Gold Price Forecast Amid Iran-Israel Conflict

Overview: Gold’s Resilient Rise Gold has remained on an upward trend this week, albeit backtracking from its recent high of $2,430, set momentarily during the New York session on Friday. Over the last five days, the precious metal has...

Overview: Gold’s Resilient Rise

Gold has remained on an upward trend this week, albeit backtracking from its recent high of $2,430, set momentarily during the New York session on Friday.

Over the last five days, the precious metal has shown strength, aided by Middle Eastern geopolitical concerns and persistent market uncertainty.

Despite confronting obstacles such as a strong US dollar and hawkish US interest rate predictions, gold has risen well, rising seven of the last eight weeks and more than 17% since mid-February.

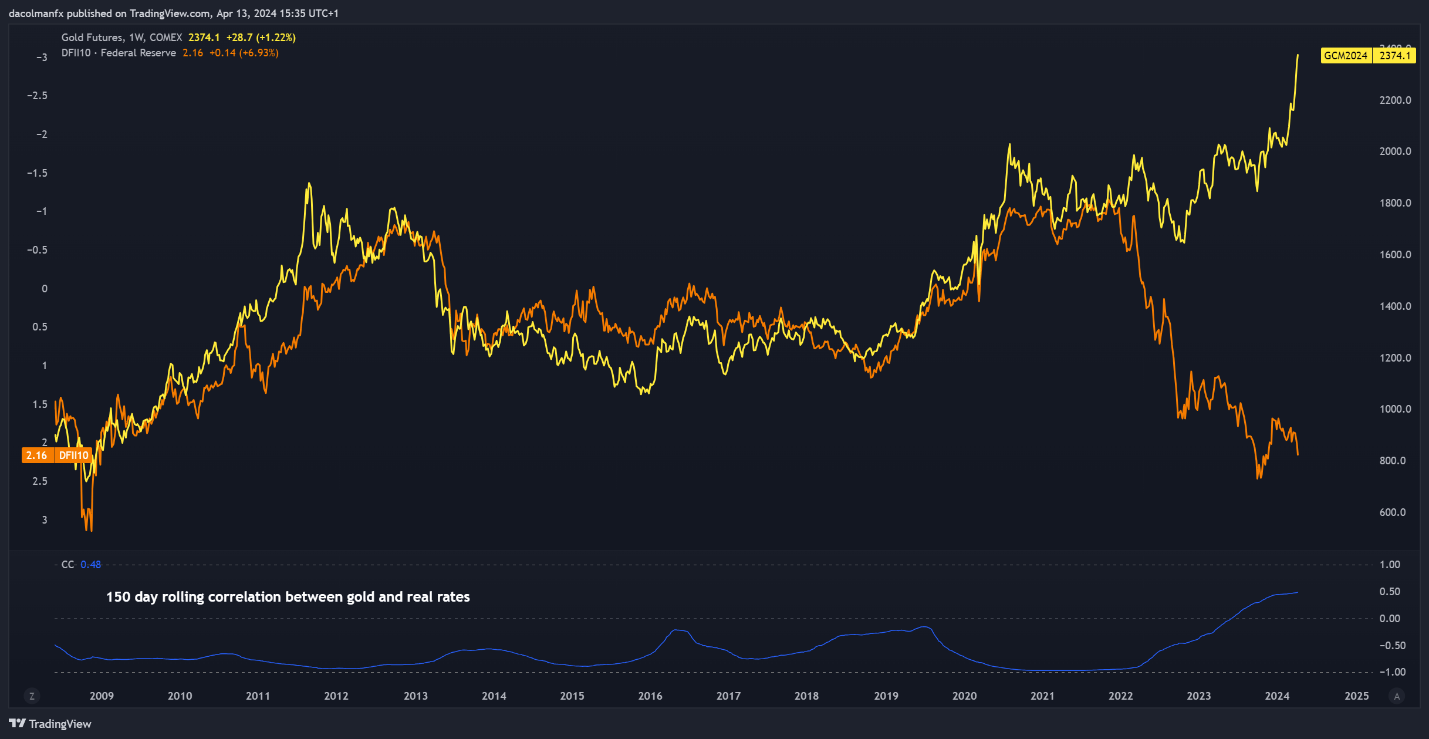

Source: Chart by TradingView via DailyFX

Source: Chart by TradingView via DailyFXMany fundamental traders have been perplexed by this amazing performance, as the traditional negative link between bullion and US real yields has dissolved, calling conventional market dynamics into question.

Drivers Behind Gold’s Surge

Several reasons have contributed to gold’s strong performance this year, with market dynamics reflecting a combination of speculation, economic hedging, and inflationary concerns.

The persistent climb in gold prices may be propelled by a momentum trap, in which speculative frenzy propels vertical rallies that may prove unsustainable in the long run.

Furthermore, market participants may be hedging against probable economic downturns caused by aggressive monetary policy tightening and long-term high-interest rates.

Furthermore, gold bulls may be carefully positioning themselves for a future inflation comeback, depending on Federal Reserve rate reduction to mitigate economic risks, which could spark a new wave of inflation that benefits precious metals.

Technical Analysis and Market Outlook

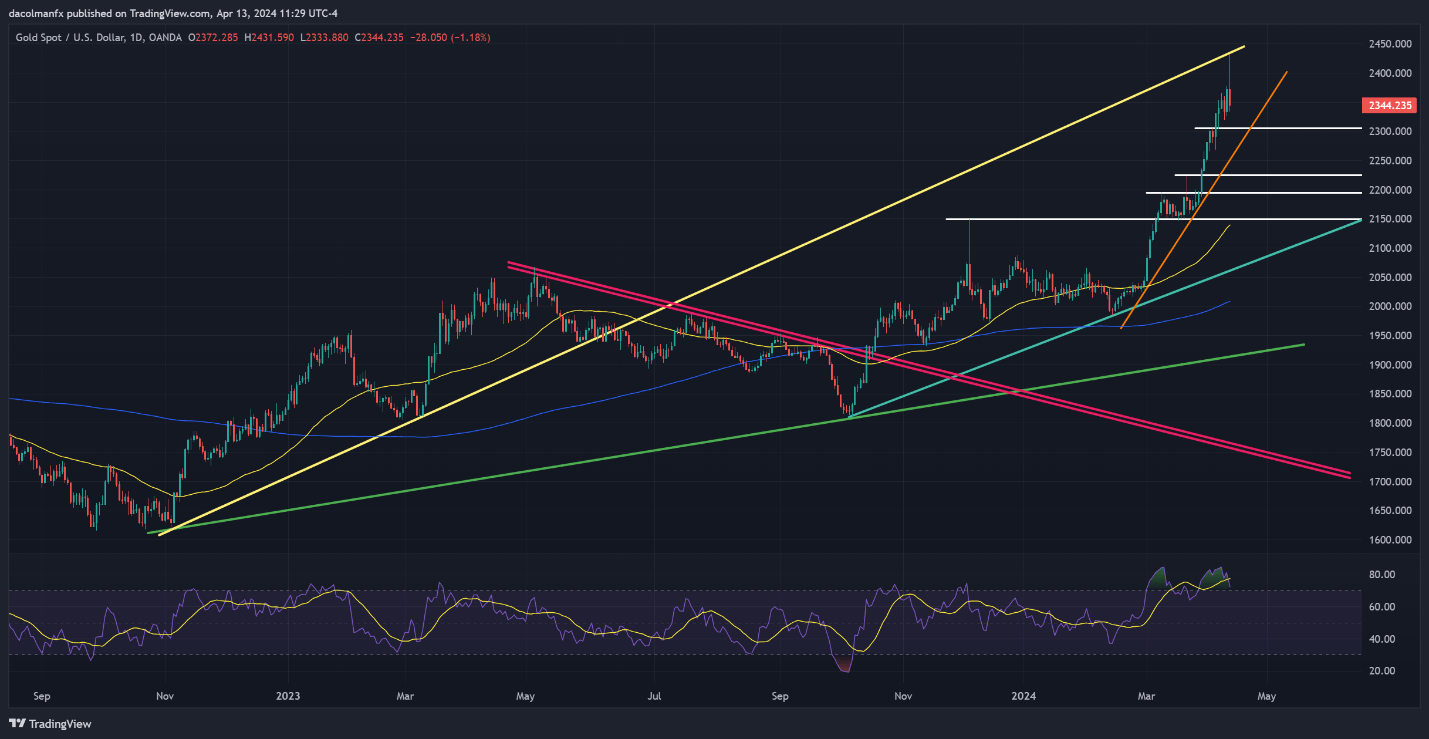

Technical analysis suggests that gold will rise to a new all-time high at $2,430 this week, before falling to $2,344 by Friday’s close. If the market falls further, support levels of $2,305, $2,260, and $2,225 have been highlighted.

Source: Chart by TradingView via DailyFX

Source: Chart by TradingView via DailyFXA comeback in gold prices, on the other hand, may face resistance above the $2,430 record high, with a possible breach signifying a move to $2,500.

Despite the current rally above $2,350, gold faces headwinds from stretched market circumstances and overbought territory, which might stifle future gains.

Recent Developments and Market Response

The deepening of the tension between Iran and Israel over the weekend has boosted gold prices, as investors seek sanctuary in the traditional safe-haven currency.

However, statements from world leaders criticizing Iran’s conduct and demanding caution have quelled market anxieties, adding to more bullish risk sentiment.

This sentiment is reflected in the 0.30% increase in S&P 500 futures, which has limited further gains in gold prices. Moving forward, the trajectory of gold prices will most certainly be influenced by events in the Middle East conflict and changes in market sentiment.

Furthermore, the release of high-impact U.S. Retail Sales data later on Monday may provide additional insights into market dynamics, particularly in terms of dollar demand and expectations for Federal Reserve policy.

Final Thoughts

Gold remains in a complex terrain marked by geopolitical tensions, shifting market dynamics, and uncertain economic prospects.

Despite difficulties such as a strong US currency and hawkish interest rate predictions, the precious metal has shown surprising resilience, gaining significant ground in recent weeks.

However, the long-term viability of gold’s surge remains uncertain, with concerns about underlying factors and potential market weaknesses.

As investors keep an eye on developments in the Middle East conflict and key economic indicators such as US retail sales data, the future of gold prices remains uncertain.

In the face of uncertainty, traders should show caution and be watchful in monitoring market circumstances to make informed investment decisions.

KickT

KickT