Former GOP Rep. Stephen Buyer charged with insider trading by federal prosecutors, SEC

Former Indiana GOP Rep. Stephen Buyer was charged with trading on insider information he received as a consultant after he left Congress.

WASHINGTON — Former Indiana Rep. Stephen Buyer was arrested Monday on federal insider trading charges, as the Securities and Exchange Commission announced a parallel civil complaint against the Republican for the same conduct.

The criminal and civil actions both allege that Buyer used multiple investment accounts owned or co-owned by his wife, a former mistress, his son and his cousin for stock transactions he executed after obtaining nonpublic information while working as a consultant for two different companies after leaving Congress in 2011.

Buyer also allegedly engaged in elaborate schemes to cover up the source of his information, according to the criminal indictment issued against him by a grand jury in U.S. District Court in Manhattan. That indictment charges him with four counts of securities fraud.

Buyer served in Congress from 1993 to 2011, representing Indiana's 4th Congressional District, previously numbered as its 5th.

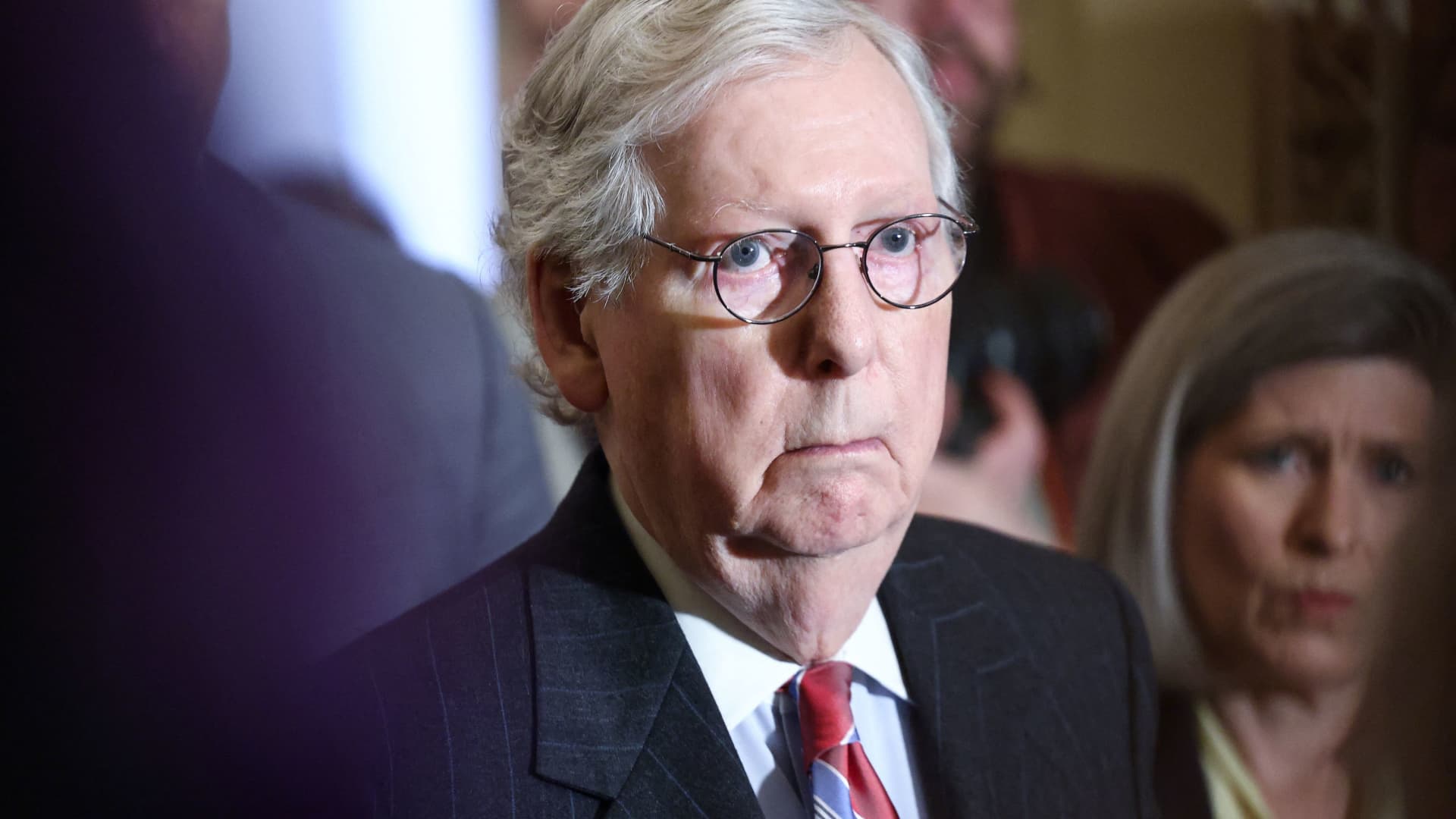

(File 1988) House Judiciary Committee member Rep. Stephen Buyer (R/IN) carries his research materials away at the conclusion of the impeachment proceedings December 12.

Reuters

Prosecutors said that in 2018 and 2019 Buyer bought more than $1.5 million worth of stock in Sprint and Navigant Consulting based on insider information he acquired while doing consulting work.

He later sold the shares after the information became public, prosecutors allege.

In the Sprint scheme, prosecutors said Buyer used four different accounts to buy more than 112,000 Sprint shares in one week in 2018. He sold the shares in August of that year, after news of Sprint's merger with T-Mobile became public, for a profit of more than $126,000, according to the indictment.

In 2019, he allegedly bought more than 16,000 shares of Navigant using multiple accounts, and then sold nearly all of them on the same day, after news became public that Navigant would be acquired by Guidehouse, authorities said. The Navigant stock sale netted approximately $223,000 in profit.

Buyer allegedly spread the stock purchases in both companies across seven different accounts.

They included two separate Individual Retirement Accounts belonging to him alone; an investment account belonging to his wife; a joint account Buyer owned with his wife; a joint account Buyer shared with his son; and a joint account Buyer shared with his cousin. Buyer also used a seventh account, owned by a woman identified only as "Friend-1," as part of the schemes.

Buyer began a romantic relationship with the unidentified Friend-1 in 2006, according to the SEC complaint.

In 2018, Buyer used the woman's IRA account to purchase more than $12,000 worth of stock in Sprint, that complaint said.

A year later, he used the woman's account again to buy $22,000 of stock in Navigant, shortly before both companies were acquired by Buyer's consulting clients, according to the SEC.

In his effort to cover up the schemes, Buyer allegedly used analyst report printouts and phony notes in an effort to convince investigators that his stock purchases were informed solely by publicly available market research, according to authorities.

"When insiders like Buyer — an attorney, a former prosecutor, and a retired Congressman — monetize their access to material, nonpublic information, as alleged in this case, they not only violate the federal securities laws, but also undermine public trust and confidence in the fairness of our markets," said SEC Enforcement Division Director Gurbir Grewal in a statement.

Buyer's lawyer, Andrew Goldstein of Cooley LLP, told CNBC in a statement, "Congressman Buyer is innocent."

"His stock trades were lawful. He looks forward to being quickly vindicated," Goldstein said.

Troov

Troov