J&J lowers 2022 revenue and earnings expectations, stops giving Covid vaccine sales guidance

When asked about halting guidance for J&J's Covid vaccine, CFO Joe Wolk said the shots are not for profit and do not impact the company's bottom line.

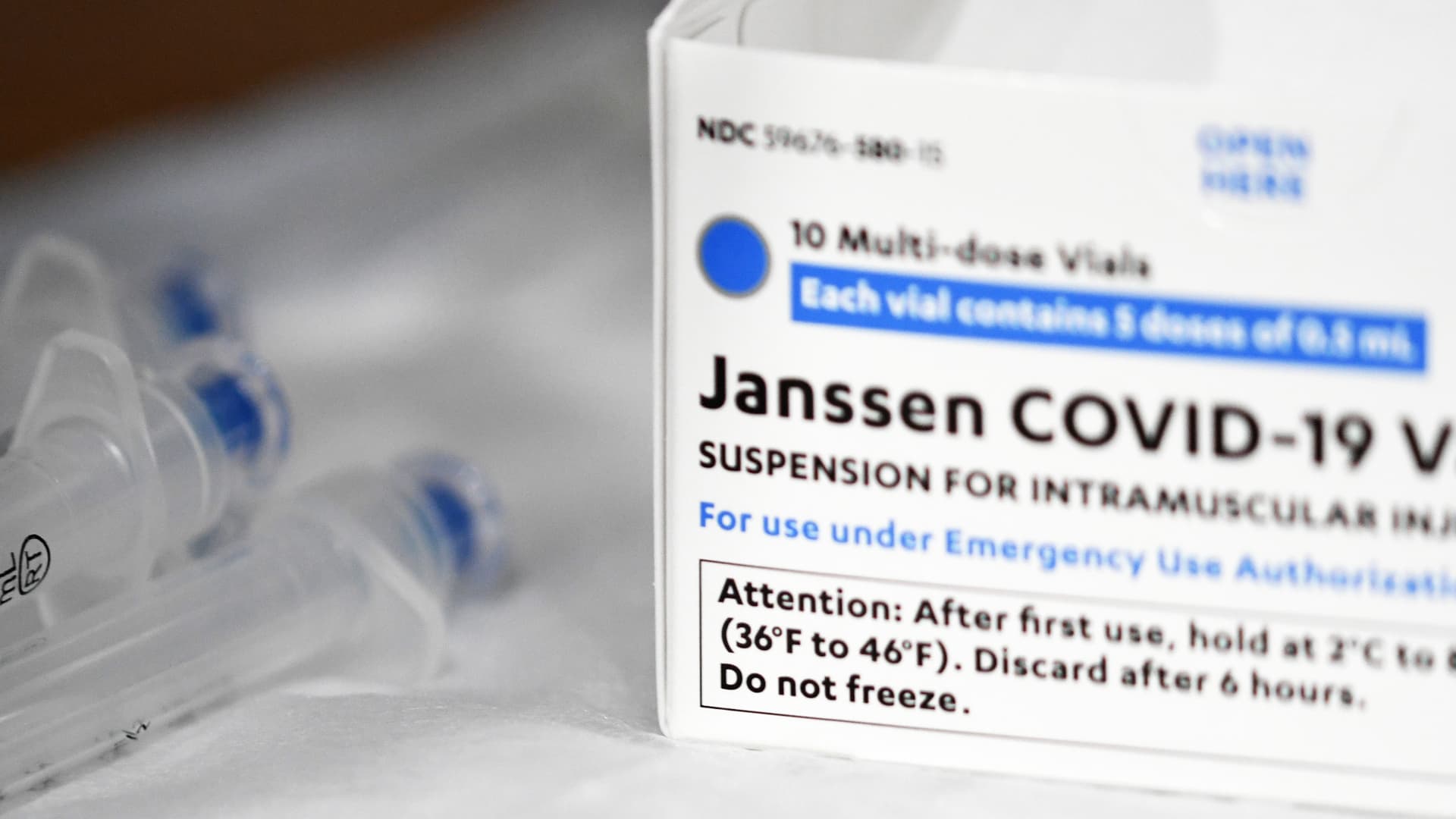

Syringes and a box of Johnson & Johnson vaccine.

Paul Hennessy | SOPA Images | LightRocket | Getty Images

Johnson & Johnson on Tuesday lowered its full-year sales and earnings outlook, and stopped providing Covid-19 vaccine revenue guidance due to a global supply surplus and demand uncertainty.

J&J is now forecasting 2022 sales of $94.8 billion to $95.8 billion, about $1 billion lower than the guidance provided in January. The company lowered its full-year adjusted earnings per share by 25 cents to between $10.15 and $10.35, from a previous forecast of $10.40 to $10.60.

CFO Joe Wolk, during J&J's earnings call later Tuesday morning, said the company faces economic headwinds from higher input costs as well as rising labor, energy and transportation prices. J&J also faced supply constrains on some commodities, Wolk said said.

J&J reported first-quarter sales of $23.4 billion, slightly missing Wall Street expectations but growing 5% over the same quarter last year. The company posted earnings of $2.67 cents per share, beating expectations and increasing 3.1% over the same period of 2021. J&J reported net income of $5.15 billion, a nearly 17% decrease over the first quarter of 2021.

Here's how J&J performed compared with what Wall Street expected, based on analysts' average estimates compiled by Refinitiv:

Adjusted EPS: $2.67 per share, vs. $2.58 expectedRevenue: $23.4 billion, vs. $23.6 billion expectedThe company sold $457 million of its Covid vaccine globally. Wolk said Tuesday that developing nations have limited capacity in terms of refrigeration and getting shots in arms, which has created a backlog of the vaccines. When asked about no longer providing a sales outlook for the shots, Wolk said it was unusual to provide guidance for a specific product to begin with.

"We did it last year because we understood the Street had an expectation or at least an excitement around understanding how vaccine sales might play out but it was never material," Wolk told CNBC's Meg Tirrell on "Squawk Box," noting the vaccine is not for profit and doesn't impact the company's bottom line. He said Covid vaccine sales met J&J's internal expectations.

J&J reported $12.87 billion in pharmaceutical sales, an increase of 6.3% over the same quarter last year. The company's medical devices business grew by 5.9% to $6.97 billion in sales compared with the first quarter of 2021. Sales at J&J's consumer health business, which it is spinning off into a separate publicly traded company, declined 1.5% to $3.59 billion.

In pharmaceuticals, Wolk said new prescriptions slowed in early January when the Covid omicron variant was sweeping the U.S., but picked up in February and March. He said J&J's medical devices business led the company's growth with an uptick in general and advanced surgery as well as orthopedics.

Ashley McEvoy, who heads the medical devices business, said diagnostic procedures were flat in the U.S. when omicron infections surged in January, and surgical procedures declined by about 10%. However, McEvoy said she expects surgeries to rise above 2019 levels in April as Covid infections have declined, easing the strain on hospitals.

Wolk said consumer health was hit by supply constraints for some product ingredients and packaging materials, particularly in skin health and beauty. However, he said demand is strong for consumer health products, notably over-the-counter medicines such as Tylenol and Motrin, and J&J expects skin health and beauty to rebound later in the year.

J&J's board has approved a 6.6% quarterly dividend increase to $1.13 per share due to the company's strong 2021 performance, the company announced.

FrankLin

FrankLin