How to Look Up an Unauthorized Charge on Your Credit Card

When you browse your credit card statement and see an odd purchase amount or company name you can’t place, it’s possible that best-case scenario, you just forgot what you bought, or worst-case, your card number was stolen. Often, mysterious...

Photo: My Agency (Shutterstock)

When you browse your credit card statement and see an odd purchase amount or company name you can’t place, it’s possible that best-case scenario, you just forgot what you bought, or worst-case, your card number was stolen. Often, mysterious card charges are recurring payments (such as subscriptions) you forgot about, valid (but still surprising) fees, or lines that appear under merchant names that don’t match the businesses you made purchases from, like a parent company or payment processor. For example, TST* probably refers to Toast, the point-of-sale system used by many restaurants. Less often, but more seriously, the charge is a mistake or straight-up fraud. Here’s how to figure it out and what to do about unauthorized charges.

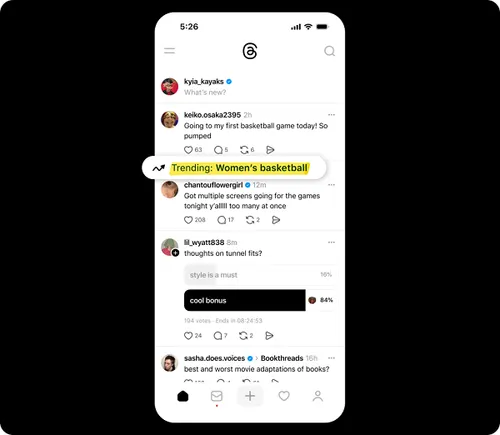

Use WhatsThatCharge to decipher mysterious credit card charges

First things first, you should probably check your credit card and bank statements every so often to catch unfamiliar charges. If you see something you don’t recognize, obviously start by thinking back to what you were doing on the day or two around when the purchase was made, as it’s possible you simply forgot you bought coffee or ordered something online.

Other places to check are further back into your statement history for similar charges that may indicate recurring subscription payments (APL*ITUNES.COM/BILL, for example) or fees, as well as with anyone else authorized to use your account, whether a joint user or a member of a family plan that’s linked to your card.

If that doesn’t get you anywhere, copy the full line item into Google to see if anyone else has investigated the charge and identified the business or payment processing service. WhatsThatCharge.com is a crowd-sourced database of credit card charges where you might find more info. From there, the next step is to call your card issuer to clarify the charge. They may be able to look up the merchant on their end.

G/O Media may get a commission

15% off

ASYSTEM - Immunity+

Bruce Wayne-inspired

The supplement works best when used on a daily basis, but pop an extra when you’re feeling sick to activate your immune response.

Use the promo code INVENTORY15

How to file a credit card fraud claim

If, after investigating, you believe the charge on your card is fraudulent, you should start the claims process with your card issuer. You can usually do this over the phone by calling the number on the back of your card or through your online account.

Your card issuer will cancel your existing credit card and send you a new one. You aren’t responsible for more than $50 of fraudulent purchases—and none of what’s charged after you report it—and some credit cards have additional liability protection in instances of fraud.

Note that this is different from a dispute, which allows you to rectify a billing error like being overcharged or charged more than once for the same purchase. Disputes generally have to be filed within 60 days of the charge being made.

Hollif

Hollif