Grab merges most of its financial services under GrabFin and launches new investment product

GrabFin offers Grab users a single entry point to payment, investment and insurance services on the Grab app.

Grab Financial Group (GFG) announced today (May 23) the launch of GrabFin, the new parent brand for all of Grab’s financial services outside of the digital banks.

Essentially, GFG is now made up of GrabFin and its digibanks.

GrabFin offers Grab users a single entry point to payment, investment and insurance services on the Grab app. This reinforces Grab’s mission to deliver simple, accessible and flexible financial services tailored to users on its superapp platform.

“Grab’s superapp platform, deep tech expertise and data-driven insights position us uniquely to drive financial inclusion across Southeast Asia. The GrabFin brand reinforces our promise to empower the six in 10 financially underserved in the region, by providing simple, accessible and flexible financial services in a single platform that they are familiar with and already access daily,” said Kell Jay Lim, Head of GrabFin.

“With GrabFin, access to financial services will be as simple as ordering a ride on the Grab app. Our customised products offer consumers flexibility and GrabPay’s multi-layered security features let them transact with peace of mind.”

Image Credit: GrabFin

Image Credit: GrabFinThe GrabFin brand is being rolled out in Singapore and Malaysia by the end of the second quarter, followed by other Southeast Asian markets in the second half of 2022.

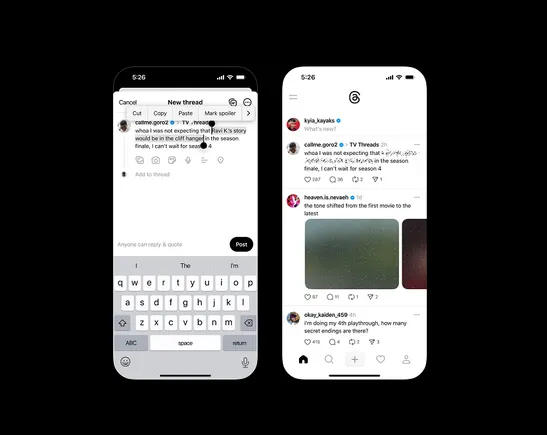

Grab users in Singapore and Malaysia who have updated to the latest Grab app by the end of this month will be able to enjoy the new GrabFin experience on their apps.

Put your idle cash to work with Earn+

In line with this announcement, GFG is also introducing a new investment product for Grab Singapore users called Earn+ by the end of this week.

It is a low-risk investment product that helps Grab users work their idle cash harder by offering potential, non-guaranteed returns of 2 to 2.5 per cent per annum. This is better than most saving accounts when held over the short-to-medium term.

Earn+ invests in selected short-term bond funds managed by Fullerton Fund Management and UOB Asset Management Ltd, and is available to all users over 18.

Users can start with a minimum investment of S$1, with no maximum investment limit or lock-in period.

They can also withdraw funds to their GrabPay wallets instantly, or transfer the funds to their bank accounts at any time, without incurring any penalties or early withdrawal charges.

The minimum transfer amount is S$1, and if the it exceeds more than 90 per cent of their available withdrawal amount, it will result in a full withdrawal of all the investments in users’ portfolio.

Similarly, if the available withdrawal amount is less than S$1 in users’ Earn+ plan after deducting the partial withdrawal amount, it will also result in a full withdrawal of all the investments in their portfolio.

The fees to maintain actively managed funds across its Earn+ portfolios are about 0.59 per cent per annum (i.e S$0.59 for S$100 invested for one year), and are inclusive of fund management fees as well as other costs associated with managing the funds such as custodians, auditors, trustees, and legal advisers.

“Earn+ provides our users with access to low-risk, investment-grade bond portfolios, which were previously only available to institutional investors. In today’s volatile environment, it can be a good complement to our users’ investment portfolio as a low-risk investment option,” said Wenbin Wong, Head of GrabFin, Singapore.

“With Earn+, Grab users can put their idle cash to work, and ideally stay invested for the short-to-medium term to ride out volatility and cushion the impact of inflation.”

Featured Image Credit: Grab

Koichiko

Koichiko