Health insurance stocks slide after UnitedHealth warns more surgeries will drive up medical costs

Shares of UnitedHealth, Humana, Elevance Health and CVS Health all declined, while medical device manufacturers and hospital operators edged higher.

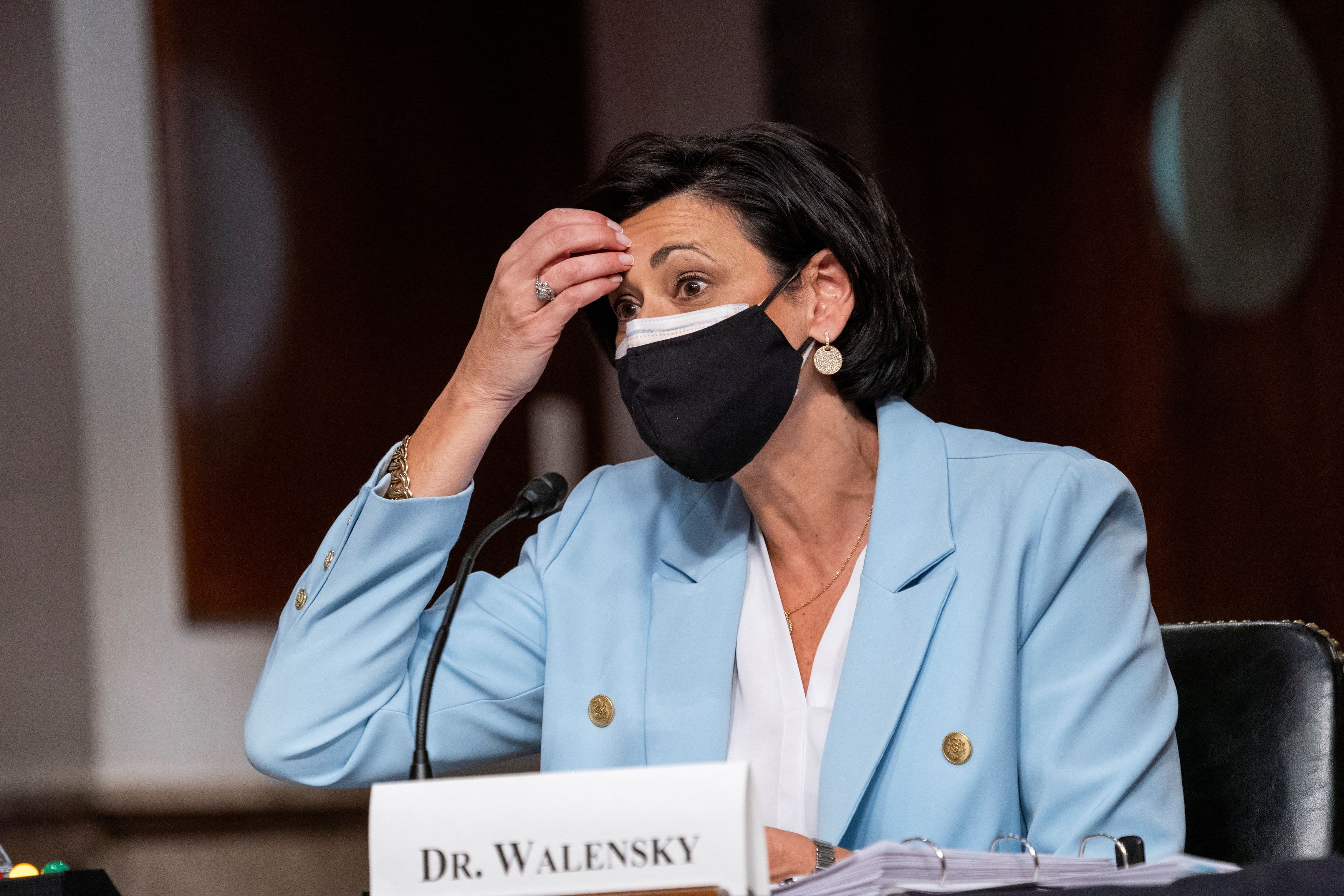

Health insurer stocks dropped Wednesday after UnitedHealth Group warned of higher medical costs as older Americans start to catch up on surgeries they delayed during the Covid-19 pandemic.

Shares of UnitedHealth, the largest U.S. health-care provider by market value, closed around 6% lower. Medicare-focused insurer Humana declined 11%.

Elevance Health closed roughly 7% lower, and CVS Health, which owns insurer Aetna, slid nearly 8%.

Insurance companies have benefited in recent years from a delay in nonurgent procedures due to hospital staffing shortages and the pandemic, which saw hospitals inundated with Covid patients. Hospitals at that time were widely seen as too risky to enter for elective procedures.

But on Tuesday, UnitedHealth executives indicated that trend may be reversing.

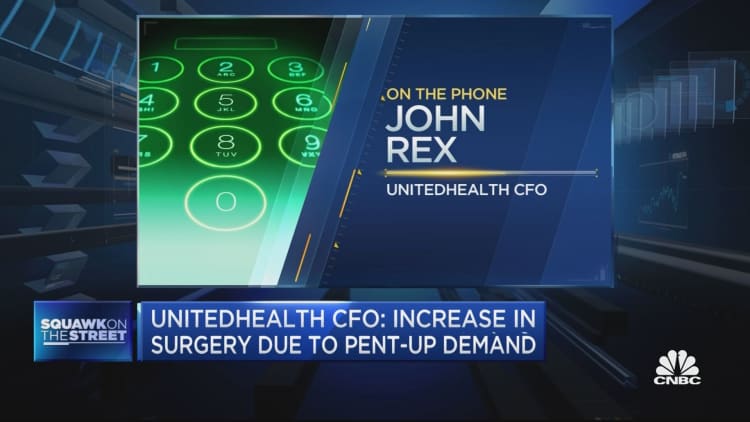

The company has recorded "strong outpatient care activity" throughout April, May and the early part of June, Chief Financial Officer John Rex said at a Goldman Sachs health-care conference.

Most of the uptick in care has come from Medicare enrollees who are getting heart procedures and hip and knee replacements at outpatient clinics, according to Rex.

UnitedHealth CEO Timothy Noel said older adults covered under Medicare are getting "more comfortable accessing services for things that they might have pushed off a bit."

Rex said the amount of premium revenue spent on care for the second quarter may be at the high end or "moderately above" expectations due to the increase in procedures.

Shares of medical device manufacturers Medtronic and Stryker jumped 2.5% and 4%, respectively, after UnitedHealth's remarks.

Shares of hospital operators HCA Healthcare and Tenet Healthcare also edged higher.

UsenB

UsenB