Industrials over tech? Gauging productivity play among AI ETFs

Exchange-traded funds tied to the AI boom might be outperforming this year, but momentum is shifting as investors weigh the tech-fueled hype and higher rates.

Exchange-traded funds tied to the artificial intelligence boom have been touted as outperformers in the first half of 2023, but momentum is shifting as investors balance the tech-fueled hype with higher rates.

"Interest rates are certainly causing the markets to kind of take a second look," Global X Chief Investment Officer Jon Maier told CNBC's Bob Pisani on "ETF Edge" on Monday. "But if you actually look at the components in some of these ETFs, they work really nicely together."

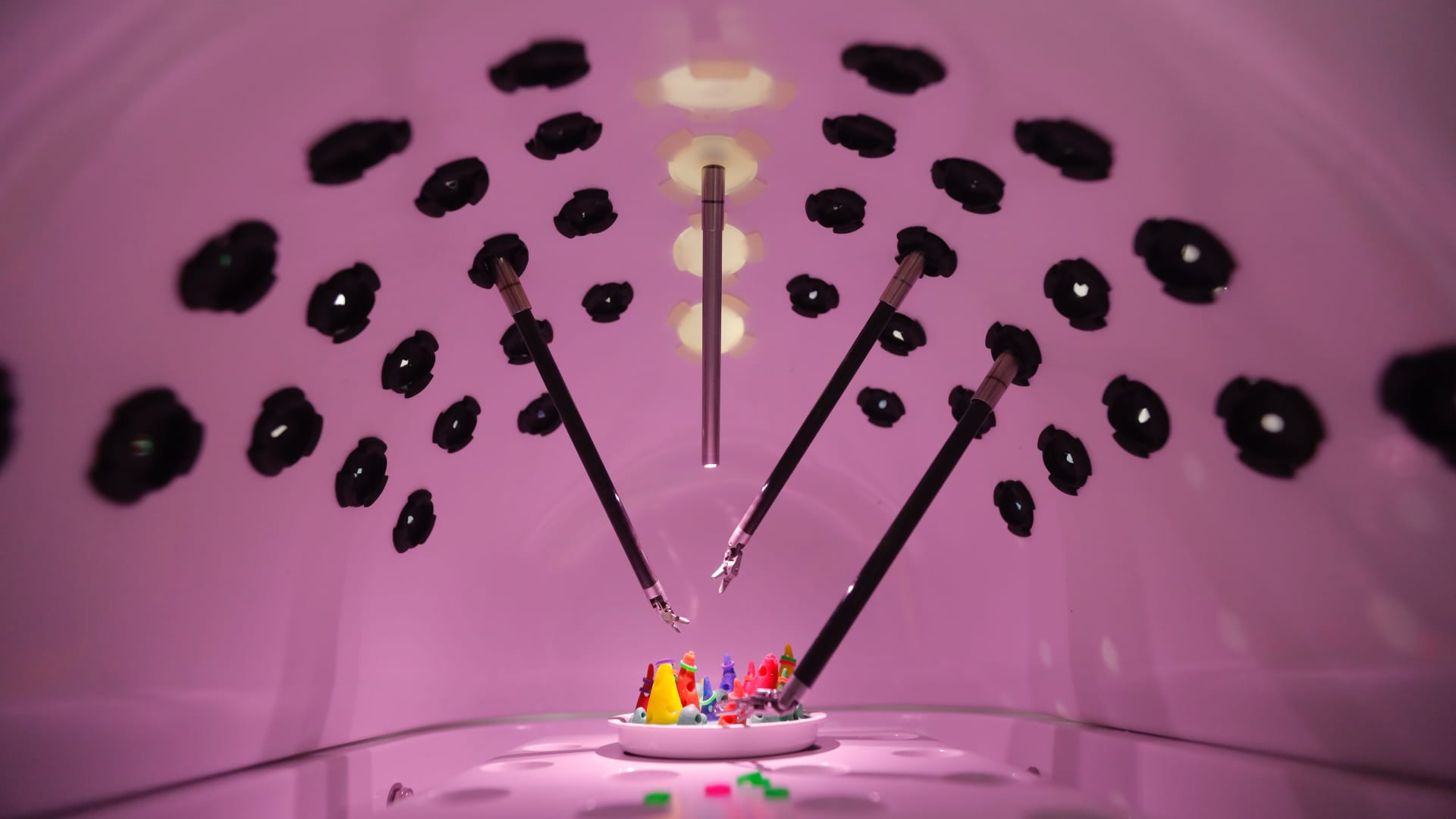

Global X operates two AI funds, one being the Robotics and Artificial Intelligence ETF (BOTZ). Maier explained that, while Nvidia is the largest holding in BOTZ, the fund also holds industrial robotics and automation names like Intuitive Surgical, Keyence and Dynatrace.

"Industrials are companies that can help other companies enhance their efficiency," he said. "I think that's something to really focus on; it's not really about all artificial intelligence."

BOTZ has been a key beneficiary of the AI advance, garnering $594 million in inflows this year, according to FactSet. The ETF is up more than 25% year to date, hitting its 2023 high in July before subsiding this month.

While many investors see AI as a tech play, Todd Sohn, ETF and technical strategist at Strategas Securities, believes that the benefit of industrials is an under-the-radar narrative worth taking a second glance at.

"Industrials as a sector have done very well for the last 10 months or so," Sohn said in the same interview. "And so, I think you're starting to see that play out among the security."

The Industrial Select Sector SPDR Fund (XLI) is up almost 8% this year, with more than $903 million in inflows, according to FactSet.

By comparison, broad thematic tech ETFs are netting outflows this year. More than $551 million has come out of the iShares U.S. Technology ETF (IYW) in 2023, and the Technology Select Sector SPDR Fund (XLK) has logged nearly $2.06 billion in outflows.

"The behavior of investors is not in sync with the market," Sohn said. "The Nasdaq 100 at one point was up 40% this year, [but] it is not being embraced like it was back in 2020 or 2021. There's no euphoria this time around."

Sohn hypothesized that some investors who have tried to ride the broader tech rally in recent years are pulling back in the name of higher interest rates and inflation, looking instead at stricter exposure plays like AI.

But tech is still prominent in Global X's more mainstream Artificial Intelligence & Technology ETF (AIQ), which has holdings of no more than 3% in the largest mega-cap tech companies.

"You don't have as high of a concentration in those names, but those names are really important in the AI space," Maier said.

AIQ is up nearly 37% year to date, garnering $344 million in inflows in 2023. And because data is what's driving AI, Maier said, larger companies like Amazon, Alphabet and Meta Platforms best retain that type of exposure.

"Right now, [data] is what AI is, while we're trying to figure out where AI is going," he said.

But for investors looking to diversify beyond the tech wave, Sohn affirmed that industrials are poised to benefit from the rise in AI-induced efficiency and productivity in robotics and automation companies.

"You can get overweight Industrials pretty easily; it's [about] 9% of the S&P 500," he said, comparing the sector to information technology's 28% weight in the index. "So, if you want it to skew toward that area, it's much easier to do."

ValVades

ValVades