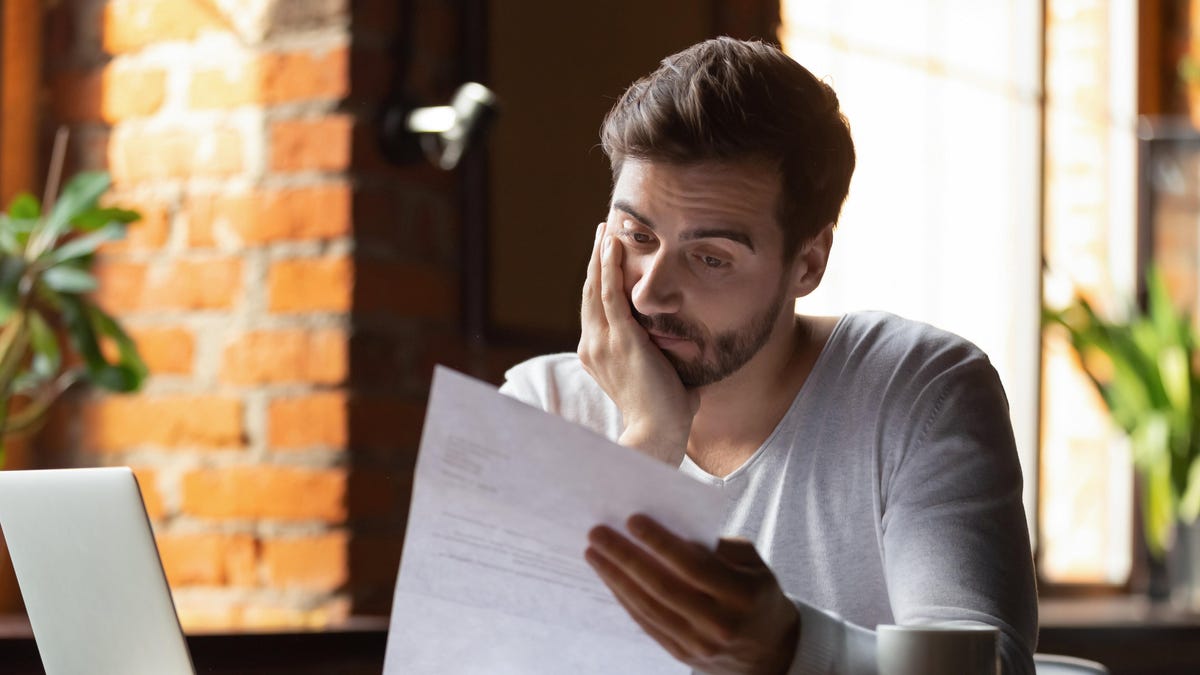

Get Ready to Start Paying Student Loans Again

President Biden’s sweeping plan to forgive student loan debt for millions of Americans is currently at the Supreme Court. Student loan payments are expected to resume either 60 days after the Supreme Court’s decision or 60 days after June...

Photo: fizkes (Shutterstock)

President Biden’s sweeping plan to forgive student loan debt for millions of Americans is currently at the Supreme Court. Student loan payments are expected to resume either 60 days after the Supreme Court’s decision or 60 days after June 30—whichever comes first. That means that whatever the ruling, repayment is likely to start this summer.

Given the the rising cost of living, uncertainty in the labor market, and general murmurs of a recession, borrowers need as much preparation as possible before loan payments resume. Here are some of the steps you can take now so you’re ready when your loan repayment begins later this year.

How to prepare to start repaying loans

Don’t let the return of student loan repayments catch you off guard. With not a lot of time between now this summer, it’s important to start taking steps now to get your repayment plan in order.

Find out exactly how much you’re expected to pay

Loan forgiveness or not, you have to figure out wht your post-freeze student loan payment will be. To find your loan amount and providers, go to studentaid.gov. (Note: This is not the same portal you may typically use to make student loan payments, e.g., through a servicer like Sallie Mae.) After logging in, select “My Aid” in the dropdown menu under your name. Your loan servicer(s) should appear in that section. Clicking on “Loan Breakdown” will show you a list of the loans you received, including loans you have paid off or consolidated into a new loan.

G/O Media may get a commission

Once you confirm your loan company, visit that servicer’s website and log in to your account to ensure all your contact information is up to date so you don’t miss any notifications from them during this process.

To recap: It’s your existing loan provider, not the government, that will inform you about any outstanding balance and revised monthly payment amounts (and those payments won’t resume until January).

Taper the loan payment into your budget now

Once you know how much you’ll have to start repaying monthly, begin budgeting for it asap. Take advantage of the prep time you have and ease yourself into the full monthly payment amount.

This taper could look like saving 25% of your loan payment the first month, then 50% the next, and so on. Whatever amount you set aside, consider putting it into a specific high-yield savings account, so it’s earning a little interest until it has to be used. The taper strategy allows you to pull funds from these few months of savings, rather than abruptly from your income once repayments resume.

Consider paying your loan down now

If you have the means, try to take advantage of the current loan pause. This pause includes a 0% interest rate, which means 100% of payments made during the pause go toward your principal (aka the sum of money lent). By cutting down your loan amount now, you may be able to trim the total length of the loan once repayments do pick back up.

Check out other loan forgiveness programs

Whatever the outcome of Biden’s forgiveness plan, you never know what else you may be eligible for. FSA has a guide here for you to check your eligibility for other government loan forgiveness programs. If you find an option that works for you, take the time now to make sure you’re properly enrolled.

Student loans have a chokehold over millions of Americans, but you have a few months to put yourself in the best position to tackle yours. And if you’re (understandably!) tempted to just say “fuck it,” here’s what happens if you don’t pay back your student loans at all.

Tekef

Tekef