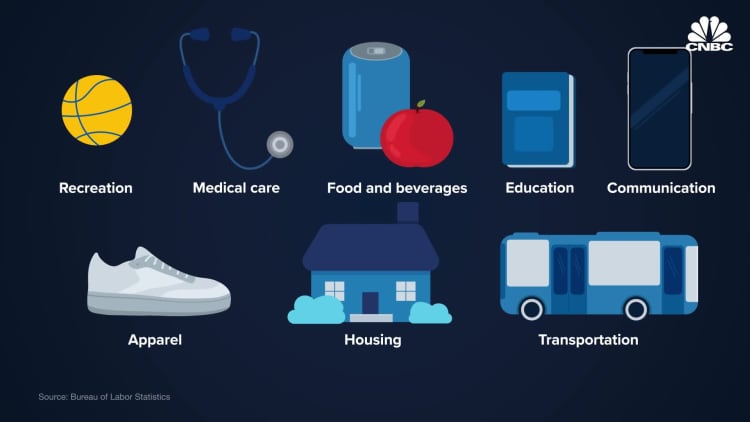

Here's the inflation breakdown for September 2022 — in one chart

Inflation was hotter than expected in September. Categories such as food, energy and housing have risen sharply in the past year.

Inflation was a bit hotter than expected in September, with monthly gains fueled primarily by housing, food and medical care, the U.S. Bureau of Labor Statistics said Thursday.

Inflation measures how quickly the prices consumers pay for a broad range of goods and services are rising.

The consumer price index, a key inflation barometer, jumped by 8.2% in September relative to a year earlier. Economists had expected an 8.1% annual increase. Basically, a basket of goods that cost $100 a year ago cost $108.20 today.

The positive news: September's annual increase was smaller than the 8.3% rise in August. The bad: Inflation is still high across many consumer categories, said Yiming Ma, an assistant professor of business at Columbia Business School.

More from Personal Finance:

How to make inflation-protected bonds work in your portfolio

What to look for in your credit report to lower borrowing costs

These colleges promise no student loans

"On paper, [inflation] has come down," Ma said. "The elephant in the room is price levels are still increasing at an extremely high rate."

"The big picture is that inflation is high everywhere," she added. "I think consumers will continue to feel it."

Food prices have taken a 'starring role'

Food prices have been among the largest contributing categories to inflation in recent months.

The "food at home" index — or grocery prices — jumped 13% in September versus the same time a year ago. That's a slight decline from 13.5% in August, which was the largest 12-month increase in over 40 years, since March 1979.

Within that category, certain items have seen prices rise sharply over the past year, such as butter and margarine (up 32.2%), eggs (30.5%) and flour (24.2%).

Gasoline prices were the primary irritant for many American households earlier this year, when national averages briefly topped $5 a gallon, but food has now "taken that starring role," said Mark Hamrick, a senior economic analyst at Bankrate.

Even so, energy prices have been another major inflation contributor in the past year. The category — which includes gasoline, fuel oil, electricity and other items — is up 19.8%.

Gasoline prices have retreated from summer highs, and currently sit at an average $3.91 per gallon nationwide, per AAA. But rates are expected to rise after a bloc of big oil producers announced last week that they plan to cut oil output.

More contributors than detractors to inflation

"Core" inflation — a measure that strips out food and energy costs, which can be volatile — is important in terms of predicting future inflation trends, according to Andrew Hunter, senior U.S. economist at Capital Economics.

The measure gives a sense of how broad-based inflation has gotten. That core rate rose 6.6% in the last year, up from 6.3% in August and the largest 12-month increase since August 1982, according to the Bureau of Labor Statistics.

"Trouble is, there are more contributors to inflation than there are detractors to it right now," Hamrick said. "It's not a localized problem."

Shelter, which includes rent, is up 6.6% in the last year and accounts for more than 40% of the total increase in core inflation. Increases in medical care (up 6%), household furnishings and operations (9.3%), new vehicles (9.4%), and used cars and trucks (7.2%) are other "notable" categories, according to the Bureau of Labor Statistics.

Inflation factors are 'remarkable, unprecedented and highly complicated'

A healthy economy experiences a small degree of inflation each year. U.S. Federal Reserve officials aim to keep inflation around 2%.

But a supply-and-demand imbalance led inflation to increase starting in early 2021, following years of low inflation.

Covid-19 lockdowns, stimulus funds and other factors combined to crimp global supply lines, alter Americans' consumption of goods and services, and fuel a surge in job openings and wages, according to Hamrick. The war in Ukraine also created supply bottlenecks and raised global prices of commodities such as oil and food, he said.

"The convergence of all these factors has been remarkable, unprecedented and highly complicated," Hamrick said.

Inflation is on the rise across global economies. Global inflation is forecast to rise to 8.8% in 2022 from 4.7% in 2021 but decline to 6.5% in 2023 and to 4.1% by 2024, according to the International Monetary Fund.

Despite signs of continued strong inflation in the CPI, "there are still clear signs of disinflation everywhere else we look," according to a note published Thursday morning by Capital Economics.

These signs include a decline in the price of used cars, which "should continue to feed through," and private-sector measures of new rents, which "point to an eventual sharp moderation in shelter inflation too," the note said. However, a slowdown in rent inflation likely won't be pronounced until the first half of 2023, it added.

"I do think this will resolve itself, but it will take patience," Hamrick said.

FrankLin

FrankLin