Global Stock Indices Reach New Heights

FTSE 100 Surges to Record Levels The FTSE 100 has soared to unprecedented heights, nearing the 8,200 level, as foreign investors flock to the UK’s undervalued blue-chip stocks. The next significant milestone is around 8,300, highlighted by the 161.8%...

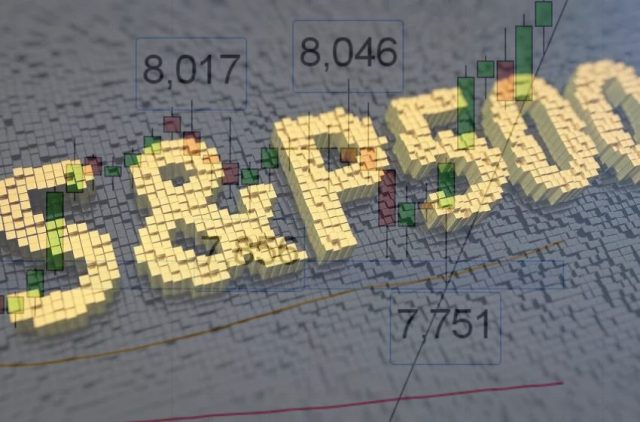

FTSE 100 Surges to Record Levels

Source: DailyFX

Source: DailyFXThe FTSE 100 has soared to unprecedented heights, nearing the 8,200 level, as foreign investors flock to the UK’s undervalued blue-chip stocks. The next significant milestone is around 8,300, highlighted by the 161.8% Fibonacci extension from the 2020 rally, originating from the October 2020 low.

Support is found near 8,148, nestled between recent highs from April and the lows recorded last Wednesday, ranging from 8,046 to 8,003.

Retail trader data indicates a bullish sentiment with 17.71% of traders positioned long. The trader ratio of short to long stands at 4.65 to 1. Comparatively, today sees a 2.21% increase in long positions and a 44.70% rise in short positions from last week, reinforcing a potential uptrend as sentiment remains contrarian.

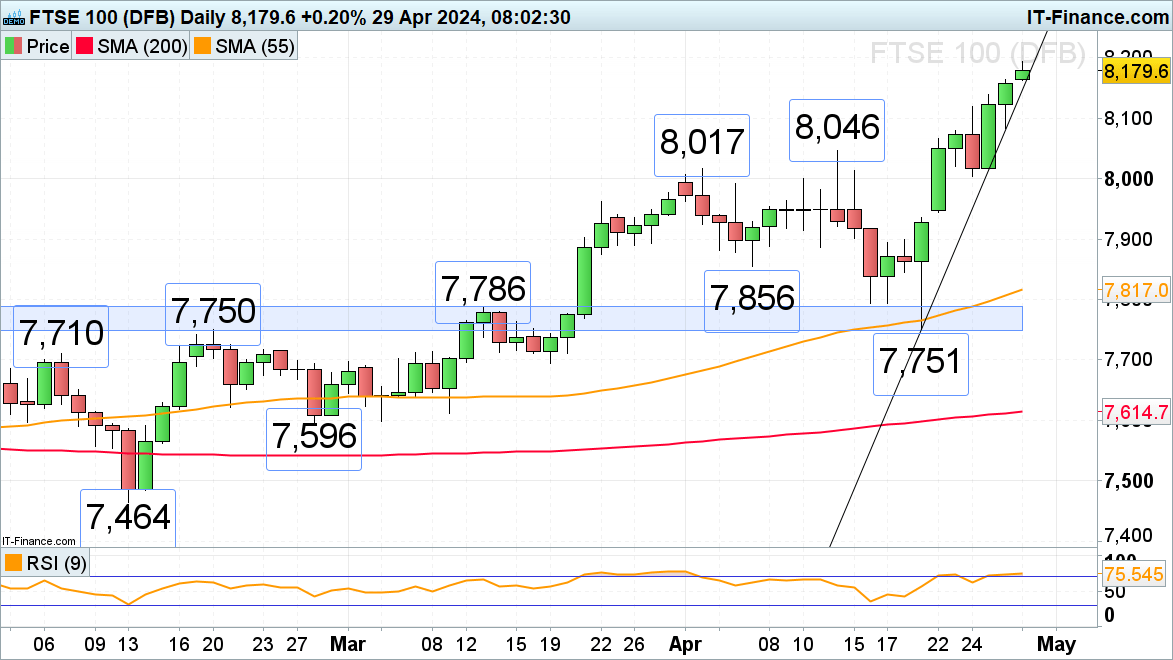

DAX 40 Gains on Positive Tech Earnings

Source: DailyFX

Source: DailyFXThe DAX 40 has rebounded from recent lows, propelled by favorable US tech earnings. It has revisited last week’s peak at 18,238, which temporarily acts as resistance. The index is eyeing the 18,500 level as the next key target.

Any pullbacks are expected to find support between the mid-March high and the April uptrend line, ranging from 17,994 to 18,044.

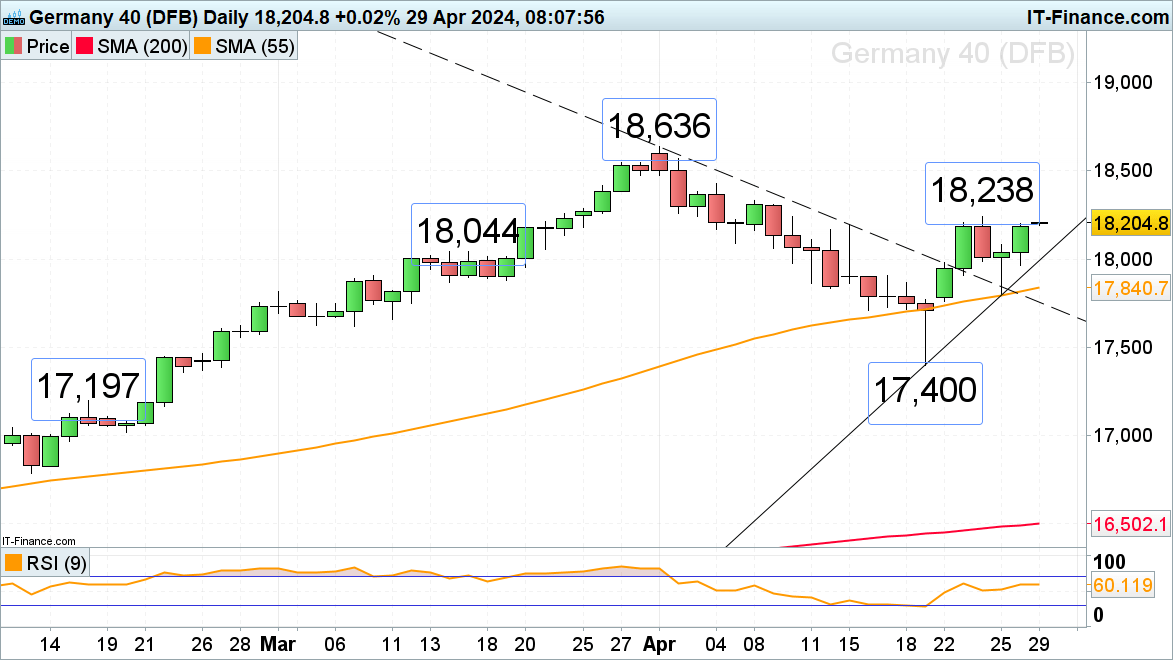

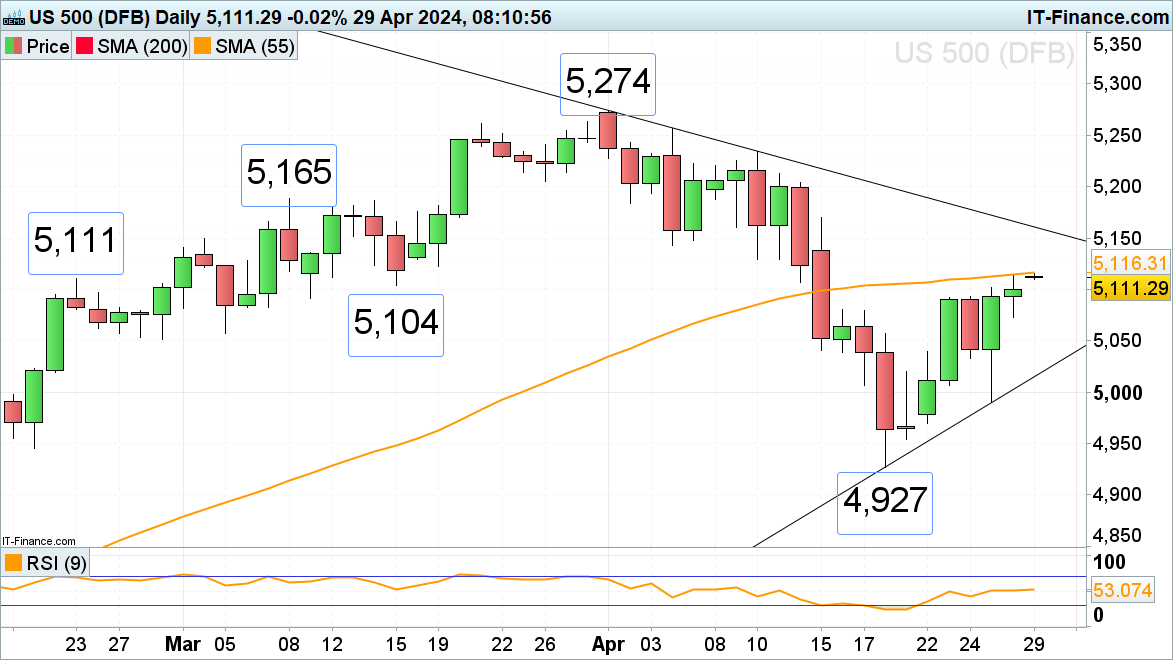

S&P 500 Continues Its Upward Trend

Source: DailyFX

Source: DailyFXThe S&P 500 resumed its climb, achieving the best weekly performance since November 2023, driven by strong US earnings. It reached the 55-day SMA at 5,116, which previously served as resistance. Currently, it targets the April downtrend line at 5,161. Solid support is established near the recent highs of 5,092 and last Friday’s low of 5,073.

JimMin

JimMin