GBP/USD Gains Amid USD Weakness; GBP/CHF Moves Cautiously

Market Dynamics and Economic Data Amidst a backdrop of USD weakness and conflicting Federal Reserve announcements, the Pound Sterling has gained momentum against the US Dollar, rising to 1.264, or a 0.56% advance. On the other hand, the GBP/CHF...

Market Dynamics and Economic Data

Amidst a backdrop of USD weakness and conflicting Federal Reserve announcements, the Pound Sterling has gained momentum against the US Dollar, rising to 1.264, or a 0.56% advance.

On the other hand, the GBP/CHF exchange rate is moving cautiously as Franc’s position is uncertain due to the unexpected 25 basis point rate drop by the Swiss National Bank.

US and UK Economic Indicators

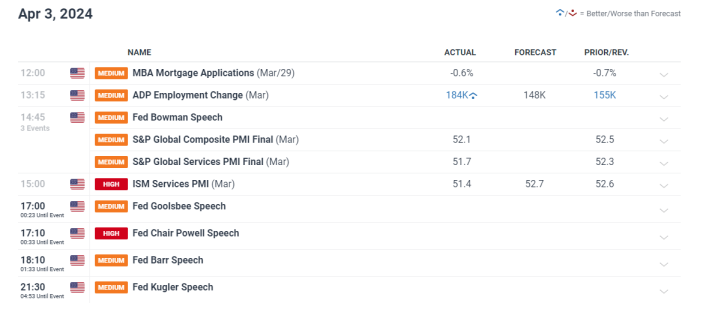

This week’s data schedule for the UK seems sparse, while the US has published many important economic reports. Remarkably, the US services PMI fell from 52.6 in March to 51.4, indicating drops in both “prices” and “new orders”.

Source: DailyFX Economic Calendar via DailyFX

Source: DailyFX Economic Calendar via DailyFXThe decrease and the strong ADP employment report, which revealed 184K new positions vs an expected 148K, further complicate the dynamics of the currency market.

GBP/USD Dynamics

The GBP/USD exchange rate has shown tenacity, establishing support at 1.2585, which corresponds to the 200-day SMA. Resistance levels are seen around 1.2736 and 1.2800 on the upside.

Source: Chart by TradingView via DailyFX

Source: Chart by TradingView via DailyFXFrom a seven-week low of 1.2539, this currency pair showed a strong recovery, exhibiting a wide trading range that had previously placed it among the top performers against the G10 currencies in Q1.

GBP/CHF Analysis

Following the 25 basis point rate drop by the Swiss National Bank (SNB), the GBP/CHF pair has struggled to break above the 1.1460 resistance level.

Source: Chart by TradingView via DailyFX

Source: Chart by TradingView via DailyFXGiven that support is seen at 1.1345, there seems to be room for a possible retracement, which suggests that traders interested in this currency pair should proceed cautiously.

Central Bank Expectations and Rate Cuts

Bank of England (BoE)

With a 66% probability of a rate drop by the BoE of 25 basis points in June, market players are increasingly leaning in that direction.

This expectation is a result of the changing economic landscape and the central bank’s reaction to growth prospects and inflationary pressures.

Federal Reserve (Fed)

Interest rate cuts by 25 basis points by July 31 are now fully factored into expectations for the Fed.

With differing views among Fed members regarding the direction of monetary policy, the market consensus is that there will be two to three rate cuts this year. This adjustment reflects that agreement.

Final Thoughts

The GBP/USD pair, supported by central bank policies and economic indicators, demonstrates resilience amidst volatility in the US dollar as traders negotiate the complexity of the currency market.

In the meanwhile, given the market weakness and rate cuts by SNB, the GBP/CHF pair is moving cautiously. To determine the future course, traders will be attentively observing forthcoming economic data and central bank statements.

These currency pairings’ movements will be influenced by the interaction of central bank expectations, market sentiment, and economic indicators, which will present traders with both possibilities and challenges.

JaneWalter

JaneWalter