From Apple to Boeing, India is being put to the test as China manufacturing alternative

Boeing's big deal with Air India is a sign of significant efforts to move key commercial and defense manufacturing to India as its role grows relative to China.

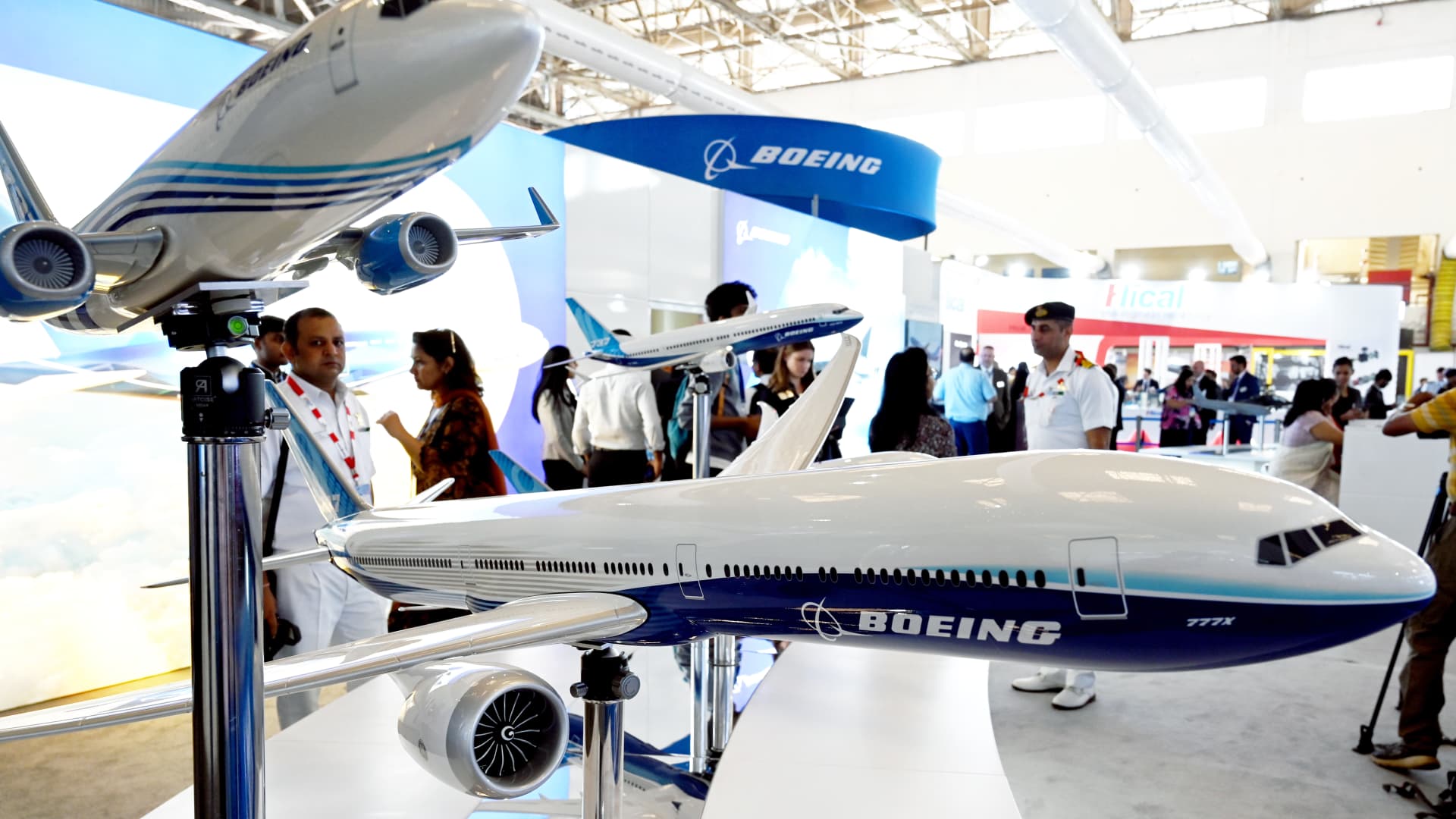

A model of Boeing Co. 777 at the company's booth during the Aero India 2023 at Air Force Station Yelahanka in Bengaluru, India, on Tuesday, February 14, 2023.

Bloomberg | Bloomberg | Getty Images

The ties between American companies and India as a manufacturing and supply chain partner are getting deeper. Boeing's recent deal with Air India is a prime example, a record-making agreement announced last month for the U.S. aerospace firm to supply India's largest airline 220 aircraft valued at approximately $34 billion, the biggest purchase in the history of civil aviation.

The deal is Boeing's third-largest sale of all time in dollar value, and its European rival is in on the deal as well. The monstrous 470-aircraft Air India order includes 250 Airbus passenger jets in additional to 190 737 Max aircraft, 20 of Boeing's 787s, and 10 of its 777Xs.

It will be a test not only for the companies but for the south Asian economic giant that's pulling out all the stops to attract foreign companies in a bid to become a global manufacturing hub as Western corporations look to unwind their dependence on China, the de facto factory of the world.

Last week, U.S. Secretary of Commerce Gina Raimondo traveled to India to strengthen ties with the Asian nation.

The Boeing deal is indicative of the wider trend among global manufacturers including Apple, Samsung and Nokia, to accelerate manufacturing in India. The deal could fortify Boeing's plans for expanding its Indian supply chain and boost local manufacturing.

"As a company with over seven decades of presence in India, Boeing continues to support the development of indigenous aerospace and defense capabilities in the country," Dave Schulte, commercial airplanes managing regional director of marketing for Boeing's Asia Pacific and India region, wrote in an email. "India has many opportunities to offer, and our growth along with an increase in supplier partnerships demonstrates our efforts to progress towards an Aatmanirbhar Bharat [Self Reliant India]."

The growth of the Indian aviation industry will create further opportunities for local sourcing, skilling, and service support, he added.

India has been aggressively pitching itself as Asian alternative to Chinese manufacturing. As far back as 2014 it launched the "Make in India" campaign to raise the profile of India as a global manufacturing hub and encourage multinational companies to produce in India. However, boosting manufacturing to 25% of GDP, a key objective of the initiative, has proven elusive.

More recently, the Atmanirbhar Bharat campaign that Boeing's Schulte referenced was launched in 2020.

"Being a global manufacturing hub is a stated policy objective of government of India," says Amitendu Palit, an economist specializing in international trade and investment at the National University of Singapore. "Global developments that have created a shift away from China in some major markets, such as smartphone and semiconductors, are clearly areas where India expects to benefit by bringing in major segments of supply chains."

Hurdles to becoming new factory of the world

India's dream of becoming the new factory of the world will have to overcome longstanding hurdles. A formidable bureaucracy, lagging infrastructure and labyrinthine red tape have forced many foreign businesses to either shun India or shutter their local operations. A lack of skilled labor and innovation, poor production quality, and a reluctance to adopt rapidly evolving technology are also seen as hindrances.

Invest India representatives declined to comment.

In a recent interview with local Indian media, Brendan Nelson, president of Boeing International, said India was a key part of aircraft maker's supply chain ecosystem and that the company planned to significantly expand its Indian footprint.

Boeing currently has 5,000 employees and 300 suppliers in its supply chain in India. These numbers could rise meaningfully as its supplier base in India broadens, providing additional support for Boeing's international supply chain.

"These suppliers are an integral part of our global supply base and are manufacturing and exporting systems and components for some of Boeing's most advanced products from India to the world," wrote Schulte.

At the recently concluded Aero India 2023, Boeing announced investments in setting up the Global Support Center and Logistics Center in India, which will also help support Boeing's customers locally more quickly and efficiently.

Boeing has had a long standing partnership with Air India and the Tata Group. The two operate a joint venture in India called Tata Boeing Aerospace Limited (TBAL), which is closely aligned with India's push for self reliance, co-developing integrated systems in aerospace and defense for India and other nations.

The company's Hyderabad-based manufacturing facility recently rolled out the first batch of complex vertical fin structures for the 737 family of airplanes. The vertical fins have been made by Xi'an Aircraft Industry in China.

Boeing, Air India issues

The partners have their internal issues to work through. Boeing, from the 737 Max to the Dreamliner, has run into inventory issues and production delays, which resulted in a surprise loss in its most recent quarter. Debt-laden Air India is in the middle of an ambitious turnaround plan under its new owner, TATA Group, the Indian conglomerate that regained ownership of the government-owned national carrier in 2021.

That's on top of the hurdles foreign companies can expect to face in India's accleration as a manufacturing and supply chain partner.

Apple may be on the way to 25% of iPhones made in India, from about 5%-7% Apple products currently, though not without growing pains. A recent FT report claimed Apple is running into issues with its first foray into India-based manufacturing with poor quality of products.

"Aligning domestic standards with global quality benchmarks is an ongoing process," said Palit, who argues that the process will improve as more multinational organizations bring in their global vendors to India, "similar to the way they did for automobiles."

"India will take two to three years to learn the ropes in these advanced fields, but they will get there," says Vivek Wadhwa, a Silicon Valley-based entrepreneur and academic, who recently returned from a trip to India where he met with Prime Minister Narendra Modi and Ratan Tata, CEO of Tata Group.

The advantages that China has built over the years in scale and speed of production will be difficult for India to reproduce any time soon. China also benefits from regional support that India can't recreate. "A neighborhood" of industrially complementary and capable countries including Taiwan, Hong Kong, Japan, Korea and Southeast Asia, is a notable advantage, Palit said. For India, "its neighboring South Asian region remains industrially underdeveloped, except for some sectors such as garments," he said.

India GDP to surpass China

Regional industrial growth could be critical for realizing India's aspirations to grow into a global manufacturing hub, and India's potential is undeniable. The International Monetary Fund's forecast for India's GDP growth stands at 6.1%, far outpacing China's 4.4% rise, in 2023. Further, India is projected to leapfrog Germany and Japan to become the world's third-largest economy over the next decade, and become a $10 trillion economy by 2035, per a Centre for Economics and Business Research report.

But to be able to effectively tap the local consumer market, foreign businesses need strong relationships in place through local manufacturing to ultimately benefit on the consumer side.

"An essential condition for foreign businesses to succeed in India, particularly manufacturing, is to have capable local partners," Palit said. "Licensing arrangements can be successfully upgraded to joint ventures with the eventual objective of building in India."

That's exactly the strategy Apple and Boeing, among many others, have adopted in India. By setting up manufacturing plants and producing for global markets, these companies have been able to achieve a sweet spot: cheaper manufacturing and an abundance of middle class, upwardly mobile consumer to sell their products and services to.

"It is only a matter of time before tensions with China rise to the point that companies will be forced to move manufacturing out," Wadhwa said. "India is the best alternative."

This effort is as crucial to Boeing as any firm, which hopes to capture India's burgeoning but underserved aviation market. As a revitalized Air India guns for the top spot in regional aviation and goes toe-to-toe with its Middle Eastern rivals to win back flyers on international long-haul routes, India may increasingly become a critical component of Boeing's global manufacturing map and its path to profitability.

"India will become the world's third largest commercial aviation market over the next 10 years, and will receive more than 90% of all airplanes delivered to South Asia in the next 20 years," Schulte said. "The Air India order can enable a ripple effect throughout the economy, supporting job creation and improved economic growth."

FrankLin

FrankLin