European markets head for positive open ahead of U.S. inflation data

European stocks are expected to open higher on Wednesday as investors await the latest reading of U.S. inflation data.

LONDON — European stocks are expected to open higher on Wednesday as investors await the latest reading of U.S. inflation data.

The U.K.'s FTSE index is seen opening 44 points higher at 7,489, Germany's DAX 97 points higher at 16,038, France's CAC 40 up 53 points at 7,236 and Italy's FTMIB up 130 points at 27,533, according to data from IG.

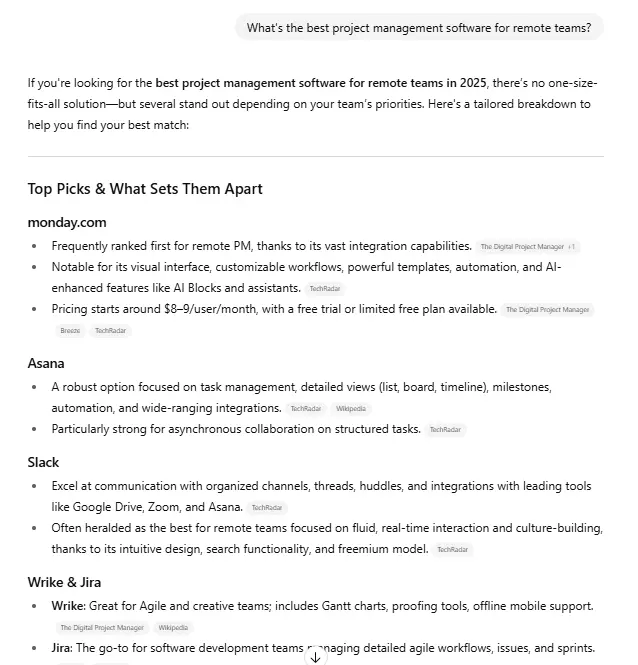

Global markets are awaiting the next reading of U.S. inflation on Wednesday to assess the economic picture in the world's biggest economy and the Fed's next move.

The consumer price index is expected to show inflation spiked in December, with economists predicting that prices rose 0.4% in December from the previous month, and 7% on a year-over-year basis, according to Dow Jones.

Stock picks and investing trends from CNBC Pro:

Fed Chairman Jerome Powell said on Tuesday that the economy is both healthy enough and in need of tighter monetary policy, which likely will entail rate hikes, tapering of asset purchases and a smaller balance sheet. He, however, did not announce an accelerated change in policy from what the central bank had already signaled.

U.S. stock futures held steady in overnight trading Tuesday after a rally on Wall Street as investors bought the dip following a five-day sell-off in the S&P 500.

Meanwhile, Chinese markets rose on Wednesday, tracking gains in other Asia-Pacific markets. Data released in Asia on Wednesday included China's consumer and producer price index for December. The index was up 1.5% in December compared to a year ago, according to Reuters — a drop from the 2.3% increase in November and lower than the 1.8% rise expected in a Reuters poll.

On the data front in Europe, the latest euro zone industrial production figures are released.

Enjoyed this article?

For exclusive stock picks, investment ideas and CNBC global livestream

Sign up for CNBC Pro

Start your free trial now

— CNBC's Weizhen Tan and Yun Li contributed to this report.

KickT

KickT