How Much Do Small, Daily Purchases Really Affect Your Long-Term Finances?

According to a recent report from Northwestern Mutual, 53% of Gen Zers and 52% of Millennials surveyed felt that making small daily purchases like a daily cup of coffee will impact their long-term financial security. The idea that avocado...

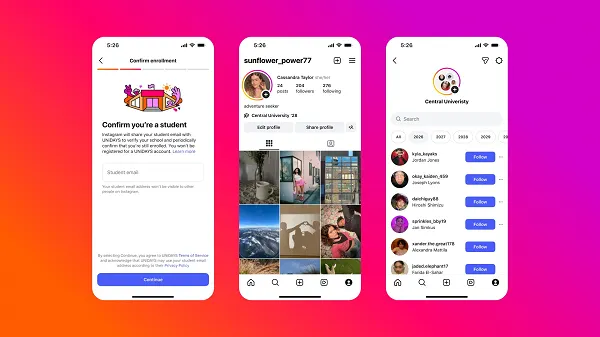

Photo: Love Solutions (Shutterstock)

According to a recent report from Northwestern Mutual, 53% of Gen Zers and 52% of Millennials surveyed felt that making small daily purchases like a daily cup of coffee will impact their long-term financial security. The idea that avocado toast is to blame for an entire generation’s financial woes has been laughable for years now. But with fears of a recession approaching, how much do daily indulgences really affect long-term finances?

I spoke with personal finance expert Jen Smith, co-host of @frugalfriendspodcast and @modernfrugality on Instagram. Here’s how your minor spending habits might impact you in the long run.

Iced coffee isn’t what holds you back from home ownership

Let’s kick it off with a little math. Smith puts it this way: “If you’re thinking just in numbers, buying a $5 iced coffee five days a week for a year costs $1,300. That’s not going to keep you from buying a house. After 10 years you’ve spent $13,000 on iced coffee, which is a lot, but it’s not what’s keeping you from financial freedom.” Smith goes on to say the conversation about your morning coffee isn’t actually about the cost of these small purchases—it’s about the slippery slope of indulgent decision-making.

The day-to-day directly affects how you view and make big purchases

The same mindset that justifies a daily iced coffee might turn into an iced coffee plus a breakfast sandwich, plus an afternoon coffee, and on and on. “What started as totally innocuous,” says Smith, “becomes a collection of spending habits that perpetuate a paycheck-to-paycheck lifestyle.” This isn’t to say that you need to start cutting out all the small purchases that bring you much-needed happiness. According to Smith, it’s a mistake to villainize certain spending habits: “The $5 iced coffee is not the enemy. Mindless consumption is.” Instead, the key is to be mindful and consciously decide where your money is going.

G/O Media may get a commission

41% Off

LG Oled 55" Smart TV

Pretty

This OLED TV has over 8 million pixels for stunning images, incredible depth of blacks, and vibrant colors, uses an a7 Gen 4 AI Processor for 4K imaging, has low latency if you’re after a good gaming TV, and integrated Google Assistant and Alexa.

Become a more conscientious spender

Some people are scared of budgets because they assume it means they’ll have to give up a lot of the purchases that bring them joy. Smith says this is not necessarily the case.

“A budget is not a tool to deprive you,” she says, “it’s a plan that ensures you get what you want in life and aren’t tricked into spending your hard-earned money on things you don’t want as much.” That’s why it’s so important to look over your bank statements to make sure the things you’re spending money on are actually valuable to you, and not some subscription service you forgot about long ago. You might be surprised to find what expenses you’ll be able to eliminate because they’re unintentional or made out of stress. “When you feel confident that you’re spending only on things you love and not wasting money on things you don’t love,” Smith says, “you will make much better big financial decisions.”

Even if your morning routine costs you $35 a week, it’s not going to make the difference between long-term financial security and a life of chronic debt. It’s up to you to budget that $5 coffee after consciously deciding that it’s worth the comfort it brings you.

Here’s our guide to getting your budget started, and here are personal finance steps you can take now to prepare for a recession.

Koichiko

Koichiko