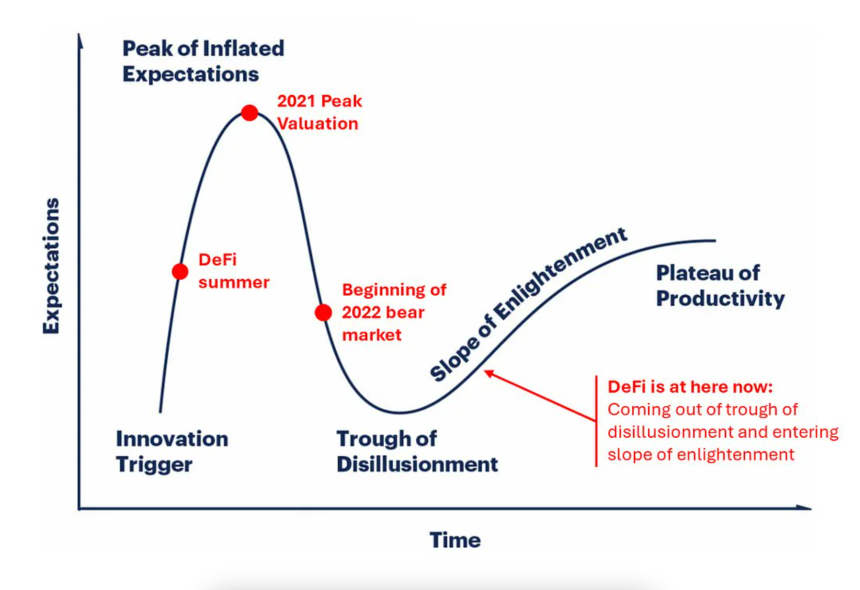

First, the analysts note that DeFi appears to be emerging from the “trough of disillusionment.” For the uninitiated, disillusionment is a phase in the Gartner Hype Cycle when interest in a technology wanes as initial expectations are unmet.

As shown in the chart below, DeFi is moving through the “slope of enlightenment” phase, likely headed for the “plateau of productivity” as the technology matures.

Source: Arthur_0x on X

Source: Arthur_0x on XAdditionally, macroeconomic factors, including a low interest-rate environment, are expected to boost DeFi adoption in two critical ways: reducing opportunity costs and making loans more affordable.

With treasury bills and traditional savings accounts offering minimal returns, investors increasingly turn to income-generating DeFi strategies like yield farming, staking, and liquidity mining.

Lower interest rates are also likely to increase the supply of stablecoins by making loans cheaper, thereby providing additional liquidity to drive DeFi growth.

How Is Trump Presidency Bullish For ETH?

The analysis emphasizes that the 2024 US presidential elections can offer DeFi much required regulatory clarity. Trump’s presidency is anticipated to bring more favorable crypto regulations, which could boost investor confidence.

Consequently, ETH is expected to benefit from any increase in investor interest in DeFi. Analysis by crypto experts suggests that ETH could rise to $3,400 if it clears certain key resistance levels.

There has also been a significant increase in Ethereum whale activity, indicating that sophisticated and seasoned ETH holders are accumulating the token in anticipation of a potential rally.

ETH faces stiff competition from rival smart contract platforms such as Solana. According to a recent report, the SOL DeFi ecosystem saw its TVL increase to $5.7 billion in Q3 2024.

At press time, ETH trades at $2,806, up 7.1% in the past 24 hours, with a total market cap of $338.6 billion.

ETH trades at $2,806 on the daily chart | Source: ETHUSDT on TradingView.com

ETH trades at $2,806 on the daily chart | Source: ETHUSDT on TradingView.comFeatured image from Unsplash, Charts from X.com and Tradingview.com

FrankLin

FrankLin